Disclaimer: This newsletter is not financial advice this is for educational purposes only so please DO NOT take this newsletter as a buy or sell signal.

Tencent Fundamentals:

Below is a checklist I normally use in my process when I look at the fundamental health of a company. If the company meets my criteria it will be colour-coded in green and if the company fails to meet my criteria it will be colour-coded in red which means I need to investigate further and ask myself why this is the case.

As you can see there is 1 red box and I am going to explain it below:

Free Cash Flow Yield- Free Cash Flow Yield gives investors another way to assess the value of a company. Free cash flow yield provides a better measure of a company's performance than the PE ratio because earnings can be manipulated based on accounting rules. The most common way to calculate free cash flow yield is free cash flow divided by the company market cap. Generally, the lower the ratio, the less attractive a company is as an investment because it means investors are putting money into the company but not receiving a very good return in exchange. A high free cash flow yield result means a company is generating enough cash to easily satisfy its debt and other obligations including dividend payout. Currently, Tencent’s free cash flow yield is 5%. Even though this is lower than my 7% threshold it is still above the risk-free rate which currently sits at 4.2%. When the treasury yield is yielding lower than a company’s earnings/cash flow, according to the intelligent investor this means you are compensated for the extra risk you are taking with an individual business.

Business Overview:

Founded in 1998 by Pony Ma, Tony Zhang, Xu Chenye, Charles Chen and Zeng Liqing, Tencent is a Chinese technology, entertainment, conglomerate and holding company headquartered in Shenzhen. Tencent is one of the highest-grossing multimedia companies in the world based on revenue. It is also the world's largest company in the video game industry. In 2018 Tencent surpassed a market value of $500 billion making it become the first Asian technology company to cross this valuation mark. Since then Tencent has emerged as the most valuable publicly traded company in China as of 2023. The name "Tencent" is based on its Chinese name “Tengxun” which incorporates part of Pony Ma's Chinese name (Ma Huateng) and means “galloping fast information.”

Naspers has a huge connection with Tencent. Naspers is a South African company founded in 1915. In 2001 Naspers made a $32 million investment from when Tencent was a start-up company and today that investment has grown to be worth $200 billion. Due to Naspers essentially being a holding company, this has caused a huge issue for Naspers and the Johannesburg Stock Exchange because Naspers now completely dominates the Johannesburg Stock Exchange (JSE). Due to Naspers being such an important part of the index in South Africa, whenever there’s a move in the share price it feeds through to the index both negatively and positively. Naspers has a 20% weighting on the JSE index. Naspers has tried to reduce its crushing weight on the exchange by creating a separate entity called Prosus, which is listed in Amsterdam, Netherlands. Prosus now holds Naspers Tencent share and other technology stocks, while Naspers controls more than 70% of Prosus.

Business Segments:

Tencent's core operations are made up of four business segments:

Value-Added Services (VAS)- The value-added services segment refers to the range of value-added services Tencent offers on its gaming and social networking platforms.

Online Advertising- The online advertising segment consists of two sub-segments and they are social and other advertising and media advertising.

FinTech And Business Services- The FinTech and business services segment refers to revenue generated from Tencent's financial technology (FinTech) business, cloud computing initiatives, and other business services. The revenue segment can be broken down into two sub-segments and they are FinTech and Cloud and Other Business Services.

Others- The others segment refers to Tencent's investments in and production and distribution of films and television programmes for third parties, copyrights licensing, merchandise sales (presumably related to Tencent's core entertainment business such as gaming-related merchandise which Tencent is licensed to sell), and various other activities.

