Disclaimer: This newsletter is not financial advice this is for educational purposes only so please DON’T take this newsletter as a buy or sell signal.

What Is A Serial Acquirer?

A serial acquirer is a registered company that purchases a portion of or all the rights to another company. The acquiring company takes over the management of another company by obtaining a majority stake in the target which effectively gives them control of the company through stock voting rights. Some great examples of well-known serial acquirers are Constellation Software which has returned 10,950.77% since its IPO in 2006, and Berkshire Hathaway which has returned 67,768.12% since its IPO in 1982. The appeal for investing in serial acquirers is the tendency of such companies to reinvest all or most of their free cash flow at a high rate of return. Serial acquirers also benefit from becoming more diversified businesses over time. A good serial acquirer can compound at high rates of return over time and simultaneously have less idiosyncratic risk, making it easier to never sell and let the position size grow with success.

SDI Group PLC Fundamentals:

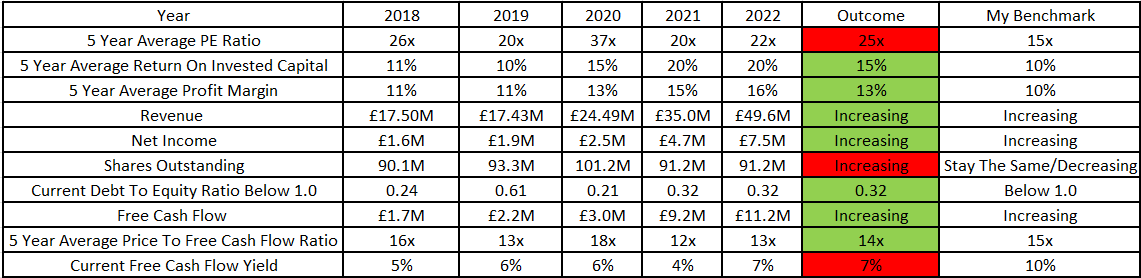

Below is a checklist I normally use in my process when looking at the fundamental health of a company. If the company meets my criteria it will be colour-coded in green and if the company fails to meet my criteria it will be colour-coded in red which means I need to investigate further and ask myself why this is the case.

As you can see below there are 3 red boxes and I am going to explain each one:

5-Year Average PE Ratio-SDI Group currently has a 5-Year PE Ratio of 25x which might be an indicator that this company is expensive since the average stock market PE Ratio is 15. One thing to remember is if a company can grow 25% from now until judgment day and it can sustain that growth then the current valuation of 25x 5-year earnings will look cheap. This goes for the opposite side of the spectrum where if a company was trading at 15x 5-year earnings and they are only growing 3% a year that might seem expensive because the company can’t justify its valuation. When it comes to investing it is all about paying an appropriate valuation relative to its growth potential.

Shares Outstanding-When looking at a company I ideally want the company to decrease their shares or keep them the same. As you can see SDI Group’s shares outstanding have gone up in the last 5 years and that was because, in the early days of the company, they would fund their acquisition by issuing shares but as they have become more free cash flow generative they have opted to use cash instead of diluting existing shareholders and destroying shareholder value.

Free Cash Flow Yield- Free cash flow yield is a financial metric that compares the free cash flow per share a company is expected to earn against its market value per share. The ratio is calculated by taking the free cash flow per share divided by the current share price. Currently, SDI Group has a trailing free cash flow yield of 7%. Even though this doesn’t meet my benchmark of 10% I still think 7% is really good because when investing in a company I like to see how much risk I am taking and if a company has a 7% free cash flow yield and you compare it against a 10-year treasury bond I am not taking much risk with this investment because the current 10-year treasury bond is at 3.5%.

