Disclaimer: This newsletter is not financial advice it is for educational purposes only. Please DO NOT take this newsletter as a buy or sell signal.

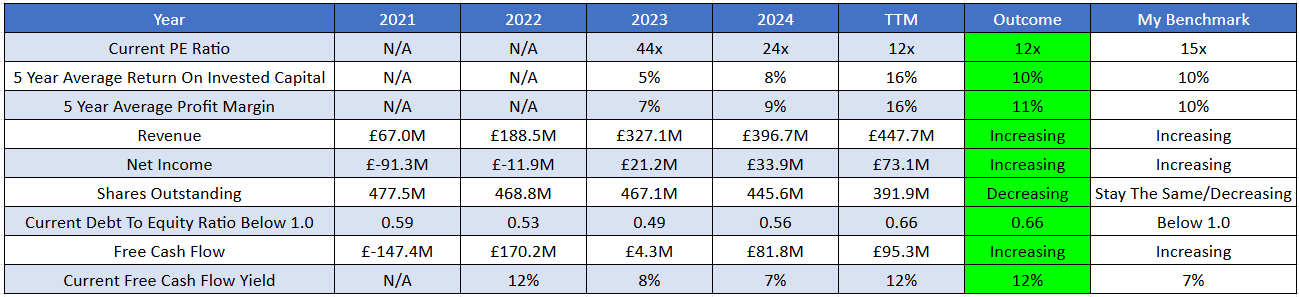

Trainline PLC Fundamentals:

Below is a checklist I normally use when analysing a company’s fundamental health. If the company meets my criteria it will be colour-coded in green and if it fails to meet my criteria it will be colour-coded in red which means I need to investigate further and ask myself why this is the case.

As you can see below Trainline PLC meets all my criteria.

Business Overview:

Founded in 1997 by Virgin Group, Trainline PLC operates an independent platform for selling rail and coach tickets worldwide. Trainline business is split into three parts. The first part is their UK consumer segment which focuses on helping individual travellers plan and book journeys within the United Kingdom through their apps and websites. The second part is their International consumer segment which also sells tickets to individual travellers for trips between the United Kingdom and other international destinations. Lastly Trainline solutions segment focuses on business clients by providing specialised ticket-booking platforms for large companies and travel management firms. It also builds online ticket-selling systems (e-commerce platforms) for UK train operating companies.

Business Segments:

UK Consumer - Trainline's most important business is selling train and bus tickets to people in the UK through its popular phone app which aggregates all UK rail ticket prices, routes, and major bus companies in one place. Trainline makes the booking process simple by promoting digital tickets such as e-tickets and digital railcards and by offering key services including real-time travel updates and self-service after-sales support for domestic travellers. Trainline's success depends heavily on the ongoing shift towards digital ticket adoption in the UK, maintaining a superior user experience, and driving repeat business among frequent travellers and commuters.

Trainline Solutions - The International consumer segment represents Trainline’s expansion into global markets. This segment primarily targets individual travellers who are looking to book journeys between the UK and international destinations or within continental Europe. This segment is strategically positioned to take advantage of the liberalisation of European high-speed rail markets such as Spain and Italy where increased competition among carriers creates strong demand for an independent aggregator. By connecting to over 270 rail and coach operators across more than 40 countries the International Consumer segment offers a platform for travellers to easily compare all available prices and routes from competing providers through a single user-friendly app interface.

International Consumer - Trainline Solutions is the company's business-to-business (B2B) and technology unit which distributes Trainline’s content and its platform technology Platform One to various partners rather than selling directly to the general public. Trainline international consumer segment has three main focuses:

The first is their White-label E-commerce Platforms. Trainline provides ready-to-use e-commerce solutions and mobile apps for UK Train Operating Companies (TOCs). By using these white-label solutions TOCs can offer a high-quality ticket-selling experience directly to customers under their own brand name without having to build the underlying technology themselves. This simplifies and upgrades the digital storefront for the train companies.

The second service is their Global API Access. This service provides a technical connection known as the Global API (Application Programming Interface) that allows Travel Management Companies (TMCs) and other global travel sellers to access Trainline’s rail content. This enables third parties to search easily and book tickets from various rail carriers worldwide through a single connection.

Last is their Managed Corporate Travel Portals. Trainline offers specialised online platforms that allow businesses of all sizes to book, manage, and track their employees' rail expenditures. These portals are customised to enforce company travel policies, provide detailed spending reporting, and often integrate with a company's financial systems.

Management:

When evaluating management I judge the CEO based on several factors such as experience, capital-allocation skills, and Incentives. In this section I will discuss whether management incentives are aligned with shareholders.