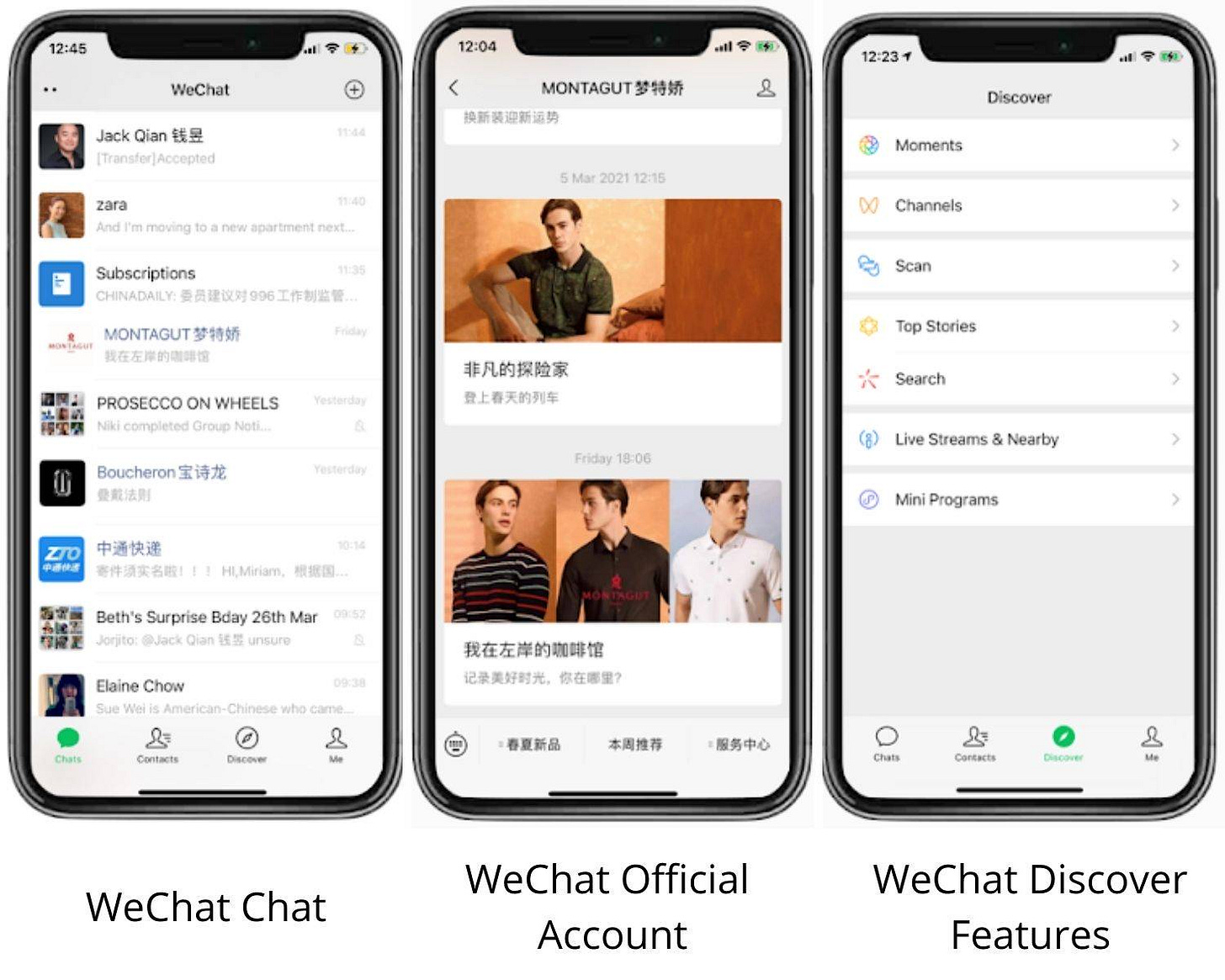

Communication And Social Networks- First released in 2011, Weixin(WeChat)is a Chinese instant messaging, social media, and mobile payment app developed by Tencent. In 2018 WeChat became the world's largest standalone mobile app with over 1 billion monthly active users. WeChat has been described as a super-app because of its wide range of functions such as:

Messaging-WeChat supports a variety of different instant messaging features including text messaging, hold-to-talk voice messaging, broadcast messaging, video calls and conferencing. Users can send previously saved or live pictures and videos, profiles of other users, coupons, lucky money packages, or current GPS locations with friends either individually or in a group chat. WeChat also provides a message recall feature which allows users to recall and withdraw information (e.g. Images, documents) that are sent within 2 minutes of a conversation. To use this feature, users can select the message or file to be recalled by long pressing.

Public Accounts-WeChat users can register as a public account which enables them to push feeds to subscribers, interact with subscribers and provide them with services. Users can also create an official account, which falls under service, subscription, or enterprise accounts. Once users as individuals or organisations set up a type of account, they cannot change it to another type.