Business Overview:

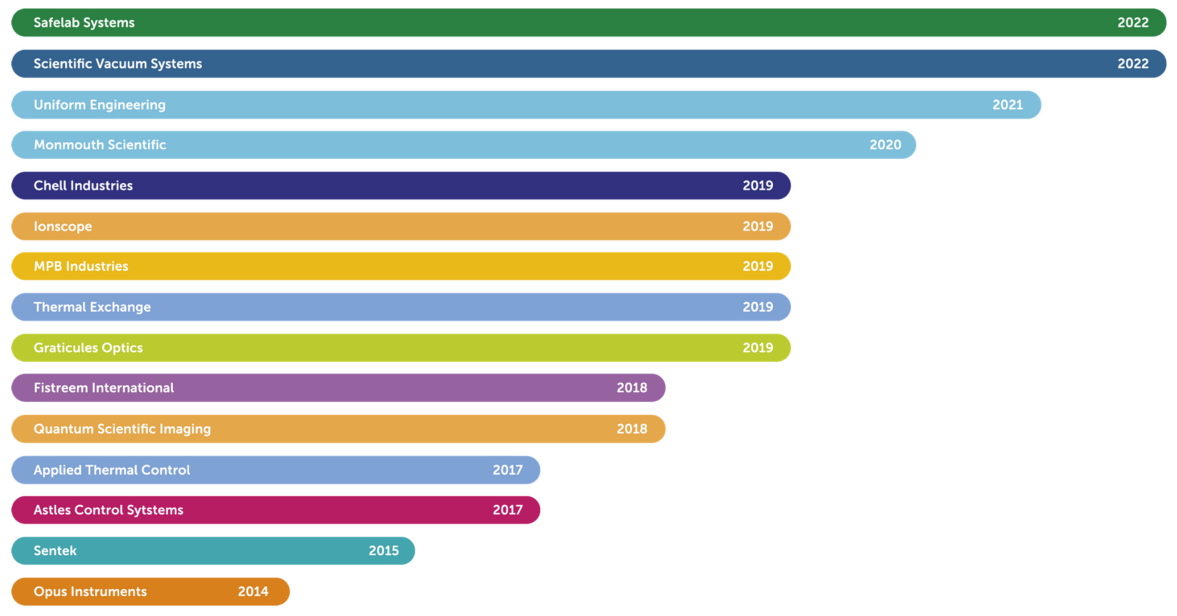

Founded in 2007, SDI Group is an acquisitive group that is made up of various manufacturing businesses in the scientific and technology sector. Through its subsidiaries, SDI Group designs and manufactures scientific and technology products based on digital imaging in the United Kingdom, Europe, The United States, Asia, and internationally. Up until 2019, SDI Group was formerly known as Scientific Digital Imaging until the company changed its name to SDI Group. SDI Group continues to grow through its technology developments, as well as pursuing strategic, complementary acquisitions.

SDI Group Acquisition Criteria

When looking at a potential acquisition target SDI Group has several criteria that a company in the public or private market has to meet. Below is a breakdown of all this:

Why sell to SDI?

The business will retain its independence.

Focus on growth.

Strong financial support and access to specialist resources within the group.

Knowledge sharing within the group.

Main Acquisition Criteria

The company must be in the scientific, technical instruments or manufacturing sector.

Have strong exporters within their niche sector.

Profitable and cash generative.

Strong track record.

Strong local management team.

Available at a fair price(4-6x EBIT).

Post-Acquisition

Implement strong financial control.

The business is run autonomously.

Focus on the medium to long-term strategy.

Create an environment for the businesses to grow and develop with investment if required.

Business Segments:

