Disclaimer this newsletter is not financial advice this is for educational purposes only so please DON’T take this as a buy or sell signal.

Dear Followers,

Welcome to the second edition of my annual letter. In this letter, I will be reflecting on my investing journey in 2023 and I hope everyone reading this report can gain some sort of value from it.

Who am I?

For the readers who aren’t familiar with me and my investing philosophy, My name is Wesley and I am a UK value investor. I got into investing during the March 2020 crash and that was a time when the stock market took a huge hit due to the ongoing pandemic. When I first got into the stock market my mentality at the time was very speculative looking back from hindsight. The first stocks that I bought were Virgin Galactic at $12.53 and Jumia at $9.47. Those weren’t the only two stocks I bought at the time because I also bought travel stocks like Easy Jet, Carnival Cruise Line and Delta Airline and I even speculated into genomics with Crispr Therapeutics on which I lost money. Fast Forward a year the market started to recover and that was a turning point for me because I made a 42% return within a short period of time and it didn’t feel natural or sustainable because I didn’t know anything. After self-reflecting on my short-term gains I had a eureka moment where I started to question my methodology of investing as a beginner. During this moment of challenging myself, I started to read about Warren Buffett and the more I started to read and watch videos on him, the more I started to realise I got investing wrong. I wasn’t the overnight genius I thought I was. Over a few weeks of submersing myself to learn more about what actual investing is I started to get into the mindset of value investing. Once I got a basic understanding of what value investing is I sold everything and started fresh. The first company that I bought as a value investor was Sprouts Farmers Market(SFM). I bought this company for $24 a share and held it for 2 years until I sold it for $31 per share due to better opportunities. As of 25/12/2023, the company is now trading at $48 and still prospering.

If I were to describe my investing strategy I would say all the investments that I look at must be based on conservative fundamental analysis. To make an informed investment decision I must have a circle of competence that I don’t deviate from because If I can’t understand something I should not be investing in it so the business must be something I can describe in a few sentences or less. I tend to favour consumer-driven companies like your retailers of various sorts and I do dip my toes in technology companies from time to time. As an investor, I tend to avoid commodity-based companies, Energy, utilities and financials. When it comes to hunting grounds I like smaller companies so I tend to favour companies below $10 billion in market cap and spin-offs. I am willing to be flexible and own larger companies but the valuation would have to be so compelling that I simply cannot turn it down(Meta and Alibaba).

Content Creation

2023 has been great for me regarding content creation on my Instagram, Twitter and Substack. My Instagram page is currently at 4.6K followers, my Twitter is currently at 1.5K followers after only creating it in late 2022 and my Substack is currently on 712 subscribers. I can’t thank all of you enough for following and supporting me throughout 2023. I would also like to thank The Wealth Builders Podcast, The Take Off Experience Podcast and Investing Mastermind Podcast for allowing me to appear on their podcast to talk about my investing experience.

