Disclaimer: This newsletter is not financial advice this is for educational purposes only so please DO NOT take this newsletter as a buy or sell signal.

Nick Scali Fundamentals:

Below is a checklist I normally use in my process when I look at the fundamental health of a company. If the company meets my criteria it will be colour-coded in green and if the company fails to meet my criteria it will be colour-coded in red which means I need to investigate further and ask myself why this is the case.

As you can see below there is 1 red box and I am going to explain it:

Current Debt To Equity Ratio Below 1.0-Nick Scali currently has a debt-to-equity ratio of 1.77 which is above my 1.0 threshold. When looking at a company with a debt load like this, it is important to understand the context behind this. Nick Scali is a retailer and most of their debt is tied to lease obligations(rent for properties/warehouses). Out of Nick Scali’s $427 million in long-term liabilities, they have $190 million in lease obligations and $91 million in long-term debt. If we back out Nick Scali’s lease obligation then their debt-to-equity ratio is closer to 0.50 than 1.77. The calculation I got for this is long-term debt($91 million)÷shareholder equity($179 million)=0.50. Their debt-to-equity ratio is skewed by lease obligations.

Business Overview:

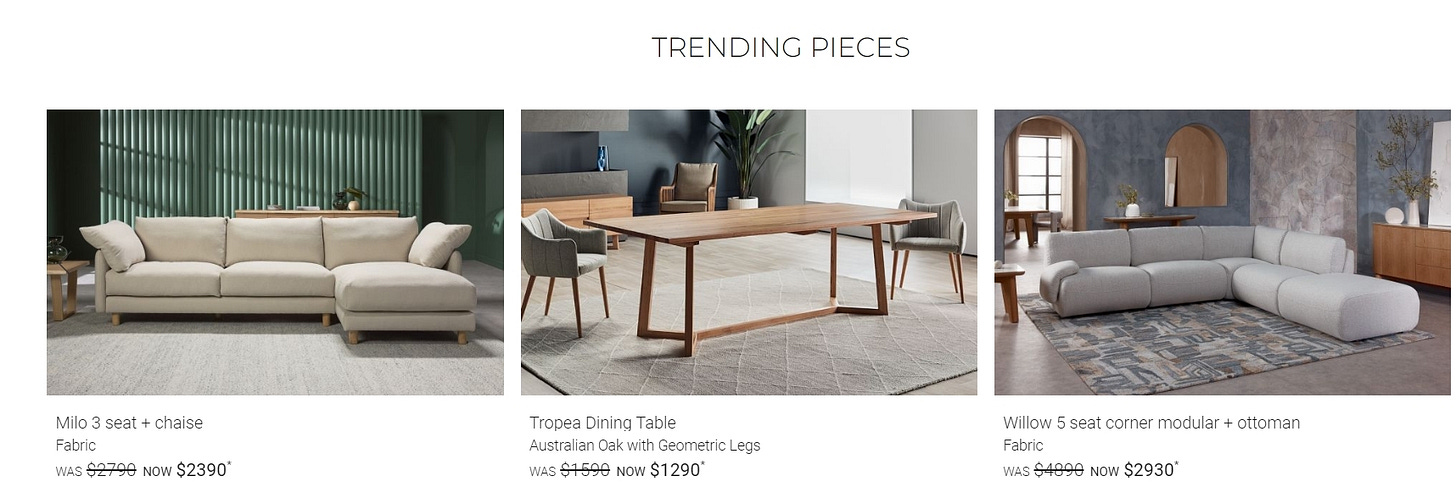

Founded in 1962 by Nick Scali, Nick Scali is an Australian company that imports branded retail furniture such as lounges, dining tables, coffee tables, chairs, and entertainment units. Nick Scali specialises in leather and fabric lounges, as well as dining room and bedroom furniture. Nick Scali imports more than 12,000 containers of quality leather and fabric lounges as well as dining room and occasional furniture per year. With a proven reputation for quality furniture at low prices, Nick Scali Furniture is a respected and trusted brand. Nick Scali currently has 62 Nick Scali stores and 45 Plush stores that are set up in Australia and New Zealand.

