Disclaimer: This newsletter is not financial advice; it is for educational purposes only. Please DO NOT take this newsletter as a buy or sell signal.

Spectra Systems Corporation Fundamentals:

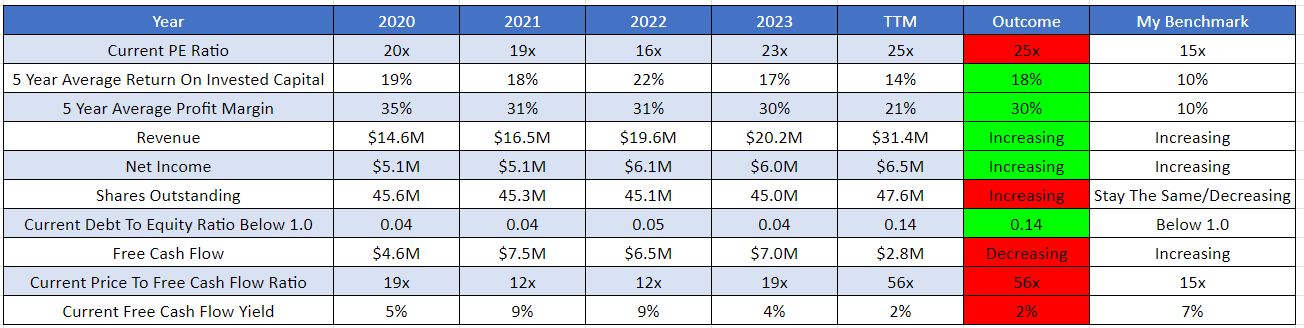

Below is a checklist I normally use when analysing a company’s fundamental health. If the company meets my criteria, it will be colour-coded in green, and if it fails to meet my criteria, it will be colour-coded in red, which means I need to investigate further and ask myself why this is the case.

As you can see below, there are five red boxes, and I am going to explain each one:

Current PE Ratio- Spectra Systems currently has a PE ratio of 25x and a Price To Free Cash Flow Ratio of 56x, which might indicate that this company is trading at a premium to the market since the average stock market PE ratio is 15x. One thing to remember is if a company can grow 25% from now until judgment day and they can sustain that growth, then the current valuation will look cheap. This goes for the opposite side of the spectrum, where if a company was trading at 15x earnings and only grew by 3% a year, that might seem expensive because the company can’t justify its valuation. The reason why Spectra Systems has a discrepancy between earnings and cash flow is because their cash flow is skewed by recent spending, but over time, the earnings and cash flow should align with each other.

Shares Outstanding- When analysing a company, I ideally want their shares outstanding to remain the same or decrease over time. As you can see, Spectra Systems shares outstanding have increased by 4.39% in the last five years. This is something to keep an eye on because issuing shares does destroy shareholder value. Most of Spectra Systems’ dilution happened between 2023 and 2024, and this is because the company used share issuance to help fund the purchase of Cartor Holding.

Free Cash Flow- Spectra Systems’ free cash flow has decreased in the last five years. However, this is due to the company’s strategic decision to invest more in capital expenditure.

Free Cash Flow Yield- Free Cash Flow Yield gives investors another way to assess the value of a company. Free cash flow yield provides a better measure of a company’s performance than the PE ratio because earnings can be manipulated based on accounting rules. The most common way to calculate free cash flow yield is free cash flow divided by the company market cap. Generally, the lower the ratio, the less attractive a company is as an investment because investors are putting money into the company but not receiving an excellent return. A high free cash flow yield implies a company generates enough cash to quickly satisfy its debt and other obligations, including dividend payout. Spectra Systems’ free cash flow yield is 2%, which is lower than my 7% threshold and lower than the risk-free rate, which currently sits at 4.2%. It is important to remember that when the treasury yield is higher than a company’s earnings/cash flow, according to the intelligent investor, you are NOT being compensated for the extra risk you are taking with an individual business.

Business Overview:

Founded in 1996 by Nabil Lawandy, Spectra Systems (formerly Spectra Science Corporation) invents, develops, and sells integrated optical systems in the United States and worldwide. Spectra Systems operates through four segments: authentication systems, secure transactions, security printing, and banknote cleaning. Spectra Systems offers comprehensive solutions, including a taggant material system and sensor equipment for authenticating banknotes and security documents, as well as banknote cleaning and disinfection systems. Additionally, the company provides optical materials for security and quality control, such as fluorescent and phosphorescent pigments and dyes, invisible pigments and dyes, and gasochromic response materials. It also offers customised materials, hardware solutions, and internal control systems for real-time fraud control and risk management used by lottery and gaming operators. Lastly, Spectra Systems provides software and hardware systems, including high-speed currency authentication sensors, conventional and hybrid postage stamps, tax stamps, vouchers, coupons, certificates, and high-security documents.