Investing Mistakes

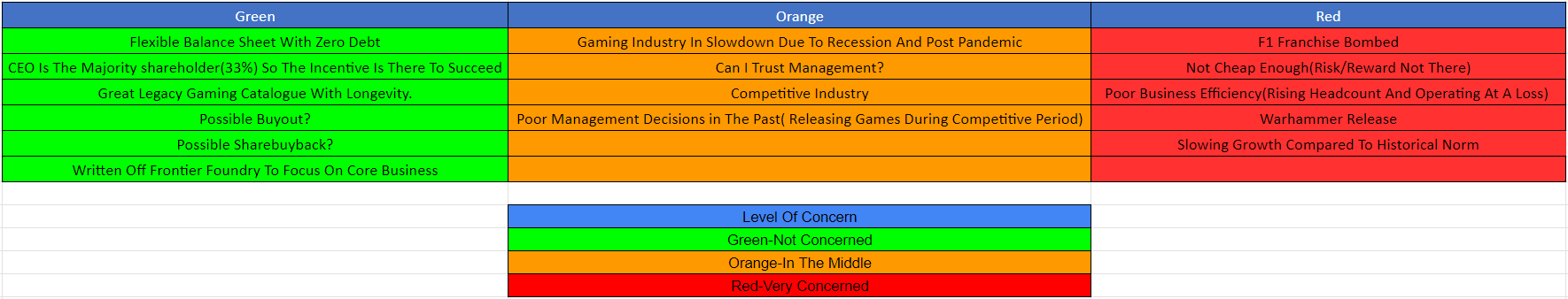

I take learning from my mistake(s) very seriously as this will help me learn to become a better overall investor. In 2023 I made one mistake when I invested in a company called Frontier Developments. This is a small gaming company from the UK that I sold for a -16% loss. I sold Frontier Development because I didn’t like the risk/reward anymore as management kept on disappointing me by failing to execute their plan, releasing poor quality games that wouldn’t generate enough sales and also poor capital allocation. I was disappointed in myself for allowing this to happen because I spotted these red flags before the investment but I gave management the benefit of the doubt that this would all turn around. Below is a table I used to stay rational as the stock price was going down. This was what allowed me to make the decision to cut my losses early which has saved me big time because the stock continued to downtrend even after I sold my shares. The table below shows all the different key points about this company. What I chose to do was separate all the key points into three categories with green being positive, orange being in the middle and red being negative.

What Have I Been Reading?

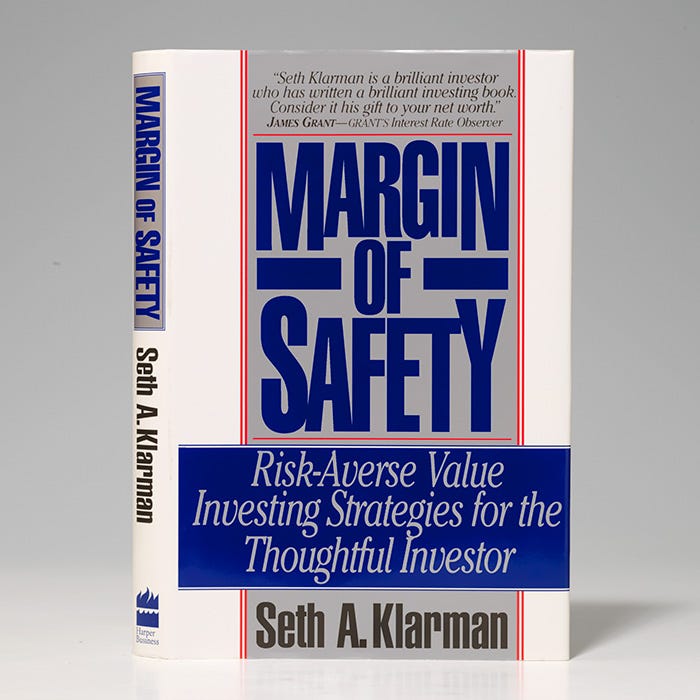

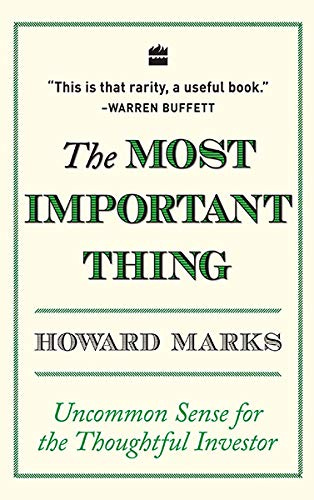

Throughout 2023 I set myself the goal of reading more. I have never been an avid reader but throughout 2023 I managed to read The Most Important Thing By Howard Marks, Margin Of Safety By Seth Klarman and Seth Klarman Baupost Annual Letters From 1995-2001. In this section, I will share 4 key points from each book/letter that resonated with me.

Margin Of Safety

Margin Of Safety- “It follows that value investors seek a margin of safety, allowing room for imprecision, bad luck, or analytical error to avoid sizable losses over time. A margin of safety is necessary because valuation is an imprecise art, the future is unpredictable, and investors are human and do make mistakes. It is adherence to the concept of a margin of safety that best distinguishes value investors from all others, who are not as concerned about loss.”