Business Segments:

Nick Scali Online-Nick Scali Online was launched in 2020. Since its launch, Nick Scali has seen tremendous growth where online sales orders increased from $8.8 million in 1H FY21 to $16.6 million in 1H FY22, Nick Scali online revenue was $13.7 million in 1H FY22, incremental EBIT contribution was $8.0 million, online sales orders were up 43% YoY in the four months to April 2022 which was driven by the strong performance of the online sales team and additional transactions via the New Zealand e-commerce platform (launched in Oct 2021).

Plush-With over 250,000 customers, 21 years of experience and 45 showrooms nationwide, Plush prides itself on being Australia's top sofa specialist. Plush first opened up its doors in Nunawading, Victoria in October 2000. The original concept for Plush or as it was known then “Plush Leather” was to provide customers with designer leather sofas at affordable prices. Being one of Australia's first specialist sofa providers, Plush Leather imported leather sofas direct from Italy and Asia which ensured it had a competitive advantage over design, quality and price. Following the successful launch of its pilot showroom in Nunawading, Plush Leather opened up its flagship showroom in Richmond, Victoria in 2001. Over the next two years, the brand consolidated its initial success by opening up a further six showrooms in the Victorian towns of Dandenong, Shepparton, Taylors Lakes, Ballarat and Knox. These showrooms were supported by dedicated products, marketing, warehousing, customer service and distribution teams.

2004 was a revolutionary year for Plush as the popularity of the Plush Leather range grew. Feedback showed that customers were looking for fabric versions of their quality leather sofas which resulted in Plush taking the natural step of sourcing and introducing fabric options to showroom floors. Plush Leather then became Plush-Think Sofas. With a new spring in its step, Plush continued its showroom expansion program in 2005 and 2006 where they opened up showrooms in Newcastle and Preston whilst opening up the first Queensland and South Australian showrooms in Bundall, Gepps Cross, Marion and Mile End. By 2009, Plush had a network of showrooms servicing the eastern states of Australia. In 2016, two new showrooms were opened in Queensland, in the homemaker stronghold of Brisbane's Fortitude Valley and up north in Townsville. Then, in 2017, this dream was further realised when Plush officially went west, with four new showrooms opening up in Perth, Western Australia. In late November 2018, a new showroom opened at North Lakes, in the Moreton Bay region of Brisbane, making it the eighth Queensland showroom. In 2020, Plush welcomed Caringbah to the Plush family, followed by Toowoomba in 2021. With a new total of 45 showrooms across the country, Plush continues to build on its reputation as an Australian sofa specialist by backing all of their sofas with a 10-year warranty.

Management:

When looking at management I like to judge the CEO in several different ways such as experience, capital allocation skills and Incentives. In this section, I will cover whether management incentives are aligned with shareholders.

Experience-Anthony J. Scali is the current Managing Director and CEO of Nick Scali since May 24, 2004. Anthony J. Scali has experience in retail and the selection and direct sourcing of products from manufacturers both in Australia and overseas. He is responsible for the overall operation of Nick Scali and identifying current and future trends in the furniture industry. Anthony J. Scali holds a Bachelor of Commerce degree from the University of New South Wales.

Below is an image illustrating the current experience of Nick Scali’s board members:

Capital Allocation-When it comes to judging management I think capital allocation skill is very important because I want management to create shareholder value and not destroy it. So far Nick Scali’s capital allocation has been spot on because they are giving value back to shareholders via reinvestment back into the business to further expand their online capabilities, paying a dividend, paying down debt and making strategic acquisitions like we saw with Plush.

Nick Scali is currently paying a dividend with a yield of 5.69%. As shown below this dividend is sustainable because this current dividend only takes up 49% of their overall free cash flow.

Incentive-This is important because if the current board is actively purchasing stock of their own business this is a positive indicator that shows that management believes the stock is undervalued and they believe in the long-term prospect of the company.

As you can see below we have 4 buy orders and 7 sell orders. BlackRock, Perpetual Limited and Magellan Asset Management Limited are the only insiders buying Nick Scali shares. As for selling BlackRock, Perpetual Limited and Magellan Asset Management Limited are the only insider selling but I am not going to put too much weight into this because there are so many reasons why someone might sell their stock.