Experience- Jody Ford is the current Chief Executive Officer (CEO) at Trainline PLC a position he has held since March 2021. He originally joined the company in September 2020 as Chief Operating Officer (COO). Jody Ford has a lot of experience in innovating and growing consumer-facing digital and technology businesses across new sectors, markets, and audiences with a focus on leveraging data and insights to improve customer experience. Before joining Trainline he served as the Chief Executive Officer of Photobox Group which included Moonpig and Photobox brands. His career also spans ten years at eBay where he was based in California and ultimately led the global growth function for the company. Academically Jody Ford holds an MBA from INSEAD (Institut Européen d’Administration des Affaires or European Institute of Business Administration) and a BA in Economics and Politics from Exeter University.

Below is an image illustrating the current experience of Trainline board members:

Capital Allocation- Capital allocation is very important when judging management because I want them to create value for shareholders not destroy it. So far Trainline has done a great job with capital allocation because they are providing value back to shareholders by reinvesting in the business to further expand their presence and buying back shares.

Trainline DOES NOT pay a dividend. All their cash flow is being reinvested into the business for future growth and to fund buybacks. As of late 2025 Trainline has committed to a multi-year share buyback strategy totalling £350 million over a three-year period. As of late 2025 Trainline has repurchased and cancelled £215 million worth of shares across all programs launched since September 2023. This total reduction represents approximately 15% of the issued share capital at the start of the first buyback (approximately 481 million shares).

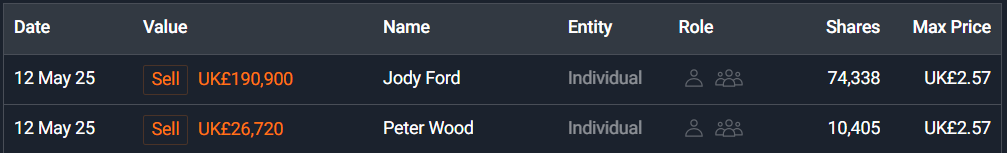

Incentive- This is important because if the current board is buying shares of their own business it indicates that management believes the stock is undervalued and is confident in the company’s long-term prospects.

As you can see below we have zero buy and two sell orders but I am not going to put too much weight into this because there are so many reasons why someone might sell their stock.

Bull And Bear Case:

Bull Case

Bull Case - The first bull case is Europe’s Rail Liberalisation. Trainline's future growth will depend on the ongoing change in European rail markets from state control to competition (liberalisation). As new private companies start operating on key routes the number of available tickets and customer choices increases significantly. Trainline is well-positioned to capitalise on this by serving as an important independent choice for travellers. This trend boosts ticket sales and encourages price competition on Trainline’s platform especially in key markets such as Spain and Italy.

Bull Case - The second bull case is A Dominant Market Position and Strong Brand Recognition. Trainline holds a clear leadership position as the most downloaded and utilised rail ticketing app in both the UK and major European markets. This established brand recognition and large loyal user base create a powerful network effect and a significant competitive moat. Its first-mover advantage and continuous investment ensure that new competitors face high barriers to entry when trying to replicate this scale and customer loyalty.

Bull Case- The third bull case is Their Highly Scalable Technology Platform. The entire business relies on its centralised tech stack called Platform One. This platform has successfully completed complex integrations with more than 270 rail and coach carriers across 40 countries. Since the challenging integration work is mostly complete the platform can be efficiently scaled into new regions at relatively low incremental cost. As a result when revenues increase their profits (EBITDA) can grow even faster leading to expanded margins.

Bear Case

Bear Case- The first bear case is Regulatory Risk. The most significant risk facing the company is the ongoing regulatory uncertainty in the United Kingdom. The primary threat is the possibility that a future centralised government entity such as the proposed Great British Railways (GBR) could launch its own state-backed ticketing website and app. If this platform were mandated to be the leading consumer portal or granted preferential access to fares it could significantly reduce Trainline’s ticket sales in the UK. While current government plans have been delayed or modified the long-term risk of the government choosing to bypass all third-party ticket retailers including Trainline remains a significant concern for the company.

Bear Case- The second bear case is Exposure To Commission Rate Cuts and Margin Pressure. Trainline’s UK revenue comes from commissions on ticket sales. The rate they earn isn’t entirely under their control as the rail industry has shown it can impose terms as seen with the agreed 0.5% cut in the base commission rate from 5.0% to 4.5% which starts this financial year. This cut immediately reduces profit margins and sets the example that regulatory rules can lower Trainline’s profits. The risk of future cuts creates ongoing uncertainty about how much money the company can make in the UK and what its profit margins might be.