Explanation- A margin of safety is the cornerstone of value investing because it leaves room for error. It helps to preserve capital from big mistakes, uncertainty, and behavioural biases. The wider the margin of safety, the more room you have to be wrong…and still not lose much.

Avoiding Losses- “I too believe that avoiding loss should be the primary goal of every investor. This does not mean that investors should never incur the risk of any loss at all. Rather “don’t lose money” means that over several years an investment portfolio should not be exposed to appreciable loss of principal.”

Explanation- Don’t lose money does not mean never lose money. Losses are an inevitable part of the investing process. The goal is to avoid the possibility that an extreme loss wipes years’ worth of returns and a huge chunk of your portfolio. Compounding your savings at an average rate offers big advantages over time.

What Is Risk?- “Rather, risk is a perception in each investor’s mind that results from analysis of the probability and amount of potential loss from an investment. If an exploratory oil well proves to be a dry hole, it is called risky. If a bond defaults or a stock plunges in price, they are called risky. But if the well is a gusher, the bond matures on schedule, and the stock rallies strongly, can we say they weren’t risky when the investment was made? Not at all. The point is, in most cases, no more is known about the risk of an investment after it is concluded than was known when it was made.”

Explanation- Risk has nothing to do with beta or volatility. Risk is directly related to the price paid. Simply put, paying too high a price gives you little room for profit and a lot of room for error. While you can never eliminate risk, you can reduce risk through diversification, hedging, and margin of safety. You also can unknowingly add to it by owning too much of one thing or too much of everything.

Be A Contrarian- “Investors may find it difficult to act as contrarians for they can never be certain whether or when they will be proven correct. Since they are acting against the crowd, contrarians are almost always initially wrong and likely for a time to suffer paper losses. By contrast, members of the herd are nearly always right for a period. Not only are contrarians initially wrong, but they may also be wrong more often and for longer periods than others because market trends can continue long past any limits warranted by underlying value.”

Explanation- By definition, all value investors are contrarian. Value investors buy when others are selling and sell when others are buying. If you are going to be a value investor you have to be prepared to go against the herd which is against human nature because humans aren't wired to depart from the group. Humans feel more comfortable being with the herd because if you are wrong you can be wrong with everyone else. When you act as a contrarian you have to be right in your judgement.

The Most Important Thing

Understanding Risk- Academics teach that volatility and beta is an accurate measure of risk. Volatility and beta are not an accurate measure of risk and if you are a long-term investor you should welcome volatility because that is a chance to buy securities at an even cheaper price which means your upside potential will increase but only if you bought the security below its intrinsic value. To value investors' risk is paying too much for an asset which could result in permanent capital loss. Risk is not volatility or beta.

Controlling Risk- When everyone believes something embodies no risk, they usually bid it up to the point where it’s risky. During good times investors are blind to risk and during bad times investors see risk when it should be the opposite. For an investor to control risk, they must invest with a margin of safety. A margin of safety will protect the individual investor from permanent capital loss where if something goes wrong in the future like a misjudgement when valuing the company or a new competitor entering the market the individual investor will not lose all his money but still have enough money where he is still in the game even if the absolute worst-case scenario come into fruition.

Understanding The Difference Between Price And Value- Investment success doesn’t come from buying good things, but rather from buying things well. No asset is so good that it can’t become a bad investment if bought at too high a price and there are few assets so bad that they can’t be a good investment when bought cheap enough. Investors need to understand the difference between price and value and what affects a company in the short and long run. In the short run, price is determined by individual investors' sentiment, news, and macro factors but in the long run, a company's value will matter more such as earnings and cash flow.

Second Level Thinking- When it comes to investing there is first-level thinking and second-level thinking. Just about everyone can do first-level thinking as first-level thinking focuses on solving an immediate problem with little or no consideration of the potential consequences. An example of what a first-level thinker might say is "Apple is a great company, let’s buy the stock" but if you are a second-level thinker you will say "If everyone thinks Apple is a great company then the likelihood of that getting priced into the stock is high" which means it is overpriced. Second-level thinking is more complex than first-level thinking as second-level thinking takes into consideration:

Which outcome do I think will occur?

What’s the probability I’m right?

What does the consensus think?

