Disclaimer: This newsletter is not financial advice this is for educational purposes only so please DO NOT take this newsletter as a buy or sell signal.

JD Fundamentals:

Below is a checklist I normally use in my process when I look at the fundamental health of a company. If the company meets my criteria it will be colour-coded in green and if the company fails to meet my criteria it will be colour-coded in red which means I need to investigate further and ask myself why this is the case.

As you can see below there are 2 red boxes and I am going to explain them:

5-Year Average Profit Margin- When analysing a company I want to see a 5-year average profit margin above 10%, however, because this is a logistic/supply chain business I will not penalise them for not meeting my 10% target. JD’s current profit margin is in line with what I expect from a company of this nature. The industry that JD operates in is a very low-margin, high-volume type of industry but in recent quarters JD has been trying to improve their profitability.

Shares Outstanding- When analysing a company I want its shares outstanding to be the same or to decrease over time. As you can see, JD shares outstanding have gone up by 6.85% in the last 5 years and this was due to JD being in its infant stage using shares as currency to fund its growth prospect instead of taking on debt. In recent years the share issuing has stopped and JD has gone as far as announcing a $3 billion share repurchase programme which was announced in 2021. This offer will end in 2024.

Business Overview:

Founded in 1998 by Liu Qiangdong, JingDong also known as JD is a Chinese e-commerce company headquartered in Beijing. JD is one of the two massive B2C online retailers in China and a major competitor to Alibaba. When classified as a tech company, it is the largest in China by revenue. JD first started its business as a magneto-optical store but soon diversified into selling electronics, mobile phones, computers, and similar items. This type of business model is very reminiscent of US tech giant Amazon where they started off selling one singular item and then branching off to different categories. JD also has investments in high-tech, AI delivery through drones, autonomous technology and robots, and possesses the largest drone delivery system, infrastructure and capability in the world. It has recently started testing robotic delivery services and building drone delivery airports as well as operating driverless delivery by unveiling its first autonomous truck.

In 2014 Tencent acquired a 15% stake in JD by paying cash and handing over its e-commerce businesses Paipai & QQ Wanggou plus a stake in Yixun to JD. The aim of this was to build a stronger competitor to Alibaba. In 2015, JD launched its Russian site aimed to expand its business globally. In 2016 Walmart sold its Chinese e-commerce business Yihaodian to JD in exchange for a 5.9% equity stake valued at $1.5 billion. In October, Walmart filed its 13G revealing it nearly doubled its stake in JD to 10.9%. In February 2017, Walmart increased its investment in JD to 289.1 million shares or 12.1%.

Business Segments:

In March 2023, JD announced its plan to follow Alibaba and spin off its business segments. JD said it will spin off JD Property and JD Industrials in separate Hong Kong listings. The company said it intends to indirectly own more than 50% of the shares in both units meaning JD will retain control of its subsidiaries while simultaneously opening them up to outside investment.

JD Retail- This is JD’s online retail business. JD acquire products from suppliers and sell them directly to customers. JD currently has the largest online product review database of any online retail company in China with approximately 10.5 billion product reviews generated by their customers. As the company is now able to offer a wide range of product categories through its online retail business model, net revenues from electronics products which include computers, mobile handsets, other mobile digital products and home appliances have declined as a percentage of their total net revenue. As of December 2022, JD has sourced products from over 45,000 suppliers. JD has had huge success in the Chinese retail space because the company believe that a large-scale and market-leading position is critical to success in the online retail market and it can provide important competitive advantages to the company. In 2010 JD launched their online marketplace business where third-party merchants offer products to customers for which JD charges a commission fee. JD provides transaction processing and billing services on all orders placed on their online marketplace and requires third-party merchants to meet their strict standards for authenticity and reliability. JD monitors third-party merchants’ performance and activities on their online marketplace closely to ensure that they meet the requirements for authentic products and high-quality customer service. JD can also tag certain top stores on their platform based on each third-party merchant’s quality of service during the entire purchase phase. Such certification can help the top third-party merchants improve their sales volumes on the platform. furthermore, it sets a benchmark to encourage other third-party merchants to improve their quality of service. JD aim to offer customers the same high-quality customer experience regardless of the source of the products they choose.