Moments-WeChat also has a feature called “moments” which is a brand name for its social feed of friends updates. “Moments” is an interactive platform that allows users to post images, text, and short videos taken by users. It also allows users to share articles and music (associated with QQ Music or other web-based music services). Friends in the contact list can give thumbs up to the content and leave comments.

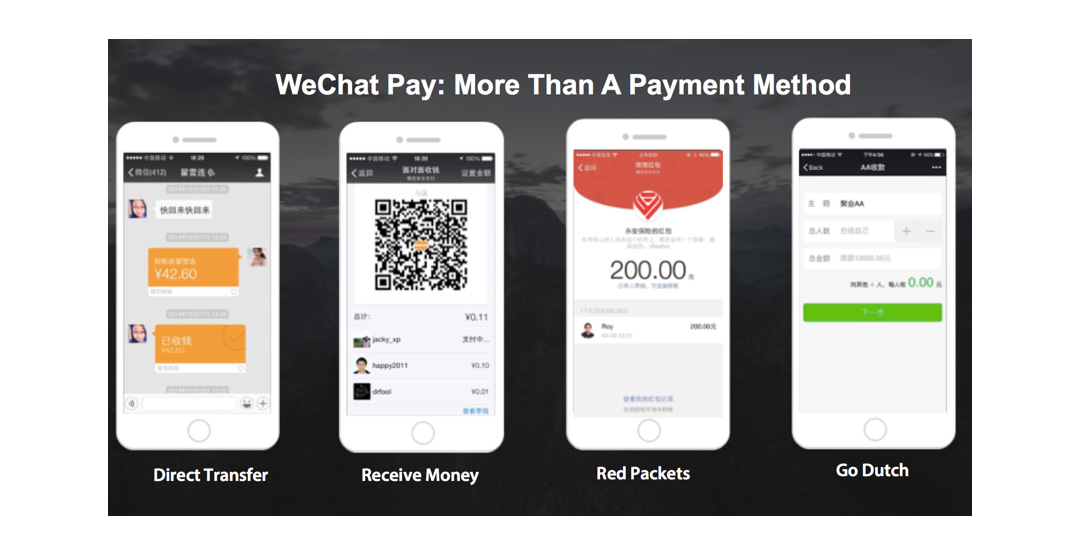

Digital Payments- WeChat Pay is a digital wallet service incorporated into Weixin. This allows users to perform mobile payments and send money between contacts. Users who have provided bank account information may use the app to pay bills, order goods and services, transfer money to other users, and pay in stores if the stores have a Weixin payment option. Users can link their Chinese bank accounts, as well as Visa, MasterCard and JCB.

Enterprise WeChat- For work purposes, companies and businesses can communicate via a special version of WeChat called Enterprise WeChat which was launched in 2016. The app was meant to help employees separate work from private life. In addition to the usual chat features, the program lets companies and their employees keep track of annual leave days and expenses that need to be reimbursed and employees could ask for time off or clock in to show they were at work.

WeChat Mini Program- In 2017, WeChat launched a feature called Mini Programs. A mini program is an app within an app. Business owners can create mini apps in the WeChat system. Users may install these inside the WeChat app. In January 2018, WeChat announced a record 580,000 mini-programs were launched. With one Mini Program, consumers could scan the quick response code using their mobile phone at a supermarket counter and pay the bill through the user's WeChat mobile wallet. WeChat Games have received huge popularity, with its "Jump Jump" game attracting 400 million players in less than 3 days and attaining 100 million daily active users in just two weeks after its launch. Ever since The WeChat Mini Program was launched, the daily active user count of WeChat Mini Programs has increased dramatically. In 2017, there were only 160 million daily active users however the number reached 450 million in 2021.

WeChat Channels- In 2020, WeChat Channels were launched. They are a short video platform within WeChat that allows users to create and share short video clips and photos to their own WeChat Channel. Users of channels can also discover content posted to other channels by others via the in-built feed. Each post can include hashtags, a location tag, a short description, and a link to a WeChat official account article. In September 2021, it was reported that WeChat Channels began allowing users to upload hour-long videos, twice the duration limit previously imposed on all WeChat Channels videos. Comparisons are often drawn between WeChat Channels and TikTok for their similarity in features.