How does my expectation differ from the consensus?

Is the consensus psychology that’s incorporated in the price too bullish or bearish?

What will happen to the asset’s price if the consensus turns out to be right, and what if I’m right?

Seth Klarman Annual Letter From 1995-2001

Seth Klarman Investing Philosophy- "The Baupost Fund is managed with the intention of earning good absolute returns regardless of how any particular financial market performs. This philosophy is implemented with a bottom-up value investment strategy whereby we hold only those securities that are significantly undervalued, and hold cash when we cannot find better alternatives. Further, we prefer investments, when we can find them at attractive prices, that involve a catalyst for the realisation of underlying value. This serves to reduce the volatility of our results and de-emphasizes market movements as the source of our investment returns. Positions with catalysts tend to lag a rapidly rising stock market like this past year’s) and outperform a lacklustre or declining one (like we used to have every few years).”

Only When The Tide Goes Out- “We have said before and will repeat here that you do not really need Baupost to invest your money in bull markets. An index fund could likely perform better. The true investment challenge is to perform well in difficult times. It is unfortunately not possible to reliably predict when those times might be. The cost of performing well in bad times can be relative underperformance in good times. We have always judged that a worthwhile price to pay.”

Being A Discipline Investor- “We will not stray from our rigid value investment discipline. We buy absolute bargains when they become available, and sell when they are no longer bargains. We hold cash when there is nothing better to do, and we hedge against the risk of a dramatic and sustained downturn in the market. Our hedging over the last several years has been expensive and, with perfect hindsight, unnecessary. Yet we are convinced that hedging against catastrophe has been the right thing to do, and it thus remains an integral part of our overall investment posture. Despite our discomfort with the level of speculative activity in the U.S. market, we remain optimistic regarding our prospects for the future. Because of our fundamental, research-driven, absolute-value orientation, we own undervalued securities that we believe will do well regardless of the overall financial environment. In the event of a major market reversal, we believe our market hedges should cushion any serious decline within the portfolio.”

"Value Always Win- “We continue to believe strongly in a value investment approach, attempting to buy assets or businesses at a considerable discount to underlying value. Bargains exist because the financial markets are inefficient, yet many investors lack the requisite patience and discipline to take advantage of them. A value approach may outperform or underperform the overall market at various times because of changing investor sentiment, but we believe that a value philosophy never goes out of style. When sentiment towards undervalued sectors of the market is at its nadir, it is the best time to be buying value.”

The Secret Sauce

Even though the SPY is up 24% YTD and the valuation of the index is getting expensive I still see value in China, The UK, and Small Caps in general. If you are an investor who is willing to do the extra work there is value to be had in spin-offs. Spin-offs or event-driven investments make great investments because their performance is completely independent of what the current market condition is.

China- The Hong Kong market is probably one of the cheapest markets in the world right now. It is currently trading at 10x earnings as investors don’t want anything to do with China. The reason behind the negative sentiment is the country's slowing economy, low interest rates and a geopolitical tussle with the US have sparked doubt about its economic potential. With the high uncertainty going on in China, this makes a perfect hunting ground for value-oriented investors who have a long time horizon of 5-10 years. I believe the issues China is facing are all short term and things will get better, especially the relationship between China and The US. What these two superpowers don’t realise is they both need each other.

Spin-Offs- A spin-off occurs when a business decides to separate a segment into a standalone company. Companies tend to spin off a part of their segment because they feel the business can unlock value on its own. When looking at stock spin-offs they can come in all forms of sizes. When a company spins off a company you tend to get selling pressure from fund managers and retail investors within the first 2 years. Fund managers tend to sell if the parent company is a part of a major index fund and the secondary company isn’t, e.g., dividend ETF with certain criteria that need to be met or if the company is too small fund manager will sell because the company isn't big enough to move the needle. Retail Investors tend to sell if they are given a new stock that they never wanted e.g. AT&T shareholders were given Warner Bros Discovery shares as a part of the spin-off deal. For an investor who is willing to do the work I recommend books such as Margin Of Safety By Seth Klarman, Investors Guide To Special Situations In The Stock Market By Maurece Schiller and You Can Be A Stock Market Genius By Joel Greenblatt.