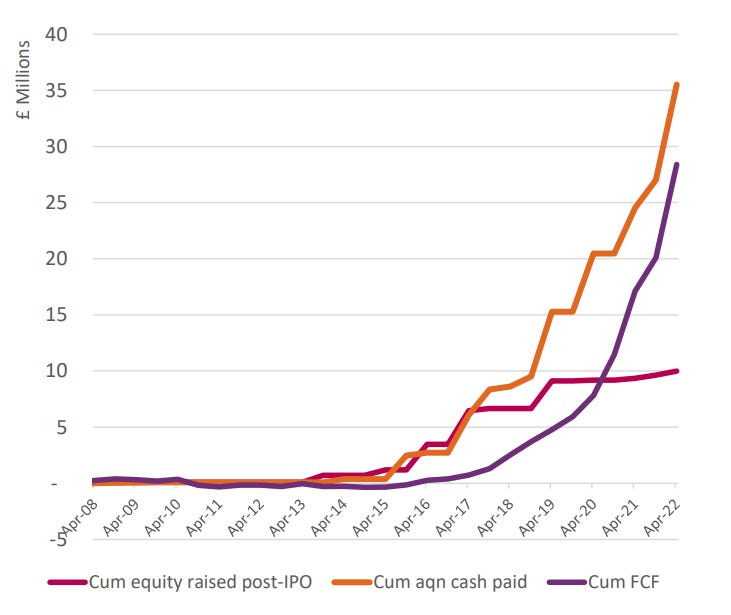

SDI Group’s business is split into two segments, and they are digital imaging and sensors & control. SDI Group operates under a buy-and-build model which first started in 2014, with acquisitions largely funded through equity raises until 2018. The last equity raise(£2.4m) was in February 2019(at 34p per share) and since then free cash flow has been the primary source of acquisition funding. The borrowing capacity has also increased in line with FCF growth. Below is a graph illustrating how SDI Group funds their acquisitions.

Digital Imaging

Atik Cameras-Atik Cameras are designed and developed in Norwich, UK with manufacturing based in Lisbon, Portugal. SDI Group develops and sells a range of cameras under three brands which are Atik, Quantum Scientific Imaging and Opus Instruments. Atik Cameras are highly sensitive cameras that are used for life science and industrial applications as well as deep-sky astronomy imaging. Its life science cameras are in demand for use in real-time PCR DNA amplifiers for detecting COVID-19.

Fistreem International-Fistreem International designs and manufactures water purification products and vacuum ovens. The firm’s Cyclon Water Still and Gallenkamp Vacuum ovens are recognised as world-leading brands and are popular in many life science laboratories.

Graticules Optics-Based in Tonbridge, Kent, Graticules Optics is a proven world-class designer and manufacturer of precision micropattern products. Graticules Optics is unique in offering photolithographic products on glass, film and metal foil, with the bonus of coatings, cementing, mounting and small optical assembly.

Opus Instruments- This is the team behind the Apollo and Osiris cameras. Opus Instruments is a world leader in the field of Infrared reflectography cameras for use in art conservation. All its cameras, including a higher specification version of OSIRIS, named Apollo, are manufactured by Atik Cameras. Opus’ cameras have been used to examine thousands of artworks at leading auction houses, galleries, conservation studios and educational establishments worldwide making notable contributions within the fields of art conservation, preservation, restoration and art authentication.

Quantum Scientific Imaging-Based in the US (Mississippi), Quantum Scientific Imaging designs and manufactures scientific cameras for applications that require superior imaging performance such as astronomical, life science, research and industrial imaging.

Quantum Scientific Imaging Snapshot

Synbiosis-This segment develops and manufactures a range of automated colony counting and zone sizing products for the microbiology laboratory in food, water, pharmaceutical and clinical applications. Its Protocol 3 system is used in all the major pharmaceutical companies for vaccine and antibiotic development and its high-end system, AutoCOL is the world’s first fully automated colony counter.

Syngene-They develop equipment for life scientists to image and analyse electrophoresis gels used for DNA and protein analysis.

Synoptics-They design and manufacture scientific instruments based on digital imaging for the life science research, microbiology and healthcare markets. Synoptics based in Cambridge is the headquarters and manufacturing site for Syngene, Synbiosis, Synoptics Health and Fistreem International products. It also has a US sales and marketing office based in Frederick, USA.

Sensor And Control

Applied Thermal-Applied Thermal Control (ATC) is based in Coalville and was acquired in August 2017. Thermal Exchange (TE) is based in Leicester and was acquired in February 2019. SDI Group decided to merge the two businesses in December 2019 in Barrow Upon Soar, UK. Both design, manufacture, and supply a range of chillers, coolers and heat exchangers used within scientific and medical instruments

Applied Thermal Control Snapshot

Astles-Astles is a supplier of chemical dosing and control systems to different manufacturing industries including manufacturers of beverage cans, engineering and motor components, white goods, architectural aluminium and steel. Astles gets recurring revenue from service, repairs and consumables.