Business Segments:

Banknotes- Spectra Systems plays a vital role in protecting governments from counterfeiting threats. The company invents, develops, and manufactures integrated authentication solutions, some of which are exclusively used by central banks. These solutions include taggant materials and sensor technology designed to authenticate banknotes at high processing speeds. Spectra Systems’ software and hardware systems feature high-speed currency authentication sensors, allowing central banks to verify up to 40 banknotes per second with an error rate of less than one in 100,000. Additionally, the company designs, manufactures and supplies quality control equipment for the production of paper and polymer banknotes. Its high-performance luminescent materials are also used in security threads and inks in the banknote industry.

Consumer Products- Spectra Systems specialises in developing, marketing, and selling customised authentication solutions that enhance the security of branded products. Their technology is applied to various consumer products, such as energy drinks, shampoo, wine, liquor, tobacco, fertiliser, and automotive parts. Spectra Systems uses a proprietary verification system that employs handheld readers and smartphones for real-time verification in the field.

Excise Stamps- Illicit trade in products that generate excise revenue is staggering. In tobacco products alone, it is estimated that $40-50 billion a year is untaxed due to the counterfeiting of poorly secured tax stamps. With access to label-making and print technology that enables fraudulent copies of legitimate tax stamps, there is a need for multi-level security features, much like those used for banknotes. Spectra Systems has leveraged the expertise and technologies developed for the banknote industry in a way that provides highly secure overt and covert features for tax stamps. Spectra Systems supplies security printers and hologram makers with high-performance luminescent pigments and dyes for unique, overt visible effects, as well as covert authentication systems comprising invisible markers and verification technology that run on handheld readers or smartphone platforms.

Lottery And Gaming- Fraudulent transactions are a significant concern for lottery directors. Consumer confidence is vital for strong sales, and any perception of misconduct in lottery operations can undermine years of effort in building a loyal customer base. To ensure transparency and compliance, lotteries and gaming regulators require an independent mechanism that provides assurance that lottery operators adhere to established rules. Many lottery jurisdictions mandate the implementation of an independent control system to meet consumer assurance standards. Spectra Systems Premier Integrity is a well-recognised and often essential component of a regulatory compliance framework. The Spectra Systems Integrity Internal Control System (ICS) is a fully automated, independent system that guarantees the integrity of lottery games by logging and validating all transactions against game rules. It detects and flags any transactions that violate these rules in real-time. The Integrity application software operates exclusively on the ICS computer hardware and offers independent sales figures and winning number verification for all online and instant lottery games. Additionally, the Integrity ICS is capable of processing transaction data in real-time as well as from offline media produced by the online gaming computer.

Manufacturing- Spectra Systems understands the significance and value of effective quality control in manufacturing. Real-time defect detection allows for swift corrections, minimising both time and material waste. Spectra Systems offers solutions that identify non-conforming products at production speed through in-line vision systems, as well as for spot checks using offline vision systems.

Management:

When evaluating management, I judge the CEO based on several factors, such as experience, capital allocation skills, and Incentives. In this section, I will discuss whether management incentives are aligned with shareholders.

Experience- Dr. Nabil M. Lawandy, Ph.D., is the Founder, Chief Executive Officer, and President of Spectra Systems Corporation, a position he has held since July 1996. He also serves as the President, Chief Technology Officer, and Chief Executive Officer of Solaris Nanosciences Corp. Previously, Dr. Nabil Lawandy was a Professor at Brown University from 1981 to 1999. He is the author of over 170 peer-reviewed scientific papers and holds 40 issued patents. Dr. Nabil Lawandy earned a B.A. in Physics, an M.S. in Chemistry, and a Ph.D. in Chemistry, all from The Johns Hopkins University. He has received several prestigious awards, including the Presidential Young Investigator Award, an Alfred P. Sloan Fellowship, a Rolex Award for Enterprise, and the Samuel Slater Award for Innovation.

Below is an image illustrating the current experience of Spectra Systems board members:

Capital Allocation- When judging management, capital allocation is very important because I want them to create value for shareholders, not destroy it. So far, Spectra Systems has done a great job with capital allocation. They are providing value back to shareholders by reinvesting in the business to improve their technology and paying dividends.

Spectra Systems currently pays a dividend with a yield of 3.63%. However, this dividend is not sustainable, as it consumes all their cash flow. However, their earnings can cover it while their cash flow is temporarily suppressed due to investments.

Incentive- This is important because if the current board is buying shares of their own business, it indicates that management believes the stock is undervalued and has confidence in the company’s long-term prospects.

As you can see below, we have zero buy orders and zero sell orders.

Bull And Bear Case:

Bull Case

Bull Case- The first bull case is the company’s long-term growth prospects. With over 150 billion banknotes manufactured annually worldwide and 85% of all transactions conducted using banknotes, this segment has established itself as a high-quality, long-term revenue source for Spectra Systems. The pandemic underscored the value of banknotes as a reliable store of value. To date, 20 central banks have utilised the company’s products and newly developed technologies, particularly for polymer banknotes. Continued strong earnings are anticipated from this sector, especially as polymer substrate banknotes are projected to grow at an 18% compound annual growth rate (CAGR). The company is well-positioned to enter this market with its unique covert, machine-readable substrate.