Global Small caps- We're approaching 2-1/2 years of relative underperformance from small caps and if you look at the valuation multiples they're very, very cheap. Valuations have boosted the appeal of small caps in a multi-asset rally sparked by investors betting that the central banks globally will begin cutting rates in 2024 if inflation keeps falling. When it comes small caps they tend to outperform larger companies during periods of increasing growth and slowing inflation, with the Russell 2000 up 25.2% on an annualised basis versus 17.3% for the S&P 500, a Morningstar Wealth analysis of data since the 1970s showed. Small-cap earnings also are expected to pick up. Russell 2000 companies' earnings are forecast to increase about 30% next year after falling 11.5% in 2023, LSEG data showed. Very exciting times for small-cap investors who have been accumulating shares over the past 2 years.

The Rise Of Magnificent Seven.

In 2013, CNBC analyst Jim Cramer popularised “FANG,” comprised of Facebook (now Meta), Amazon, Netflix, and Google (now Alphabet), as a shorthand for the best-performing technology stocks on the market. Apple was added in 2017, making it FAANG. In 2023, a new moniker given by Bank of America analyst Michael Hartnett highlights the most valuable and popularly-owned companies on the American stock market called “The Magnificent Seven” stocks. The Magnificent Seven make up more than one-quarter of the S&P 500 and more than half of the Nasdaq 100. Meanwhile, five of the seven are part of the rare trillion-dollar club with Nvidia being the most recent entry. A common theme among the Magnificent Seven is their ability to collect vast amounts of customer data, create cutting-edge hardware and software, as well as harness the power of AI.

Due to the two major indexes being so concentrated into a basket of companies, this could backfire for several reasons:

If a recession or another pandemic or something worse was to happen it would be incredibly painful because most investors currently own stock in at least some of the Magnificent Seven.

Another risk is that these companies, which many investors say are already richly valued or expensive, could become overvalued, raising fears of a bubble that could burst.

Another mania forming? If you look at all the major stock market mania there was always a handful of companies pulling the market for example in the late 1990s when the stock market's gains were driven by another small basket of big tech companies such as Cisco, Dell, Intel and Microsoft, Wall Street nicknamed that group "The Four Horsemen," and the promise of the Internet back then drove their stock price higher. Another example is the Nifty Fifty Bubble. The Nifty Fifty was a name given to a group of fifty large-cap stocks on the New York Stock Exchange in the 1960s and 1970s(Coca-Cola, McDonald’s, IBM) etc. These stocks were widely regarded as solid buy-and-hold growth stocks. The most common characteristic of the Nifty Fifty Growth Stocks was solid earnings growth for which these stocks were assigned extraordinarily high price-to-earnings ratios. Trading at 50x earnings or higher was common for this group of companies but the issue is this was far above the long-term market average of 15. Below is a graph illustrating the performance of the magnificent 7.

