Disclaimer: This newsletter is not financial advice this is for educational purposes only so please DON’T take this newsletter as a buy or sell signal.

Williams-Sonoma Fundamentals:

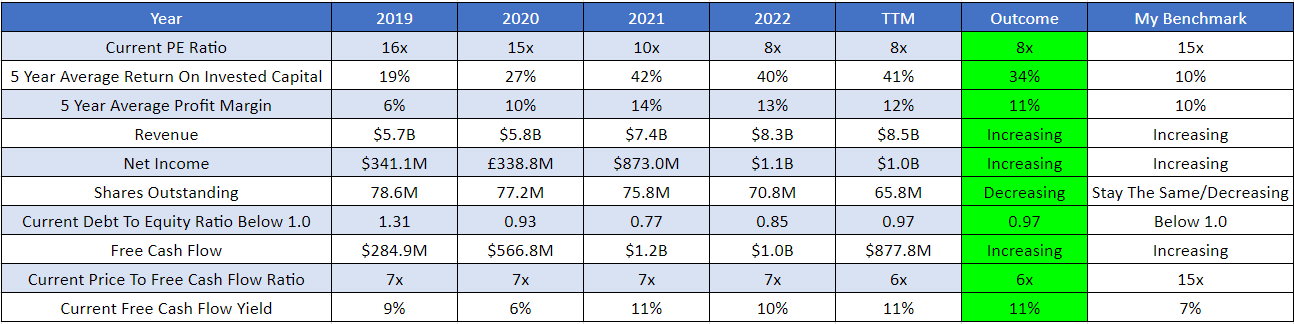

Below is a checklist I normally use in my process when I look at the fundamental health of a company. If the company meets my criteria it will be colour-coded in green and if the company fails to meet my criteria it will be colour-coded in red which means I need to investigate further and ask myself why this is the case.

As you can see below Williams-Sonoma meets all my criteria.

Business Overview:

Founded in 1956 by Chuck Williams, Williams-Sonoma is an American consumer retail company that sells kitchenware and home furnishings. Williams-Sonoma currently has 625 brick-and-mortar stores and distributes to more than 60 countries, with brands including Williams-Sonoma, Williams-Sonoma Home, Pottery Barn, Pottery Barn Kids, PBteen, West Elm, Mark and Graham, and Rejuvenation. Williams-Sonoma is one of the largest e-commerce retailers in the U.S. and one of the biggest multi-channel speciality retailers in the world. In 1986, Williams-Sonoma acquired Pottery Barn from Gap. The acquisition included Pottery Barn's 27 housewares stores located in California, Connecticut, New Jersey, and New York for $6 million. The company's expansion led to the opening of its first distribution centre in Memphis, Tennessee, in 1984. Williams-Sonoma has one of the largest proprietary distributors in the Memphis area with 3.5 million square feet of distribution space. From 1986 to 1989, Williams-Sonoma grew by an average of 12 stores per year, bringing the total locations to over 100 stores in the U.S. The following year, Williams-Sonoma launched its e-commerce websites followed by the launch of Pottery Barn Kids which is a spin-off from Pottery Barn that specialises in home furnishings for children. The Pottery Barn brand further expanded with the launch of PBteen in early 2003. Pottery Barn extended its merchandising with the introduction of the Pottery Barn Bed & Bath and Pottery Barn Kids in Manhattan. By 2009, Williams-Sonoma was operating 610 stores with an annual revenue of over $3 billion. In November 2011, Williams-Sonoma acquired Rejuvenation, a manufacturer and direct marketer of light fixtures and hardware with stores in Portland, Seattle, and Los Angeles. In 2020, the Federal Trade Commission (FTC) announced a settlement with Williams-Sonoma over false advertising claims where Goldtouch Bakeware products, Rejuvenation-branded products, and Pottery Barn Teen and Pottery Barn Kids were falsely advertised as being made in the USA. As part of the settlement with the FTC, Williams-Sonoma agreed to stop making false "Made in USA" claims and is required to pay $1 million to the FTC.