Bull And Bear Case:

Bull Case

Bull Case- The first bull case is a long runway for growth. Nick Scali has highlighted four ways they can continue to grow their business and they are:

Plush-Nick Scali can Focus on the improvement of the Plush business through better merchandising and store presentation.

New Store Roll-Out-Roll-out of the Nick Scali and Plush brands across Australia and New Zealand. The current network of 108 stores has the scope to increase by 78 stores, leveraging group infrastructure across distribution and shared services.

Online-Continued growth of the group’s online platforms to supplement the in-store experience. New product categories to support further revenue growth within the Nick Scali brand.

Acquisitions-Capitalise on further acquisition opportunities that may arise.

Bull Case-The second bull case is Nick Scali’s Total addressable market(TAM). The growth in the Nick Scali business has been consistent, despite reports of a slowdown in new housing starts. From a furnishing perspective, the renovation market is as important as the second home buyer. This is one of the key reasons for Nick Scali’s strong growth performance. Nick Scali has deliberately focused on the 35-55 age demographic because people in this group are looking to replace items of furniture after renovating or following the purchase of their second home. These buyers are less price-driven and are generally concentrated in the middle to upper-income bracket. Statistics show that households in this income bracket account for 78% of all furniture purchases in Australia. The Australian population is becoming wealthier and older. The increasing affluence combined with an ageing population will continue to provide opportunities for Nick Scali to extend both market presence and market penetration.

Bear Case

Bear Case-The first bear case is Nick Scali’s debt. In December 2019 Nick Scali had $33.7 million in debt which is about the same as the year before but it also had $43.7 million in cash to offset that meaning it has $10.0 million net cash. According to the last reported balance sheet, Nick Scali has liabilities of $149.4 million due within 12 months and liabilities of $427 million due beyond 12 months where $89 million of it is debt. The reason Nick Scali’s debt has increased so much is because of a recent acquisition they made for Plush in 2021 where the acquisition was funded by cash and new debt facilities. In the current trailing twelve months Nick Scali produced $125 Million in free cash flow and they currently have $89 million in cash and equivalents on the balance sheet so they are a cash-rich company that won’t have any issues paying down any long-term debt.

Bear Case-The second Bear care is consumer spending. Nick Scali’s business depends on consumer demand for their products and consequently, the company is sensitive to several factors that influence consumer spending, including general economic conditions, inflationary pressures, consumer disposable income, fuel prices, recession and fears of recession, unemployment, availability of consumer credit, consumer debt levels, conditions in the housing market and elevated interest rates. Past economic downturns and inflationary pressures have led to decreased discretionary spending, which adversely impacted Nick Scali’s business.

Valuation:

In this section, I am going to talk about valuation. Using some basic metrics I am going to compare Nick Scali against its industry rivals and see if the company is cheap relative to its peer then I will value Nick Scali using a discounted cash flow model to come up with a price I am willing to pay based on expected growth rate and my desired return of 15%.

As shown below when comparing Nick Scali against its peer it scores 3/6 whilst Harvey Norman scores 4/6. The reason why I like Nick Scali more is because they’re a much better quality company than Harvey Norman, Nick Scali operates in a much better niche and Nick Scali has better management.

As you can see based on my conservative assumption, Nick Scali is looking to grow 7% so I went conservative and assumed a 5% growth in the first 1-3 years then the growth will slow down to 2% 4-6 years out. In my assumption, I also went with an exit multiple of 12x earnings which is below the historical average that Nick Scali has traded at. Based on my assumption I have come to a buy price of $12.12 compared to the current stock price of $12.08 which means right now Nick Scali is trading below intrinsic value.

Thanks for reading my newsletter on Nick Scali. Disclaimer This newsletter is not financial advice This is for educational purposes only so please DO NOT take this as a buy or sell signal.

Follow for more:

Don’t forget to subscribe, share and leave a comment below if you found this newsletter insightful as it helps support my work.

Great write up once again. You have to look further than the US to find the gems