Disclaimer: This newsletter is not financial advice. This is for educational purposes only, so please DO NOT take this newsletter as a buy or sell signal.

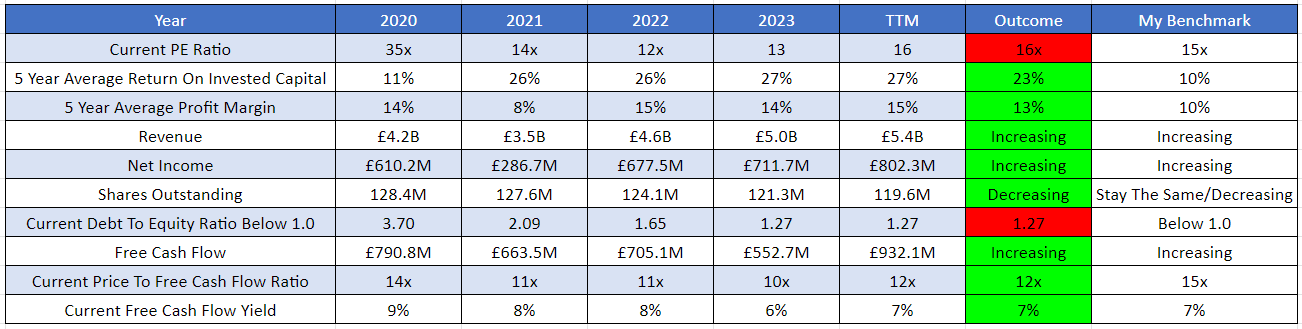

Next PLC Fundamentals:

Below is a checklist I usually use when analysing a company's fundamental health. If the company meets my criteria, it will be colour-coded in green, and if it fails to meet my criteria, it will be colour-coded in red, which means I need to investigate further and ask myself why this is the case.

As you can see below, there are two red boxes, and I am going to explain each one:

Current PE Ratio- Next PLC currently has a PE ratio of 16x, which might indicate that this company is trading at a premium to the market since the average stock market PE ratio is 15x. One thing to remember is if a company can grow 16% from now until judgment day and it can sustain that growth, then the current valuation will look cheap. This goes for the opposite side of the spectrum, where if a company was trading at 15x earnings and only grew by 3% a year, that might seem expensive because the company can’t justify its valuation.

Current Debt-To-Equity Ratio Below 1.0- Next PLC has a debt-to-equity ratio of 1.27, which is above my 1.0 threshold. When looking at a company with a debt load like this, it is important to understand what drives it. Currently, Next PLC has £1.8b in long-term liabilities, of which £29.5m is in interest-bearing loans and £869.9m is in lease liabilities.

Business Overview:

Founded in 1864 by Joseph Hepworth, Next PLC(formerly J Hepworth & Son) engages in the retail of clothing, beauty, footwear, and home products in the United Kingdom, The Rest Of Europe, The Middle East, Asia, and Internationally. The company operates through Next PLC Retail, Next PLC Online and Next PLC Finance. Next PLC also offers consumer credit, Next PLC branded products, women’s, men’s, and children’s clothing, homeware, and beauty products under the label brand, as well as other third-party brands. The company also provides property management services, including holding and leasing properties, and operates call centres, websites, marketing, warehousing, and distribution networks for third-party brands.

Business Segments:

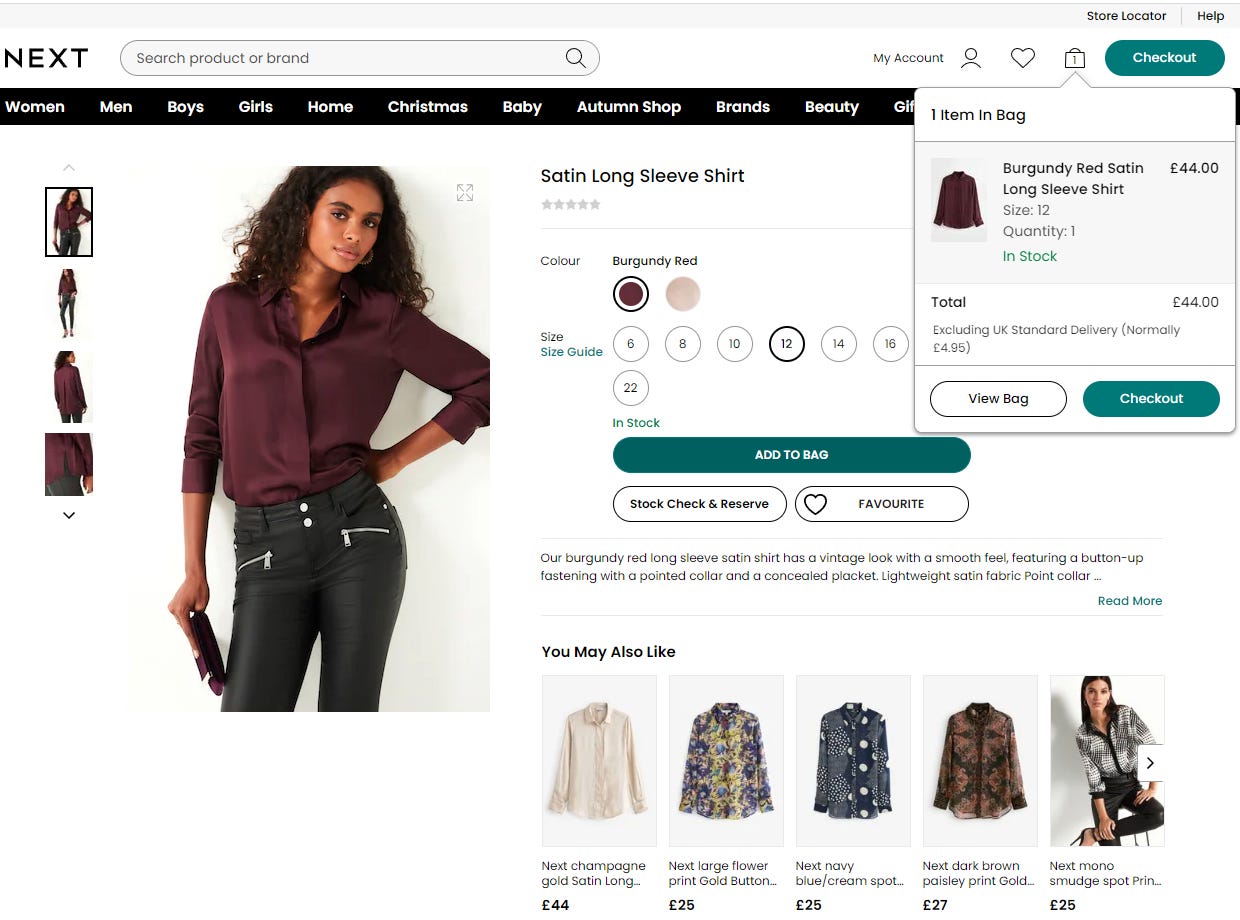

Next PLC Retail- Next PLC retail segment encompasses a network of physical stores where customers can explore and purchase a diverse range of clothing, footwear, and home products. These stores serve as a platform for customers to engage with the products first-hand, receive personalised assistance from store staff, and make purchases directly at the store locations. The strategic placement of Next PLC retail stores aims to attract customers and provide them with a memorable and interactive shopping experience.

Next PLC Online- Next PLC online segment is a crucial part of the company’s operation as it enables customers to shop conveniently for a wide range of products on their website. The online platform offers clothing, footwear, and home products, providing customers with a seamless shopping experience. Customers can choose between home delivery or in-store collection options. The online segment also features secure payment methods and exclusive promotions to enhance customers’ shopping experience.