Business Segments:

Pottery Barn-Pottery Barn was built on the idea that home furnishings should be exceptional in comfort, quality, style and value. Originally founded in 1948, the brand was acquired by Williams-Sonoma in 1986, when it expanded its scope to include furniture, accessories and decorating advice for every room in the home. Featuring exclusive products many designed by in-house artists and crafted in the USA, Pottery Barn inspires great style for spaces small and large.

Pottery Barn Kids-Launched in 1999 to bring style, quality and value to children's spaces throughout the home, Pottery Barn Kids is a premier destination for well-made kids' furniture and accessories. Specialising for ages from newborn to age 8, Pottery Barn Kids offers everything from bedding to bath accessories, cribs to classic toys, and luggage to lunch bags.

PBTeen-PBteen is the first home retail concept to focus exclusively on the teen market. The brand was launched in 2003 and offers a complete line of furniture and accessories for teen bedrooms, study and lounge spaces, and college dorm rooms. PBteen’s innovative product line is specifically designed to help teens create unique, comfortable spaces that reflect both their parents' appreciation for quality and their own personal style.

Williams-Sonoma-For more than half a century, Williams-Sonoma namesake brand has been bringing people together around cooking. Williams-Sonoma is America's leader in high-quality cookware and tools, electrics and entertaining essentials. The brand includes a vast library of cookbooks, along with a speciality food hall that offers distinctive and artisan-crafted items. The Agrarian product line was launched in 2012 to support a lifestyle of healthy living, and to help their customers grow and preserve their food.

Williams-Sonoma Home-Expanding on the exceptional quality and exquisite craftsmanship are hallmarks of the Williams-Sonoma brand. Williams-Sonoma Home offers a bold assortment of casually elegant furniture, lighting and decorative accessories that will stand the test of time. With a focus on exquisite materials and design details, Williams-Sonoma Home designers use contrasting textures, colours and materials to create products that are as accessible and functional as they are elegant and sophisticated. From kitchen islands and dining tables to sofas and chairs custom in the United States, Williams Sonoma Home brings classic design and timeless luxury to the comforts of your home.

West Elm-West Elm launched in 2002 and quickly became a leader in home furnishings that are approachable, affordable and sustainably produced. Each season, West Elm's talented in-house team of designers creates an exclusive collection, collaborating with artists and independent designers globally and locally. The brand also offers handmade and one-of-a-kind discoveries from around the world, partnering with organisations that support the development of global craft communities.

Mark And Graham-Launched in 2012, Mark and Graham offer colourful and timeless gifts and accessories, personalised with your choice of over 50 unique monograms and type treatments.

Rejuvenation-Acquired by Williams-Sonoma in 2011, Rejuvenation is a general store for home improvement whose mission is to add real value to homes, buildings, and projects. From the front porch to the back door, Rejuvenation offers lighting, hardware and functional home goods based on the best pieces of the past, designed for today, and made to last for years to come.

GreenRow-GreenRow, established in 2023, is an internally designed and developed brand specialising in the use of sustainable materials and manufacturing practices to create colourful, vintage-inspired heirloom quality products. Every product in the GreenRow assortment will support at least one of Williams-Sonoma’s social or environmental initiatives and prioritise utilising innovative, sustainable manufacturing practices with low-impact materials wherever possible-including responsibly sourced linen, cotton, wood, and recycled materials.

Omnichannel

Williams-Sonoma’s digital transformation journey has been remarkable. As far back as 2017, the US retailer has passed a milestone of seeing half of its revenues come from online, with CEO Laura Alber making the bullish claim that the firm was safe from the disruption of Amazon. During 2020 as COVID-driven lockdowns delivered their by-now-familiar boost to online shift across much of the retail sector as a whole. Their e-commerce operation now accounts for over 65 % of its total revenue. Williams-Sonoma’s digital transformation hasn’t come cheap. The company spent $170 million in 2020, primarily on technology and supply chain to support e-commerce growth, with a focus on increased customer engagement and conversion online. Over the past five years, e-commerce-related spending has gone from under 50% of total expenditure to a planned 85% in 2021. That level of spending will continue for the foreseeable future, with plans for the addition of two new distribution centres to provide an incremental two million square feet in inventory capacity, as well as investments in automation. CEO Laura Alber said “One of the key reasons we outperformed was because our e-commerce platform was able to serve our customers at scale. We are uniquely positioned to take market share as the home industry shifts online. We are already the number one non-pureplay e-commerce retailer in home furnishings and a top 25 e-commerce retailer in the US across all industries. In our digital channels, we have been acquiring new customers at record rates and our customer retention metrics continue to improve among new customers. We have the platform, the supply chain infrastructure, the tech stack and the talent to push our growth in e-commerce even higher.” That said, Williams-Sonoma hasn’t forgotten the store side of the omnichannel balance that eludes so many retailers in their frenzy to fend off Amazon. Laura Alber said “We are digital-first, but not digital only. Our stores are a competitive advantage that supports our online business for customers who want to experience our products in person, as well as for those who prefer the convenience of our omnichannel services.”