In June 2016, JD entered into a series of agreements with Walmart. JD collaborated with Sam’s Club Flagship Store and Walmart China Flagship Store to sell specific category products for example Walmart Beauty and Personal Care. In 2018 JD opened up their first offline fresh food market brand called 7Fresh. JD integrated their advanced supply chain management and cutting-edge storage technologies into 7Fresh stores to deliver a unique shopping experience. In 2021, JD opened up their first JD Mall offline store in Xi’an. This will offer consumers an immersive omnichannel shopping experience In addition to traditional electronic categories offered by JD Super Experience Store.

Dada- This part of JD business has been cooperating with JD Logistics to provide fast on-demand delivery services for merchants and consumers. In 2021, JD and Dada formed a strategic partnership with ASUS a global technology leader launching more than 150 ASUS stores on JD Daojia. Leveraging this partnership, JD will further accelerate their digital transformation of physical stores to improve the offline shopping experience for computer and digital products including the extension of “one-hour delivery” service to all ASUS offline stores in China. In 2021 JD entered into a share subscription agreement with Dada under which Dada issued to JD 109,215,017 ordinary shares worth $546 million. This deal will allow JD to provide certain strategic resources to Dada as well as help JD to further diversify its retail services enabling its business partners to improve their operating efficiency and deliver better services for its consumers.

JD Logistics- JD Logistics is a leading technology-driven supply chain solutions and logistics services provider. JD Logistics has been operating as the company’s internal logistics department since 2007 and as a stand-alone business segment since 2017. JD Logistics offers a full spectrum of supply chain solutions and high-quality logistics services enabled by technology ranging from warehousing to distribution. JD Logistics’ value proposition is to empower customers’ supply chains and substantially improve their operational efficiencies which in turn enhance their own customer experience and stickiness. JD Logistics helps customers reduce redundant distribution layers, improve the agility of their supply chains, and optimise inventory management. As of 2022, JD Logistics operates with over 1,500 warehouses which cover an aggregate gross floor area of over 30 million square meters including warehouse space managed under the JD Logistics open warehouse platform. In the second quarter of 2020, JD Logistics launched a new Asia No.1 warehouse in the Hebei Province near Beijing. This warehouse is equipped with the first automated storage and retrieval system for bulky items in Asia’s e-commerce industry. This new sophisticated technology improves the company’s efficiency in handling items including air conditioners, refrigerators and furniture.

New Business- JD Health is one of the largest online healthcare platforms in China. JD Health is also pioneering the digitalisation and transformation of the healthcare industry. Over the past few years, JD Health has been building a comprehensive Internet and healthcare ecosystem by providing pharmaceutical and healthcare products and Internet healthcare services to customers. In 2022 the average daily consultations exceeded 300,000. As a leading online healthcare platform, JD Health’s mission is to become the go-to health management platform for everyone in China. Its strategic position is to create a technology-driven platform that centres on the supply chain of pharmaceutical and healthcare products and is strengthened by healthcare services, encompassing a user’s full life span for all healthcare needs. It is committed to offering users easily accessible, convenient, high-quality yet affordable pharmaceutical and healthcare products. To achieve this goal, JD Health has built a one-stop online health management platform to create greater value for all participants in the healthcare value chain and will continue to expand its core businesses, retail pharmacy business and online healthcare services through utilising AI, big data, cloud computing and other advanced technology.

JD Property was established in 2018 as an infrastructure asset management and integrated service platform for developing and managing modern infrastructure to support JD Logistics and third parties. JD Property is a leading and fast-growing platform for developing and managing modern infrastructure, consisting primarily of logistics parks and business parks in China and Asia. JD Property has unique advantages to securing scarce land resources as they continue to help boost economies across China through creating employment opportunities and contributing tax, among others. JD Property aims to develop its logistics asset portfolios while maintaining strong capital discipline. With the expansion of its asset portfolios, JD Property has adopted a capital recycling strategy through its fund management platform and other partnerships. JD Property believes this strategy will help further expand its asset portfolios whilst minimising their related future capital expenditures and enhancing their returns. As of 2022, JD Property manages properties with a total gross floor area of approximately 23 million square meters.