Chell Instruments-Chell Instruments specialises in the design, manufacture and calibration of pressure, vacuum, and gas flow measurement instruments. Based in Norfolk, UK, Chell Instruments supplies products for sectors including aerospace, vehicle aerodynamics, gas and steam turbine testing, and power generation industries.

LTE Scientific-Established in 1947, LTE Scientific is one of the UK’s leading manufacturers of life science, research and medical equipment which includes medium to large capacity autoclaves, environmental rooms and chambers, endoscope drying and storage cabinets, and a range of thermal processing equipment including ovens, incubators, drying cabinets and solution/blanket warming cabinets. LTE Service Centre employs a large team of engineers nationwide to carry out service, maintenance and testing to UKAS standards and HTM guidelines.

Monmouth Scientific Limited-Located in Bridgwater, Somerset, Monmouth was acquired by SDI Group in December 2020. Monmouth Scientific Limited is one of the UK’s leading designers, manufacturers, and suppliers of clean air solutions. Monmouth Scientific Limited specialises in filtration fume cupboard and ducted fume cupboard installations alongside Laminar Flow and Class I/Class II biological safety cabinets. Biological Safety Cabinets are in high demand for use in COVID-19 testing laboratories.

Monmouth Scientific Limited Snapshot

MPB Industries-Based in East Peckham, UK, MPB Industries designs and manufactures flowmeters, flow alarms, flow indicators, flow switches, calibration cylinders and sight glasses for the measurement of liquids and gases by well-known industrial and scientific users. MPB operates across a broad range of applications including water treatment, oil and gas production, medical ventilators, medical anaesthesia, and scientific analysis. It has been a major contributor to the manufacture of ventilators for the UK during the outbreak of COVID-19.

Safe lab Systems-With over 30 years of experience, Safelab Systems is recognised as one of the UK's leading fume cupboard manufacturers. Safelab’s roots are firmly in the South West of England and, having recently moved to a larger facility in Weston-Super-Mare. SafeLab Systems has increased its capacity to design and manufacture high-quality BS EN-compliant products(BS EN-compliant is a European standard which ensures that the bactericidal activity of chemical disinfectants is effective against controlling harmful micro-organisms). SafeLab Systems’ dedicated team of service engineers, based around the UK carry out installation and commissioning and conduct routine testing and servicing of Safelab and other manufacturers' fume cupboards to ensure they continue to be safe to use.

Scientific Vacuum Systems(SVS)-Established in 1990, Scientific Vacuum Systems specialises in the manufacture of Physical Vapour Deposition(PVD) systems. SVS’s longevity has been due to its ethos of “strength in design”, which has been the foundation of all its manufactured products. SVS has also recognised the importance of being amongst the leaders in emerging technologies. SVS is committed to investing in research for new sputtering and evaporation techniques to develop processes on a commercial scale.

Scientific Vacuum Systems(SVS) Snapshot

Sentek-Based in Braintree, Essex, Sentek manufactures and markets off-the-shelf and custom-made electrochemical sensors for water-based applications. These sensors are used in laboratory analysis, food, beverage, and personal care. Sentek serves global markets and has long-term contracts to supply sensors for use in vaccine and biologics production to two major life science companies.

Uniform Engineering-Acquired in January 2021, Uniform Engineering is based in Highbridge, Somerset. Uniform Engineering is a team of expert precision metal manufacturers that have a wealth of experience in providing the highest quality bespoke metal enclosures and housings used in a variety of applications including pharmaceutical, laboratory and safety equipment. Uniform Engineering is a major supplier of components to Monmouth Scientific, a fellow subsidiary of SDI Group.

Management

When looking at management I like to judge the CEO in several different ways such as experience, capital allocation skills and Incentives. In this section, I will cover if management incentive is aligned with shareholders.