Easy Mode- In September 2021, WeChat introduced a brand-new feature on its platform called Easy Mode. It was mainly designed for elderly people with higher readability by providing a larger font size, sharper colours, and bigger buttons. Another feature provided in this update was the ability to listen to text messages.

Guardian Mode-Guardian Mode is a function in WeChat for protecting users under 14 years old. It was introduced to promote safety and provide a security environment for WeChat users. After operating the Guardian Mode, the functions of people nearby, games, and search will not be accessible in the interface. The channels function in WeChat would only show content suitable for adolescents. Additionally, WeChat users who turn on the Guardian Mode are only able to add friends through QR codes and group chats. Moreover, WeChat users would only be able to view the 10th latest moments posts and would not be able to view the 10 latest moments posts of non-friend users under the privacy setting of guardian mode.

WeChat Business- WeChat Business is one of the latest mobile social network business models after e-commerce which utilises business relationships and friendships to maintain a customer relationship. Compared with traditional e-businesses like JD and Alibaba, WeChat Business has a large range of influence and profits with less input and a lower threshold which attracts lots of people to join in WeChat business. As more and more people have joined WeChat Business, it has brought many problems for example some sellers have begun to sell counterfeit luxury goods such as bags, clothes and watches. Some sellers have disguised themselves as international flight attendants or overseas students to post fake stylish photos on WeChat Moments. They also claim that they can provide overseas purchasing services but sell counterfeit luxury goods at the same price as authentic ones.

QQ-First released in 1999 under the name OICQ, QQ is an instant messaging software service and web portal developed by Tencent. QQ offers services that provide online social games, music, shopping, microblogging, movies, and group and voice chat software. As of March 2023, there were 597 million monthly active QQ accounts. In 1999 Tencent changed its name from OICQ to QQ after AOL threatened the company with trademark infringement.

Fintech-Weixin Pay in China is a mobile payment and digital wallet service that allows users to make mobile payments and online transactions. As of March 2023, Weixin Pay has over 1.133 billion active users. WeChat Pay's main competitor in China and the market leader in online payments is Alibaba Alipay. Users who provide their bank account information can utilise the app for various financial transactions such as paying bills, making purchases, transferring money to other users, and even conducting in-store payments if the stores support WeChat payment. These services are offered by verified third-party entities called official accounts which create mini-programs.

In 2014, for Chinese New Year WeChat introduced a new feature for distributing virtual red envelopes. The feature allows users to send money to contacts and groups as gifts. When sent to groups the money is distributed equally or in random shares. The feature was launched through a promotion during China Central Television (CCTV)'s heavily watched New Year's Gala, where viewers were instructed to shake their phones during the broadcast for a chance to win sponsored cash prizes from red envelopes. The red envelope feature significantly increased the adoption of WeChat Pay. According to the Wall Street Journal, 16 million red envelopes were sent in the first 24 hours of this new feature's launch. A month after its launch WeChat Pay's user base expanded from 30 million to 100 million users and 20 million red envelopes were distributed during the Chinese New Year holiday. In 2016 3.2 billion red envelopes were sent over the holiday period and 409,000 alone were sent at midnight on Chinese New Year.

Tencent Cloud Services- Tencent Cloud provides a full suite of industry and technical solutions that fit a wide variety of business scenarios. Tencent Cloud International operates 70 availability zones spread across 26 regions globally. Tencent Cloud provides services for hundreds of millions of people via its flagship products like QQ and WeChat.

Utilities(Mobile Browser And Mobile Security- In March 2006, Tencent launched its search engine “Soso.” In 2012 “Soso” was the 33rd most visited website in the world, the 11th most visited in China and the 8th most visited website in South Korea according to Alexa Internet. It was also a Chinese partner of Google using AdWords. In 2013, Tencent discontinued “Soso” after it invested in Sogou and replaced “Soso” with Sogou Search as its main search engine.

In 2008, Tencent released a media player, available for free download under the name QQ Player. Tencent also launched Tencent Traveler a web browser based on Trident. It became the third most-visited browser in China in 2008.