Williams-Sonoma has also been investing heavily in AI, VR, AR and 3D modelling capabilities but that was put on hold as the pandemic struck. One of the key advantages of having built their in-house tech platform is they can implement and test new initiatives quickly and adjust based on customer feedback. An example of this is Williams-Sonoma 3D capabilities. Williams-Sonoma 3D capabilities come to life as they introduce design crew room planners, including immersive multi-product AR room layouts and 360-degree experiences. These enhancements are important because this tool drives sales.

The company is also looking at new fulfilment models, another area of retail that’s been given greater emphasis by the pandemic and the need for assured delivery. Laura Alber says “In our supply chain we are aggressively expanding our US manufacturing and fulfilment capability by over 20% to 30% including adding close to two million square feet of distribution space to our delivery network. This will support our elevated demand, particularly for furniture. To help mitigate industry-wide shipping constraints and higher costs, we will test and expand our in-home delivery to include small packages, in addition to leveraging our omnichannel network.”

Management

When looking at management I like to judge the CEO in several different ways such as experience, capital allocation skills and Incentives. In this section, I will cover whether management incentives are aligned with shareholders.

Experience-Laura Alber is the current President of Williams-Sonoma. Laura Alber served as the President of Pottery Barn Brands, a subsidiary of Williams-Sonoma from February 2002 to 2006. She was responsible for the Pottery Barn Merchandising and Pottery Barn Kids stores. In her tenure at Williams-Sonoma, she has held various leadership roles, executing effective growth strategies, strengthening brand recognition and bolstering profits for its portfolio of multi-channel brands. As William-Sonoma continues to innovate, launch new businesses and expand product offerings, she has extended the Williams-Sonoma imprint into new categories with the introductions of brands such as Pottery Barn Kids, PBteen, PBdorm and new growth opportunities such as West Elm, West Elm Market, Mark and Graham, Rejuvenation and the Williams-Sonoma Agrarian collection. Before 2002, she served in various brand management roles, including Executive Vice President of Pottery Barn from 2000 to 2002, Senior Vice President of Pottery Barn Catalogue and Pottery Barn Kids Retail from 1999 to 2000 and Divisional Vice President of Pottery Barn Catalogue from 1997 to 1999.

Below is an image illustrating the current experience of Williams-Sonoma board members:

Capital Allocation-When it comes to judging management I think capital allocation skill is very important because I want management to create shareholder value and not destroy it. So far Williams-Sonoma’s capital allocation has been spot on because they are giving value back to shareholders via reinvestment back into the business to further expand their omnichannel capabilities, paying a dividend and doing share buybacks.

Williams-Sonoma is currently paying a dividend with a yield of 2.87%. As shown below this dividend is sustainable because this current dividend only takes up 26% of their overall free cash flow.

Incentive-This is important because if the current board is actively purchasing stock of their own business this is a positive indicator that shows that management believes the stock is undervalued and they believe in the long-term prospect of the company.

As you can see below we have 1 person selling Williams-Sonoma stock and no one buying. The insider that is selling Williams-Sonoma stock is Marta Benson(CEO and President Of Pottery Barn). I am not going to put too much weight into this because there are so many reasons why someone might sell their stock.