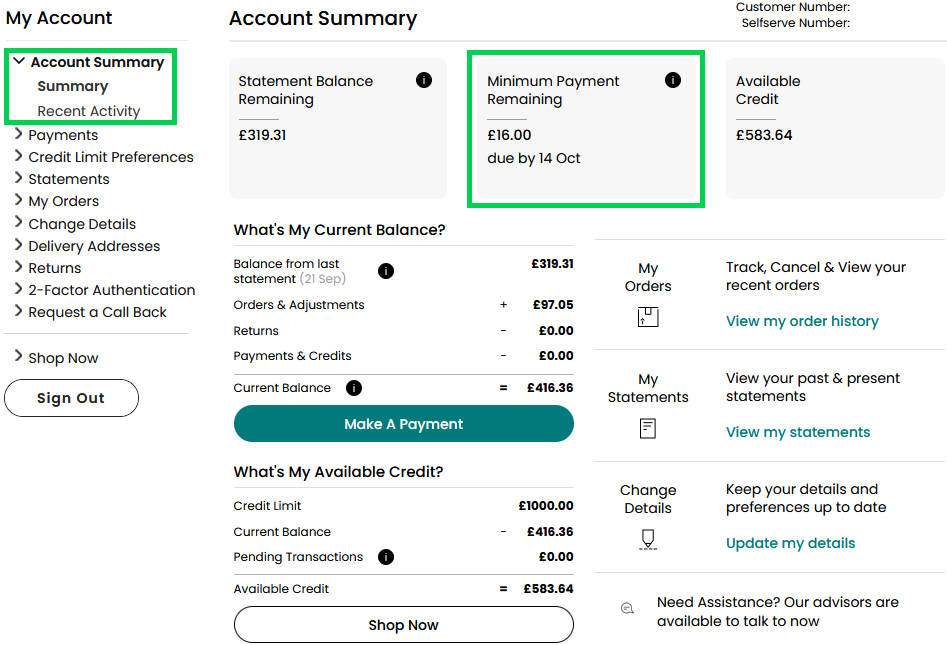

Next PLC Finance- Next PLC Finance offers credit to customers, which has been a popular service that benefits the company's online sales and profitability. The company's receivables book is considered a valuable asset that contributes to its financial strength.

Management:

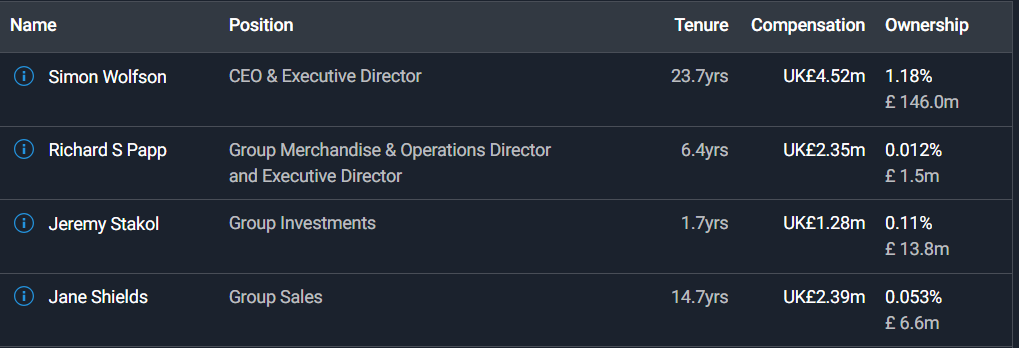

When evaluating management, I judge the CEO based on several factors, such as experience, capital allocation skills, and Incentives. In this section, I will discuss whether management incentives are aligned with shareholders.

Experience- Lord Simon Wolfson has been the Chief Executive Officer of Next PLC since 2001. Lord Simon Wolfson joined Next PLC in 1991, served as its retail sales director since 1993 and became responsible for Next PLC directory in 1995. Lord Simon Wolfson also served as an Independent Non-Executive Director at Deliveroo PLC (Formerly Known as Roofoods Limited) from January 2021 to August 2022. Currently, Lord Simon Wolfson is the longest-serving CEO of the FTSE 100.

Below is an image illustrating the current experience of JD Sports board members:

Capital Allocation- When judging management, capital allocation skills are critical because I want management to create shareholder value, not destroy it. So far, Next PLC’s capital allocation has been spot-on because they are giving value back to shareholders via reinvestment into the business to further expand their footprint, paying a dividend, paying down debt and doing share buybacks.