JD Industrials is the leading industrial supply chain technology and service provider in China. Through transformational end-to-end industrial supply chain digitalisation, it helps its customers increase supply chain reliability, reduce costs, and enhance efficiency.

Management

When looking at management I like to judge the CEO in several different ways such as experience, capital allocation skills and Incentives. In this section, I will cover whether management incentives are aligned with shareholders.

Experience- Qiangdong Liu, also known as Richard Liu founded JD in 2004. Richard Liu started his own business in Beijing, which was mainly engaged in the distribution of magneto-optical products. In 2004 Richard Liu launched his first online retail website. In 2011 Richard Liu received the 2011 China Economic Person of the Year from CCTV(China’s largest nationwide television network). Richard Liu has received numerous other awards for his achievements in the e-commerce industry in China, such as 2011 Chinese Business Leader and Fortune China’s 2012 Chinese Businessman. Richard Liu has a bachelor’s degree in sociology from Renmin University Of China in Beijing and an EMBA degree from the China Europe International Business School. Since Richard Liu founded JD, he has served as a non-executive director at JD Logistics since 2012 and he currently serves as its non-executive chairman and served previously as its non-executive chairman until 2023. Richard Liu has also been a non-executive director at JD Health International 2020 and has served as its chairman since 2021.

Below is an image illustrating the current experience of JD board members:

Capital Allocation-When it comes to judging management I think capital allocation skill is very important because I want management to create shareholder value and not destroy it. So far JD’s capital allocation has been spot on because they are giving value back to shareholders via reinvestment back into the business, buyback shares and paying a dividend.

JD is currently paying a dividend with a yield of 2.46%. As shown below this dividend is sustainable because this current dividend only takes up 23% of their overall free cash flow.

Incentive- This is important because if the current board is actively purchasing stock of their own business this is a positive indicator that shows that management believes the stock is undervalued and they believe in the long-term prospect of the company.

As you can see below we have 0 buy orders and 0 sell orders.

Bull And Bear Case:

Bull Case

Bull Case- The first bull case is the end of the tech crackdown. Since the government's regulatory crackdown on the sector began more than two years ago, China's major tech companies have shed more than $1 trillion in value which is the equivalent of the entire Dutch economy. The government looks like they have changed their stance towards their tech companies after they have realised they might have taken things too far. The government is now calling for China’s tech companies to help support the economy after the Chinese economy took a hit due to their strict lockdown measures.

Bull Case- The second bull case is valuation. Even if JD does not grow at all or show a low growth rate over the next 5 years the company will earn its entire enterprise value($26 billion) in free cash flow over that period. This company is being priced with very low expectations so it would not take a lot for the stock price to move upwards.

Bear Case

Bear Case- The first bear case is delisting. When it comes to Chinese stocks, delisting is always a fear because investors aren’t sure if Chinese companies will comply with US regulators. In July 2022, the SEC added JD to a list of companies facing delisting from U.S. stock exchanges if its auditors remain unable to examine JD‘s books before 2024. The transparency between China and US regulators seems to have improved as US regulators managed to gain access to JD books.

Bear Case- The Second bear case is growth. JD has always been a company that has managed to grow its revenue at an astronomical pace but that has changed in recent years. In the last 5 years, JD’s revenue grew 20% but in the last year, their revenue is only growing by 7%. This drastic slowdown in revenue could be down to several factors like the harsh regulatory pressures imposed by the government, China’s harsh lockdown measures and the competition in the Chinese e-commerce industry is heating up.