Bull Case- The second bull case is the company’s opportunity beyond banknotes. TruBrand’s smartphone authentication technology, already utilised by some Chinese tobacco manufacturers, has the potential to revolutionise how brand owners track the time and location of counterfeit products. Additionally, there are opportunities for using smartphone authentication technology in documents and passports, as well as new market possibilities for optical materials in consumer applications.

Bear Case

Bear Case- The first bear case is the expiration of patents. All patents have a limited duration of enforceability, typically lasting 20 years from the filing date in the U.S. Once a patent expires, the public is free to use the invention without needing permission from the patent owner as long as there are no other unexpired patents covering any aspect of the invention.

Bear Case- The second bear case is technological change. The markets for the company’s products may experience rapidly evolving technology, shifting industry standards, and increasingly sophisticated customer requirements. The launch of products featuring new technology and the establishment of new industry standards could render the company’s existing products obsolete and unmarketable, potentially leading to pricing pressures on those products. If the company cannot develop new products that remain competitive in terms of technology, pricing, and customer needs, this could negatively impact the business.

Valuation:

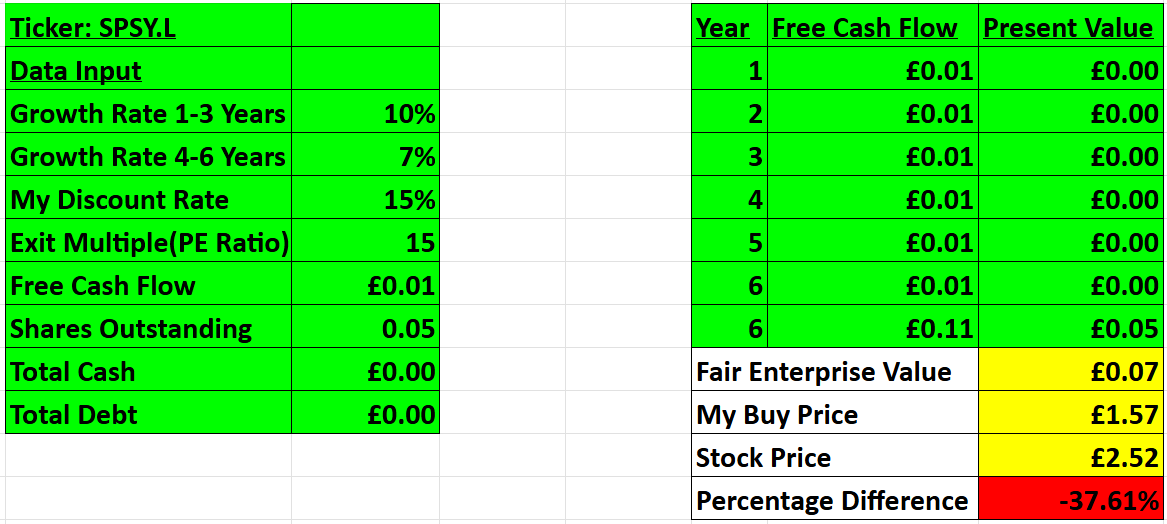

In this section, I will discuss the company’s valuation. Using some basic metrics, I will compare Spectra Systems against its industry rivals and see if it is cheap relative to its peers. Then, I will value Spectra Systems using a discounted cash flow model to determine a price I will pay based on the expected growth rate and my desired return of 15%.

As shown below, when compared to its peer, Spectra Systems scores 3/5, whilst De La Rue PLC scores 2/5. Spectra Systems is a much better company that is cash-generative and has low debt, while De La Rue has a lot of debt and is losing money.

As you can see, based on my conservative assumption, Spectra Systems is looking to grow 12%, so I went conservative and assumed a 10% growth in the first 1-3 years, then the growth will slow down to 7% 4-6 years out. In my assumption, I also went with an exit multiple of 15x earnings, which is below the historical average at which Spectra Systems has traded. Based on my assumption, I have come to a buy price of £1.57p compared to the current stock price of £2.52, which means right now, Spectra Systems is trading above its intrinsic value.

Thanks for reading my newsletter on Spectra Systems. Disclaimer: This newsletter is not financial advice. This is for educational purposes only, so please DO NOT take this as a buy or sell signal.

Follow for more:

Don’t forget to subscribe, share, and comment below if you find this newsletter insightful, as it helps support my work.

Fabulously detailed research. I featured Spectra as a featured Company in early 2021. The Company hides its light under a bushel almost embarrassed about its success. It never disappoints. https://open.substack.com/pub/smallcompanychampion/p/updates-jet2-spectra-systems-and?r=kcv2o&utm_campaign=post&utm_medium=web&showWelcomeOnShare=true

What is the point of having both P/FCF and FCF yield as criteria? They're the same thing, just with the fraction the other way around.