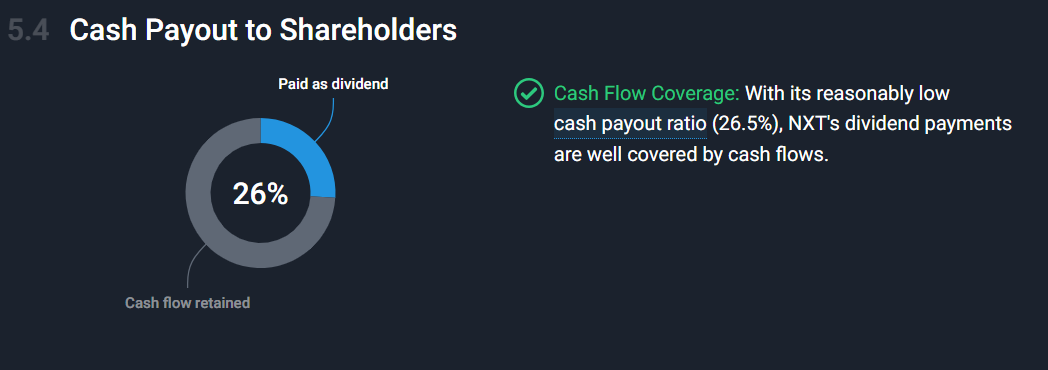

Next PLC is currently paying a dividend with a yield of 1.97%. This dividend is sustainable because it only covers 26% of the company's free cash flow.

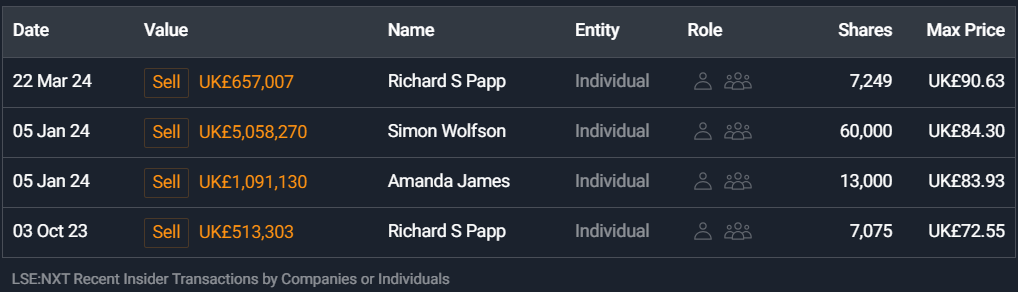

Incentive- This is important because if the current board is actively purchasing stock of their own business, this is a positive indicator that shows that management believes the stock is undervalued and believes in the company's long-term prospects.

As you can see below, we have zero buy orders and four sell orders. Richard Sapp(Group Merchandise & Operations Director & Executive Director), Lord Simon Wolfson(CEO & Executive Director), and Amanda James(Executive Officer)are the only insiders selling Next PLC shares. I am not going to put too much weight into this because there are so many reasons why someone might sell their stock.

Bull And Bear Case:

Bull Case

Bull Case- The first bull case is the company’s resilience and ability to adapt to the retail landscape. The business has an impressive 160-year track record, showcasing innovation and successful strategic pivots. Next PLC pioneered out-of-town stores, expanded apparel categories, and launched a multi-brand marketplace. Throughout this period, it consistently achieved high operating margins compared to its peers.

Bull Case- The second bull case is a long runway for growth through overseas expansion. Next PLC’s online overseas business has made good progress, with sales up 17% (+14.5% in constant currency) and net margins improving from 8.6% to 13.0%. It is unusual for a business to accelerate its top-line growth and improve net margins at the same time. This has been achieved through a combination of improved full-price sales with overseas third-party aggregators, which grew by +52%, and increased spending on digital marketing funded through targeted price increases, the removal of unprofitable products from overseas offers and improving sales on third-party aggregators.