Experience-Michael Creedon is a chartered certified accountant who holds an MBA from Henley Management College. Michael Creedon is currently the CEO of SDI Group and he has been in this position since 2012. Before taking on the role of CEO at SDI Group, Michael Creedon previously served as Chief Financial Officer of Durham Scientific Crystals Limited as well as being a finance director at Ideal Shopping Direct Limited. Michael Creedon has also taken on other major roles within SDI Group such as a secretary role and acting managing director.

Below is an image illustrating the current experience of the SDI Group board members.

Capital Allocation-When it comes to judging management I think capital allocation is very important because we want management to create shareholder value and not destroy it. Management has reiterated that their main goal is to create shareholder value through the acquisition and if they can’t find any acquisition they will pay a dividend but as long as they can earn a better return through acquisition then dividends are off the table for now.

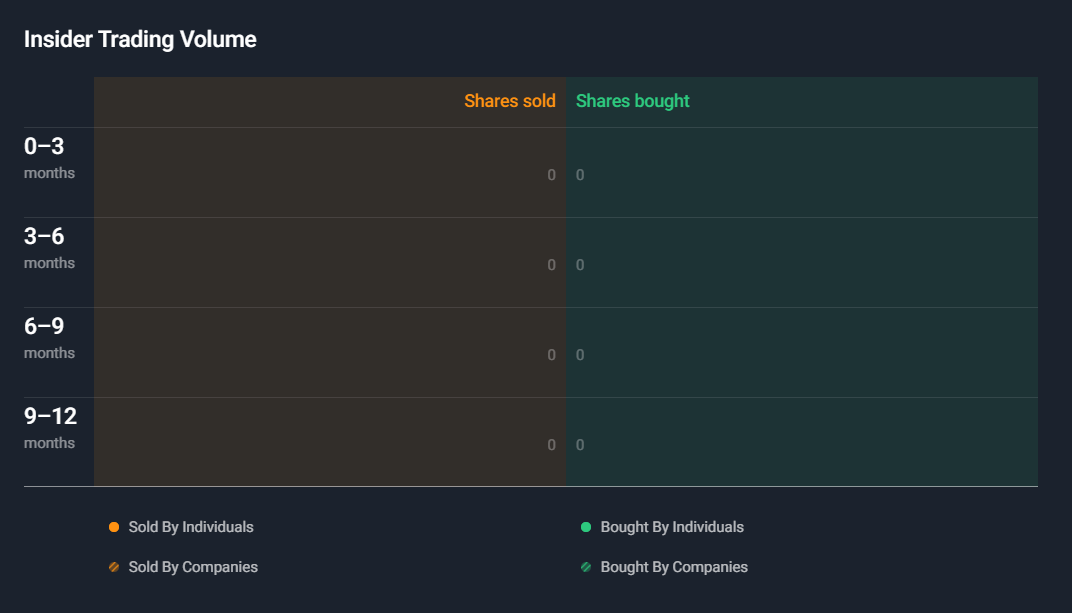

Incentive-This is important because if the current board is actively purchasing stock of their own business this is a positive indicator that shows that management believes the stock is undervalued and they believe in the long-term prospect of the company.

As you can see below there has been no insider activity within the last 12 months.

Bull And Bear Case:

In this section, I am going to highlight the bull and bear case for this investment.

Bull Case

Bull Case- SDI Group believe many businesses operate within the market which presents an ideal opportunity for consolidation as most of these businesses have not achieved critical mass. This strategy will be primarily focused within the UK but they won’t be afraid to look for opportunities in Europe, The United States, and elsewhere will also be considered particularly if these enable geographic expansion of the existing businesses.

Bear Case

Bear Case- Competition from direct competitors or third-party technologies could impact SDI Group’s market share and pricing. To mitigate this risk SDI Group continues to invest in researching its markets and continues to offer new products in response to changing customer preferences. In addition, SDI Group invests in research and development to maintain its competitive advantage.

Bear Case- Acquisitions are a key element of SDI Group strategy, and the failure to identify and prosecute acquisition opportunities would impact future growth in profit and share price.