QQ Haiwai is Tencent's first venture into international real estate listings and information and is the result of a partnership with Chinese international real estate website Juwai. Haiwai was announced at Tencent's annual regional summit in Beijing in 2016.

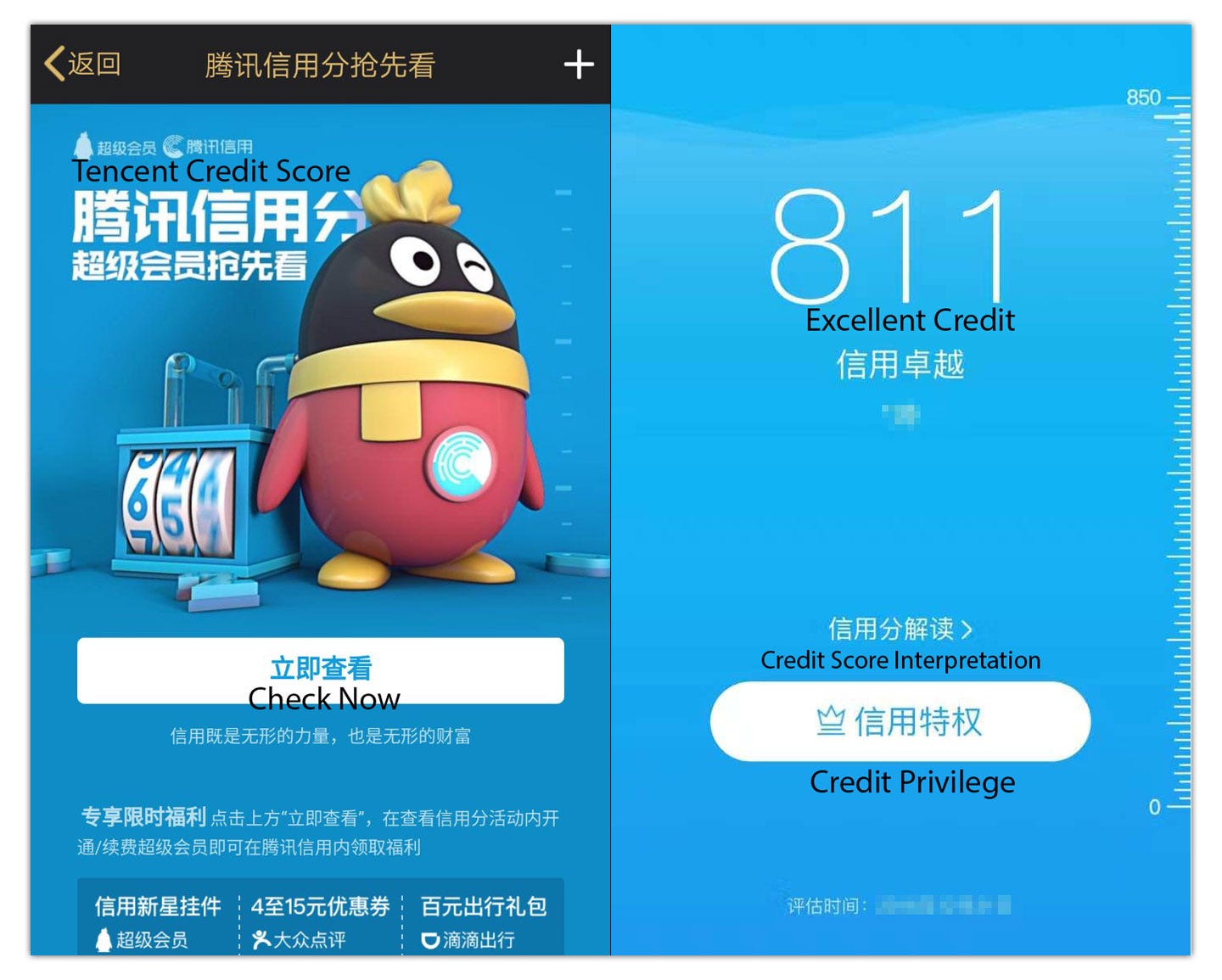

In 2017, Tencent launched its credit score system called Tencent Credit with a process similar to that of Sesame Credit operated by its competitor Alibaba through its subsidiary Ant Financial.