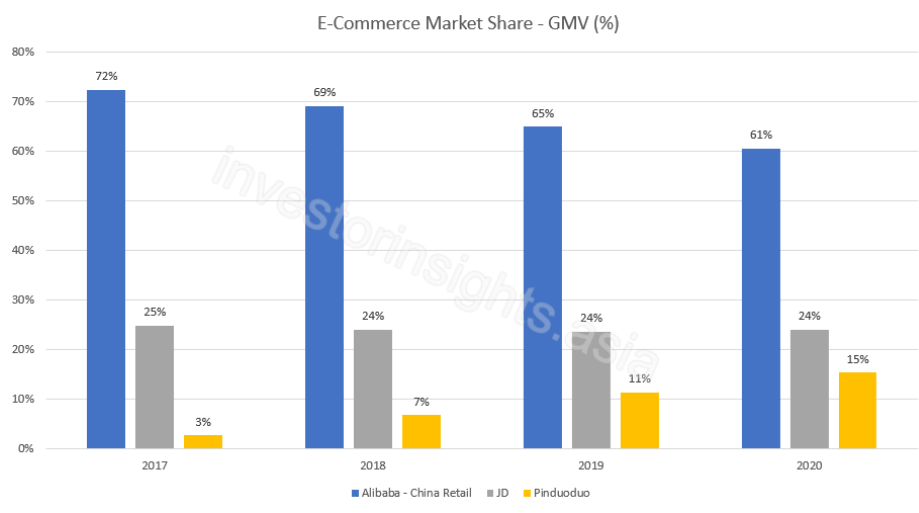

Bear Case- The Third bear care is competition. The Chinese E-commerce industry is getting very competitive with the likes of Pinduoduo, JD and Alibaba competing for market share. Alibaba dominates in terms of market share followed by JD. In recent years JD has maintained a consistent and moderate 24% market share. Even though China’s 3 main players in the E-commerce space seem to be fighting over market share the pie will get bigger over time with the Chinese E-commerce market looking to be worth $3.3 Trillion by 2025. It is vital that JD defends or gains more market share and they have acted on this with a subsidy campaign against close competitor Pinduoduo worth $1.5 billion. This isn’t the first time JD has used extreme tactics in an attempt to crush their competition. In 2010, JD's founder Richard Liu announced through his Weibo account that every book sold on JD would be priced 20% cheaper than its competitors. Although Richard Liu did not give a specific name to his opponent, journalists thought Dangdang was JD’s obvious rival in the field of online book sales. The price war between JD and Dangdang started on December 14 when users of JD found out that the books were cheaper than Dangdang. In response, Dangdang also began to offer discounts to customers such as ¥30 off when they spent ¥199 or more. On the morning of December 16, Dangdang stated that the company would invest ¥40 million to give discounts to customers. As a result, JD launched the second promotion to sell books at a lower price than Dangdang that afternoon. On the same day, Richard Liu posted through his Weibo account that JD would give coupons instead of reducing prices to protect the benefits of publishers, which marked a phase of the price war. The price war ended in 2013 when most of the e-books on Dangdang's website were free for users to download then JD responded by pricing 50,000 electronic books at ¥0 to match.

Valuation:

In this section, I am going to talk about valuation. Using some basic metrics I am going to compare JD against its industry rivals and see if the company is cheap relative to its peers then I will value JD using a discounted cash flow model to come up with a price I am willing to pay based on expected growth rate and my desired return of 15%.

As shown below when comparing JD against its peers it scores 3/5 whilst Alibaba and Pinduoduo score 1/5. If you ask me to pick between JD and Alibaba I probably can’t do that since they are very different in terms of business model. JD focuses mainly on premium products(mostly 1P platform) whilst Alibaba focuses on medium to high premium products(3P Platform).

As you can see based on my conservative assumption, JD is looking to grow between 6-8% so I went conservative and assumed a 6% growth in the first 1-3 years then the growth will slow down to 3% 4-6 years out. In my assumption, I also went with an exit multiple of 15x earnings which is below the historical average that JD has traded at. Based on my assumption I have come to a buy price of $39.79 compared to the current stock price of $25.65 which means right now JD is trading below intrinsic value.

Thanks for reading my newsletter on JD. Disclaimer This newsletter is not financial advice This is for educational purposes only so please DO NOT take this as a buy or sell signal.

Follow for more:

Don’t forget to subscribe, share and leave a comment below if you found this newsletter insightful as it helps support my work.

Great write up Wes. I especially like your checklist, great things to look for when analyzing a company.

How do they plan to "indirectly own more than 50% of the shares in both units " and still be in control? Are they going to have different management and everything? Is it going to be like BAM?