Bear Case

Bear Case- The first bear case is innovation. Next PLC's success depends on designing and selecting products that customers want to buy at appropriate prices. In the short term, a failure to manage this risk may result in surplus stock that cannot be sold and may have to be disposed of at a loss. Over the longer term, a failure to meet the design, quality, and value expectations of their customers will adversely affect the reputation of the Next PLC Brand and its profitability.

Bear Case- The second bear case is capital allocation. Poor management of Next PLC's longer-term liabilities and capital expenditure could jeopardise the long-term sustainability of the business. It is important that the company continues to be responsive and flexible to meet the challenges of a rapidly changing retail sector.

Valuation:

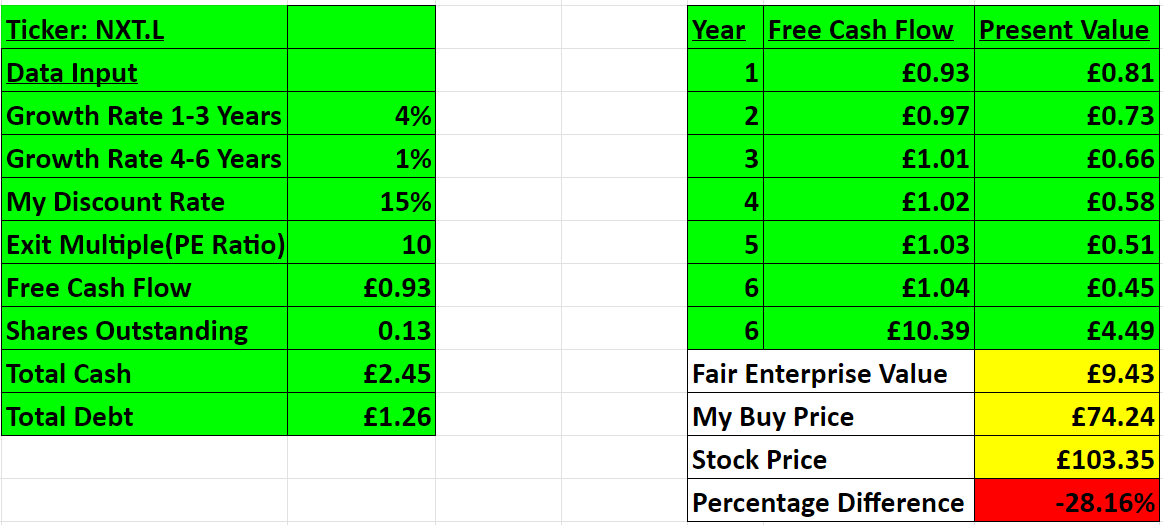

In this section, I will discuss the company's valuation. Using some basic metrics, I will compare Next PLC against its industry rivals and see if it is cheap relative to its peers. Then, I will value Next PLC using a discounted cash flow model to determine a price I will pay based on the expected growth rate and my desired return of 15%. Since Next PLC hasn’t got a like-for-like publicly traded competitor, there won’t be an industry comparison; however, the company does overlap with companies like Boohoo, Fraser Group and Asos.

As you can see, based on my conservative assumption, Next PLC is looking to grow 4-6%, so I went conservative and assumed a 4% growth in the first 1-3 years, then the growth will slow down to 1% 4-6 years out. In my assumption, I also went with an exit multiple of 10x earnings, which is below the historical average at which Next PLC has traded. Based on my assumption, I have come to a buy price of £74.24p compared to the current stock price of £103.35p, which means right now, Next PLC is trading above its intrinsic value.

Thanks for reading my newsletter on Next PLC. Disclaimer: This newsletter is not financial advice. This is for educational purposes only, so please DO NOT take this as a buy or sell signal.

Follow for more:

Don’t forget to subscribe, share, and comment below if you find this newsletter insightful, as it helps support my work.

What is the moat here? They're neither price competitive on the low end nor a particularly strong brand, in my experience.

Thank you for the write up Wesley. Enjoyed reading it as always