Digital Content- On the principle of connecting everything, Tencent continues to explore a range of diverse, integrated social entertainment offerings that look towards the future. Building upon high-quality content and driven by its technological innovations Tencent continues to explore the next generation of social and content integration. Through cross-screen, multi-platform and multi-format models, Tencent aims to provide Internet users with diversified and multi-dimensional content, to satisfy all of their users' entertainment needs.

Gaming- Tencent Games is the video game publishing division of Tencent. It has five internal studio groups including TiMi Studio Group, Lightspeed Studios, Aurora Studio Group, Morefun Studio and Next Studio. Tencent Games published its first game QQ Tang which was based on its social media platform QQ. This was soon followed by QQ variant games such as Dungeon Fighter Online, QQ Fantasy, Xunxian, QQ Sanguo and QQ Huaxia. In 2013 Tencent gradually turned to mobile gaming. A game centre with a sizable mobile game user base was launched by Mobile QQ and WeChat in the upcoming years. To become the biggest online gaming firm in the world Tencent concentrated on the global gaming market by investing aggressively in foreign gaming companies.

In 2015, Tencent Games published a multiplayer online battle arena game called Honor Of Kings. This game was exclusively for the Mainland China market and was developed by the L1 division of TiMi Studio Group. In 2017 the game was both the world's most popular and highest-grossing game of all time as well as the most downloaded app globally. In 2011, Tencent Games started hosting online multiplayer games such as Call Of Duty Online which consists of previous Call Of Duty titles with added content as well as the game League of Legends.

In April 2017, Tencent Games unveiled its flagship gaming platform WeGame which will host games, content, and services from all over the world and will provide gaming info, purchases, downloads, live streaming, and community services. WeGame is an upgraded version of TGP (Tencent Games Platform) that already has more than 200 million active users (compared to Steam's 125 million in 2015) and over 4.5 billion downloads. The platform will be dedicated to global developers and players.

On 18 March 2019, Tencent announced that its subsidiary, TiMi Studio Group would develop Activision's Call of Duty: Mobile. The game was released worldwide in 2019. As of October 2019, the game has surpassed 35 million downloads and over $2 million in revenue. PUBG Mobile and its Mainland China version topped the global mobile games chart by revenue raking in a combined $232 million in sales in March 2020. Honour Of Kings is ranked as the second highest-earning game globally generating $112 million in revenue.