Bull And Bear Case:

Bull Case

Bull Case- The first bull case is share buybacks. Williams-Sonoma is a great example of a uber-cannibal. An uber-cannibal is a company that aggressively buys back its stock and in the last 5 years, Williams-Sonoma has bought back 21% of its outstanding shares. In March 2023 Williams-Sonoma announced a new $1b share repurchase programme which means more buybacks are on the way.

Bull Case-The second bull case is Williams-Sonoma Long Runway for Growth. Williams-Sonoma operates in a fragmented market where no player owns more than 5% of the pie. Currently, the home industry is an $830b opportunity where if Williams-Sonoma can capture 3% of the market share it will drive an additional $16B+ in revenues(or triple their business today).

Bear Case

Bear Case-The first Bear care is consumer spending. Williams-Sonoma’s business depends on consumer demand for their products and, consequently, is sensitive to several factors that influence consumer spending, including general economic conditions, inflationary pressures, consumer disposable income, fuel prices, recession and fears of recession, unemployment, availability of consumer credit, consumer debt levels, conditions in the housing market and elevated interest rates. Past economic downturns and inflationary pressures have led to decreased discretionary spending, which adversely impacted Williams-Sonoma’s business.

Bear Case-The second bear case is competition. Williams-Sonoma sales may be negatively impacted by increasing competition from companies with brands or products similar to theirs. The speciality retail industry is very competitive. Williams-Sonoma competes with other retailers that market lines of merchandise similar to theirs. Williams-Sonoma also competes with national, regional and local businesses that utilise a similar retail store strategy, as well as traditional furniture stores, department stores, direct-to-consumer businesses and speciality stores. The continued sales growth in the e-commerce industry has encouraged the entry of many new competitors, including discount retailers selling similar products at reduced prices, new business models, and an increase in competition from established companies, many of whom are willing to spend significant funds and/or reduce pricing to gain market share. The competitive challenges facing Williams-Sonoma today include:

Anticipating and quickly responding to changing consumer demands or preferences better than their competitors.

Maintaining favourable brand recognition and achieving customer perception of value.

Effectively marketing and competitively pricing their products to consumers in several diverse market segments.

Effectively managing and controlling costs, including advertising spend.

Effectively managing increasingly competitive promotional activity.

Effectively attracting new customers.

Developing new innovative shopping experiences, like mobile applications and augmented reality capabilities, that effectively engage today’s digital customers.

Developing innovative, high-quality products in colours and styles that appeal to consumers of varying age groups, tastes and regions, and in ways that favourably distinguish them from their competitors.

Effectively managing their supply chain and distribution strategies to provide their products to their consumers on a timely basis and minimise returns, replacements and damaged products. In light of the many competitive challenges facing the company, they may not be able to compete successfully. Increased competition could reduce their sales and harm their operating results and business.

Valuation:

In this section, I am going to talk about valuation. Using some basic metrics I am going to compare Williams-Sonoma against its industry rival and see if the company is cheap relative to its peers then I will value Williams-Sonoma using a discounted cash flow model to come up with a price I am willing to pay based on expected growth rate and my desired return of 15%.

As shown below when comparing Williams-Sonoma against its peers it scores 6/6 against RH(Restoration Hardware).

As you can see based on my conservative assumption, Williams-Sonoma is looking to grow mid-high single digits in the long term so I went conservative and assumed a 4% growth in the first 1-3 years then the growth will slow down to 1% in 4-6 years out. In my assumption, I also went with an exit multiple of 8x earnings which is below the historical average that Williams-Sonoma has traded at. Based on my assumption I have come to a buy price of $100.41 compared to the current stock price of $127.04 which means right now Williams-Sonoma is trading above what I am willing to pay. Because Williams-Sonoma is trading above what I am willing to pay I will add the company to my watchlist.

Thanks for reading my newsletter on Williams-Sonoma. Disclaimer this newsletter is not financial advice this is for educational purposes only so please DON’T take this as a buy or sell signal.

Follow for more:

Don’t forget to subscribe, share and leave a comment below if you found this newsletter insightful as it helps support my work.

Does is have a durable competitive advantage over its competitors?

Great article. Turns out the stock more than doubled again. another error of omission. Stupid discussions around RH & W let me think that Williams-Sonoma did not have a competitive advantage & deserved such a low multiple.