Bear Case- The third bear case is Technological Displacement by Contactless Payments. In densely populated urban and commuter networks there is a significant trend toward expanding tap-as-you-go contactless payment systems onto the national rail network similar to those successfully implemented by Transport for London (TfL). These systems enable commuters to use their bank cards or mobile phones directly at the gate. This technological shift bypasses Trainline’s app-based sales channel putting a substantial portion of its high-volume commuter transaction sales at risk in high-density areas.

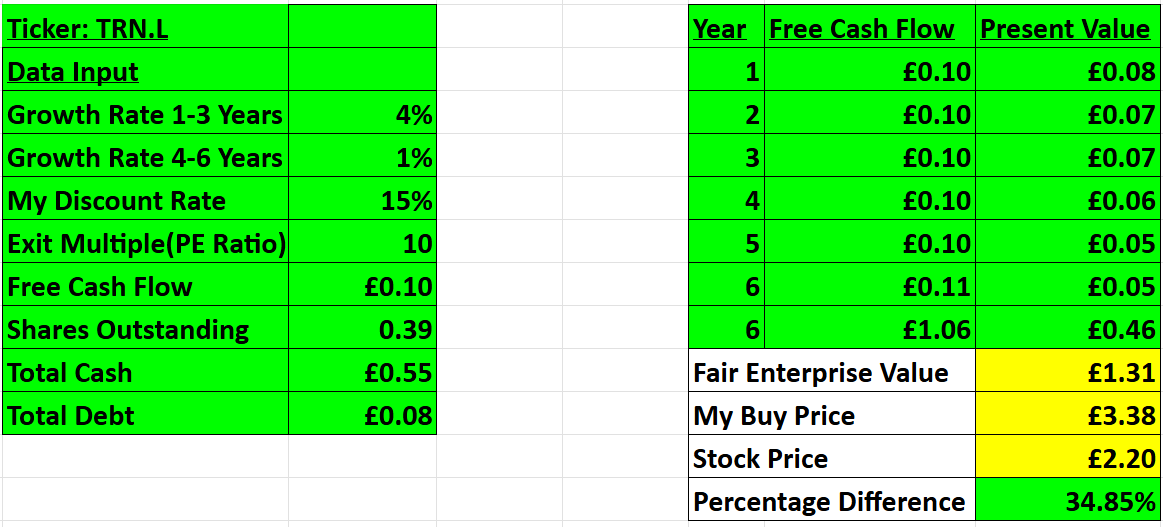

Valuation:

In this section I will discuss valuation. Using some basic metrics I will compare Trainline to its industry rivals and determine whether the company is cheap relative to its peers. Then I will value Trainline using a discounted cash flow model to determine a price I am willing to pay based on its expected growth rate and my desired return of 15%.

Trainline does not have direct like-for-like competition but it faces challenges from unlisted or state-owned entities such as:

Omio (formerly GoEuro) - This is a private/venture capital-backed competitor in the European market that offers multimodal search (train, bus, plane) that challenges Trainline’s international growth.

National Rail Carriers - Individual rail operators in Europe (such as Trenitalia and SNCF, the French state-owned rail company) are its primary rivals as they try to push customers to book directly through their own websites to avoid paying aggregator commissions.

Great British Railways (GBR) - A proposed UK government entity that poses a future political/regulatory threat as a state-owned ticket platform could displace Trainline in its home market.

As you can see based on my conservative assumption Trainline is looking to grow 4%-6% over the long run so I went conservative and assumed a 4% growth in the first 1-3 years then the growth will slow down to 1% 4-6 years out. In my assumption I also went with an exit multiple of 10x earnings which is below the historical average at which Trainline has traded. Based on my assumption I have come to a buy price of £3.38 compared to the current stock price of £2.20 which means right now Trainline is trading below its intrinsic value.

Thanks for reading my newsletter on Trainline Disclaimer: This newsletter is not financial advice. This is for educational purposes only, so please DO NOT take this as a buy or sell signal.

Follow for more:

Remember to subscribe, share, and comment below if you find this newsletter insightful. Your support helps me continue my work.

How big do you think is the risk of Great British Railways eating into Trainline's market share when their proposed app gets set up?

Thanks for flagging Trainline - never considered it as an investment despite having used it plenty when I lived in the UK. At a forward PE of ~9, strong buyback and genuine brand value it does sound interesting.

A few things I think will act as a permanent cap on valuation:

- The specter of a national ticketing agency replacing them

- The fact that commission rates aren't in their control. A company that doesn't have real pricing power will always be penalized..

That being said, the EU is a huge market. I remember 5-7yrs ago it was still better to go through (incredibly clunky) regional train company websites to get the best ticket prices. If they could chip into that pain point, they could have great runway. I don't know how much brand recognition they have ex-UK, and that could take a significant S&M budget.

Is there any way to track digital ticket adoption in the UK? The tap to pay point is also interesting..do people really just show up to a regional train without pre-buying a ticket these days?!