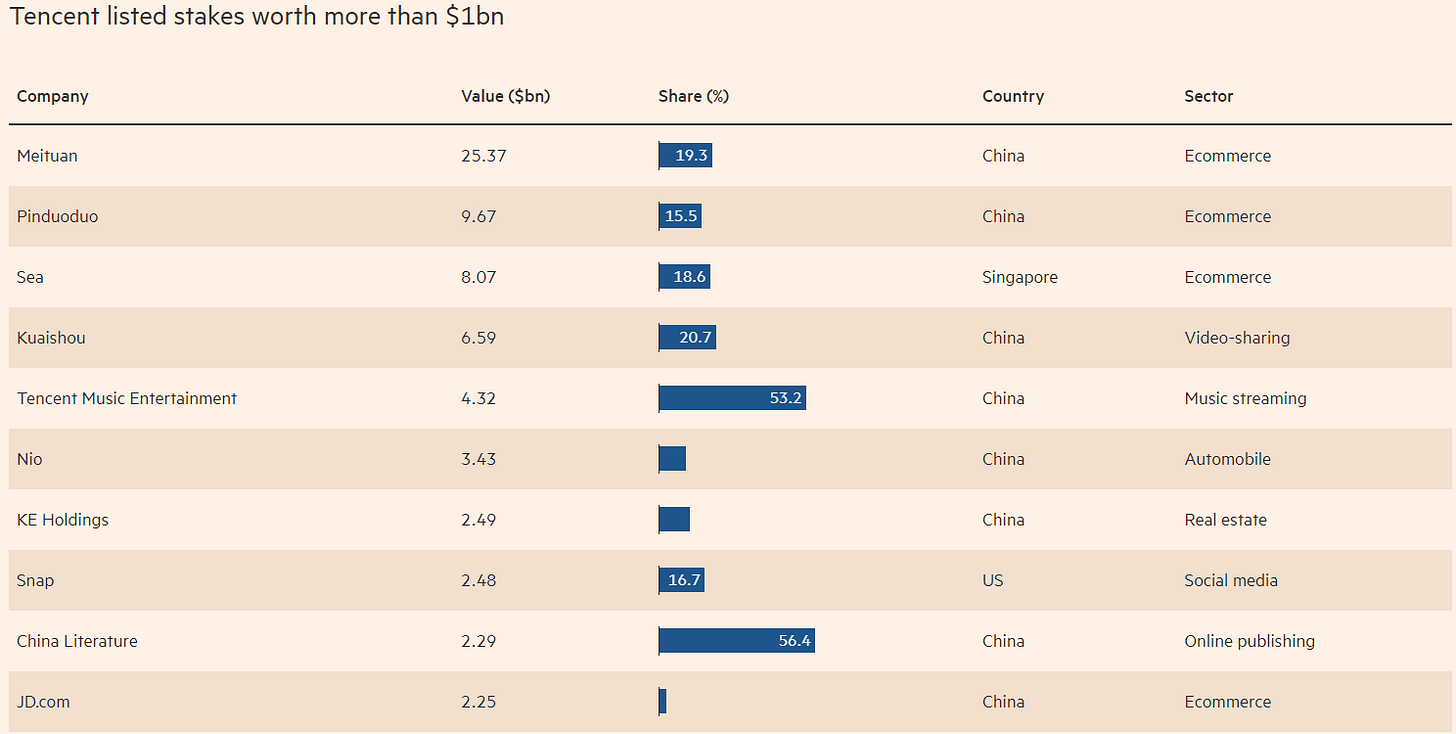

Tencent Investment Portfolio- Tencent manages its investment portfolio with the primary objective of strengthening its leading position in core businesses and complementing its “Connection” strategy in various industries, particularly in social and digital content, O2O and smart retail sectors. Tencent also invests in transportation, FinTech, cloud and other sectors. Tencent’s investment portfolio contains several international companies such as Tesla, Spotify, and some private companies like Discord and Tile. International investments represent slightly less than half of the portfolio, and that percentage is increasing. Many investors are reluctant to buy a company for its investment portfolio because they prefer to pick stocks themselves. In my view, there are four major benefits that Tencent's portfolio offers over individual stock picking:

The investment portfolio isn't the only reason to buy Tencent it could still be a good investment without it.

Their track record is very good, with the portfolio returning over 230% in the last 7 years.

Less than 10% of the companies in the portfolio are publicly traded, so it would be difficult for most investors to get direct access to most of the companies.

Tencent can utilise its platform and intellectual property to give its investments a moat and increase the chance that they will be successful e.g. JingDong(JD) and Pinduoduo.

Management

When looking at management I like to judge the CEO in several different ways such as experience, capital allocation skills and Incentives. In this section, I will cover whether management incentives are aligned with shareholders.

Experience- Ma Huateng also known as Pony Ma, is the Co-Founder of Tencent and serves as its Chairman and Chief Executive Officer. Pony Ma has overall responsibilities for strategic planning, positioning and management of the company. Before his current employment, he was in charge of research and development for Internet paging system development at China Motion Telecom Development Limited, a supplier of telecommunications services and products in China. He has more than 24 years of experience in the telecommunications and Internet industries. Pony Ma is a deputy to the 13th National People’s Congress. He serves as a Director of Ohio River Investment Limited. Pony Ma also holds a Bachelor of Science (Computer Applications) obtained from Shenzhen University in 1993.

Below is an image illustrating the current experience of Tencent board members:

Capital Allocation-When it comes to judging management I think capital allocation skill is very important because I want management to create shareholder value and not destroy it. So far Tencent capital allocation has been spot on because they are giving value back to shareholders via reinvestment back into the business, share buyback and paying a dividend.

Tencent is currently paying a dividend with a yield of 0.74%. As shown below this dividend is sustainable because this current dividend only takes up 13% of their overall free cash flow.

Incentive- This is important because if the current board is actively purchasing stock of their own business this is a positive indicator that shows that management believes the stock is undervalued and they believe in the long-term prospect of the company.