Valuation:

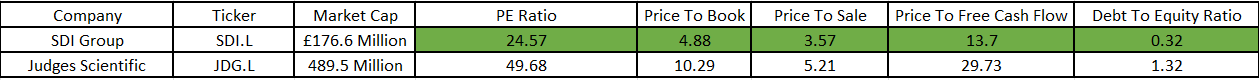

In this section, I am going to talk about valuation. Using some basic metrics I am going to compare SDI Group against its industry rival and see if the company is cheap relative to its peer then I will value SDI Group using a discounted cash flow model to come up with a price I am willing to pay based on expected growth rate and my desired return of 15%.

As shown below when comparing SDI Group against its peers it scores 5/5 against Judges Scientific.

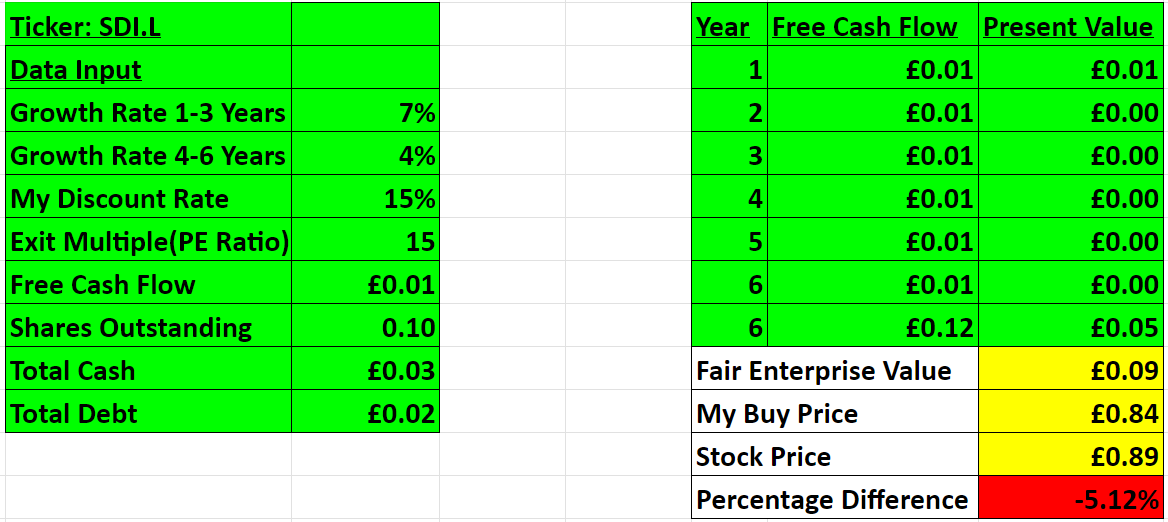

In this final part, I will be valuing SDI Group by using a discounted cash flow model to come up with a price that I need to pay. When valuing a company I tend to be conservative so below is the valuation of SDI Group based on a 6-year projection.

SDI Group is looking to grow around 10% so I went conservative and assumed a 7% growth in the first 1-3 years then the growth will slow down to 4% 4-6 years out. In my assumption, I also went with an exit multiple of 15x earnings. Based on my assumption I have come to a buy price of £0.84p which means SDI Group is trading above what I am willing to pay.

Thanks for reading my newsletter on SDI Group. Disclaimer this newsletter is not financial advice this is for educational purposes only so please DON’T take this as a buy or sell signal.

Follow for more:

Don’t forget to subscribe, share and leave a comment below if you found this newsletter insightful as it helps support my work.

Any thoughts on current level? It looks attractive. What bothers me is that there is hardly any insidership. That's why I put them back again and again.

Interesting blog.

Just on the "5-Year Average PE Ratio", given this is a valuation measure, isn't it illogical to compare the average 5 year PE ratio against a benchmark, as more relevant is the current valuation, and (perhaps) historical valuation levels. E.g. if a high quality company has often traded at an optically high valuation level (say 30x), but is currently at 14x due to a temporary issue, it would fail your criteria and yet may be very attractive.