My 2023 Performance

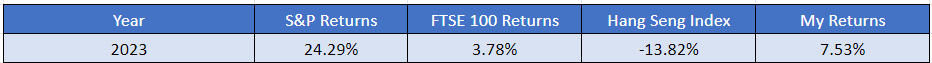

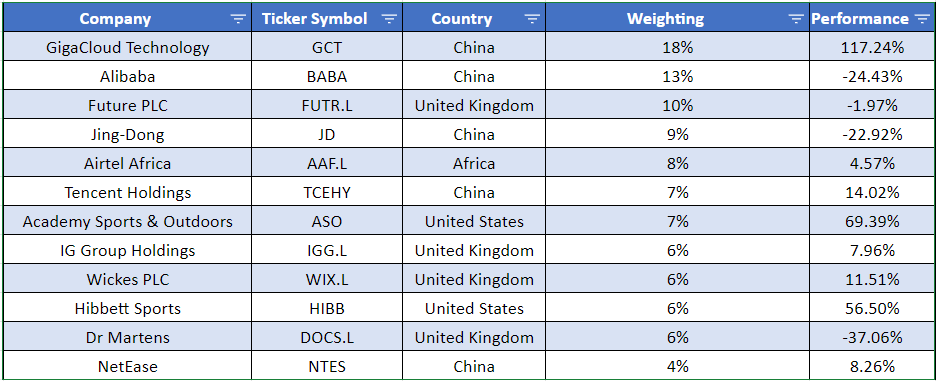

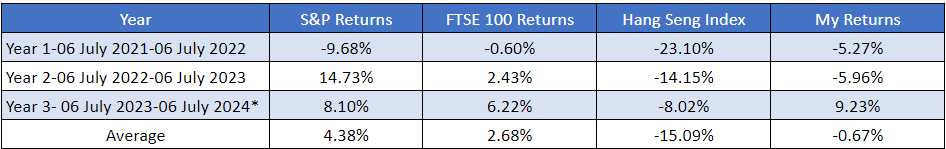

My 2023 performance has been lacklustre where my YTD return was +7.53% compared to the S&P 500 of +24.29%. Even though we significantly underperform the major index on a YTD basis I do see light at the end of the tunnel where over the long run I should start to see some sort of outperformance because I believe as a collective my portfolio is much cheaper than S&P500 with significant upside and it is only a matter of time until the market realises the true intrinsic value of my portfolio. When it comes to value investing I want my readers to remember that value investing is a risk-adverse approach which means the primary goal is to protect on the downside. Value investors tend to buy when others are fearful and sell when others are greedy. Securities owned by value investors can take years before we see any substantial profit but ultimately if you’re patient and you do good valuation work the market will eventually reward you. This is why value investors tend to go through periods of underperformance. Below is a table illustrating my performance against 3 other indexes on a year-to-date basis.

The main reason for my underperformance compared to The SPY is because of my asset allocation where my portfolio is not heavily exposed to the US market. As shown below Only 12% of my portfolio allocation is in US stocks and when you break it down even further the US stocks that I have picked have collectively done well where the returns of my US basket are up 30.81% YTD vs The S&P 500 of 24.29%. It is the UK segment of my portfolio that is causing a drag on the overall performance.

Current Holdings

As you can see from the table below this is my current portfolio. My top 3 holdings consist of GigaCloud Technology, Alibaba and Future PLC and collectively they make up 41% of my portfolio. On 22nd December I decided to sell my shares in Warner Brothers Discovery for a -21% loss because I saw a better long-term opportunity in NetEase. The rationale behind this is if NetEase does recover to its previous level before the latest gaming cracking and I can’t increase my position size from 4% to 7% I will sell the shares at a gain to offset the Warner bros loss and if the stock price does stay depressed whilst allowing me to accumulate shares I will hold this company for the long term because I truly believe this company can recoup my loss from the trade-off and some more so I am not worried about this decision too much.

My Inception Returns:

As you can see below since inception my portfolio has lagged behind the market and this is attributed to my low exposure to certain markets and my over-exposure to certain out-of-favour markets. I am not worried about my current performance because 2 years(the third year being played out)is not enough to say whether I am a good investor or not.

Strategy going into 2024

My strategy will remain the same as always and nothing will change. I will continue to buy securities where I see there is some sort of mispricing, I will continue to focus on special situations and small caps as I believe these sorts of areas will provide me with the best chance of outsize returns as a small investor. One thing I need to keep in the back of my head is to have patience and trust in my process because even though the true value of the companies that I have picked aren’t being valued based on their full potential I do have a solid portfolio that will take time to perform. Considering my over-exposure to China and The UK I am very happy with how I am still within touching distance of all major benchmarks.

Thanks for reading my newsletter. Disclaimer this newsletter is not financial advice this is for educational purposes only so please DON’T take this as a buy or sell signal.

Follow for more:

Don’t forget to subscribe, share and leave a comment below if you found this newsletter insightful as it helps support my work.

Out of interest what are you using to track your portfolio?

I'm guessing you have holdings in multiple currencies (GBP, USD, etc) and as a UK investor potentially a mix across multiple accounts (ISA, GIA, SIPP) and potentially brokerages.

I'm on the hunt for a good solution but haven't had much luck

That's one excellent annual review! Thank you for the transparancy.