As you can see below we have 0 buy orders and 0 sell orders.

Bull And Bear Case:

Bull Case

Bull Case- The first bull case is the end of the Tech crackdown. Since the government's regulatory crackdown on the sector began more than two years ago China's major tech companies have shed more than $1 trillion in value which is the equivalent of the entire Dutch economy. The government looks like they have changed their stance towards Chinese Tech after they have realised they might have taken things too far. The government is now calling for China’s tech companies to help support the economy after the Chinese economy took a hit due to their strict lockdown measures. The government has also been more lenient with their fines towards their tech giants after fining Tencent and its subsidiary Tenpay $410 million and Alibaba and Ant Group $1 billion.

Bull Case-The second bull case is Pony Ma world class capital allocation skills. Pony Ma is one of the most unrecognised and underappreciated capital allocators ever. He is arguably China’s version of a young Warren Buffett (admittedly with different approaches). Pony Ma is a very reserved, non-public CEO which may explain the lack of praise. Pony Ma has not only proved his ability to build incredible businesses but he has also been just as successful with M&A. Two incredible examples of acquisitions are game developers Riot Games and Epic Games which are known for League of Legends & Fortnite.

Bear Case

Bear Case-The first bear case is the regulation on gaming. Tencent faces tight playtime restrictions for minors and intense competition across China's crowded gaming market. Tencent is trying to offset that domestic pressure by expanding beyond China and acquiring more overseas studios but that expansion could also be disrupted by regulatory and antitrust headwinds.

Bear Case-The second bear case is delisting. When it comes to Chinese stocks delisting is always a fear because investors aren’t sure if Chinese companies will comply with US regulators. In 2022, the SEC added Tencent to a list of companies facing delisting from U.S. stock exchanges if its auditors remain unable to examine Tencent’s books before 2024. The transparency between China and US regulators seems to have improved as Tencent vows to comply with US regulators to protect shareholder value.

Valuation:

In this section, I am going to talk about valuation. I will be valuing Tencent by using a discounted cash flow model to come up with a price I am willing to pay based on a conservative growth rate and my desired return of 15%. Since Tencent hasn’t got a like-for-like competitor there won’t be any industry comparison however Tencent does have companies that they compete with based on the various sub-sectors they are involved in for example in gaming, NetEase is Tencent's biggest competitor in China's gaming market. Tencent's Honor Of Kings and Game For Peace are currently the two highest-grossing iOS games in China, according to App Annie but four of NetEase's games Onmyoji, Immortal Conquest, and two entries in its flagship Fantasy Westward Journey franchise are also top-10 titles. Another example is the competition in the payment space where Tencent's WeChat Pay remains the top payment platform in China, and 86% of China's mobile users used the app last year, according to Ipsos. However, 71% of users used Alibaba-backed Alipay, and 64% regularly used both apps. Therefore, the growth of Alibaba's core marketplaces and its ongoing push into brick-and-mortar stores could still curb the growth of Tencent's fintech business.

In this final part, I will be valuing Tencent by using a discounted cash flow model to come up with a price that I am willing to pay for the company. When valuing a company I tend to be conservative so below is the valuation of Tencent based on a 6-year projection.

As you can see based on my conservative assumption, Tencent is looking to grow 10% so I went conservative and assumed a 8% growth in the first 1-3 years then the growth will slow down to 5% 4-6 years out. In my assumption, I also went with an exit multiple of 15x earnings which is below the historical average that Tencent has traded at. Based on my assumption I have come to a buy price of $39.77 compared to the current stock price of $40.52 which means right now Tencent is trading above intrinsic value.

Thanks for reading my newsletter on Tencent Holdings. Disclaimer This newsletter is not financial advice This is for educational purposes only so please DO NOT take this as a buy or sell signal.

Follow for more:

Don’t forget to subscribe, share and leave a comment below if you found this newsletter insightful as it helps support my work.

Great work Wes, on one of the best companies in the Tech space🙏👍

I'll feature this in the next Friday Round-Up later today

https://open.substack.com/pub/rhinoinsight/p/the-friday-roundup-632?r=2587ts&utm_campaign=post&utm_medium=web

You did a great job once again Wesley 👏🏻