Disclaimer: This newsletter is not financial advice. This is for educational purposes only, so please DO NOT take this newsletter as a buy or sell signal.

JD Sports Fundamentals:

Below is a checklist I usually use when analysing a company's fundamental health. If the company meets my criteria, it will be colour-coded in green, and if it fails to meet my criteria, it will be colour-coded in red, which means I need to investigate further and ask myself why this is the case.

As you can see below, there are four red boxes, and I am going to explain each one:

5-Year Average Profit Margin- When analysing a company, I want to see a 5-year average profit margin above 10%. However, because this company operates in an industry(retail) where margins are very low, I will not penalise them for this.

Shares Outstanding- When analysing a company, I ideally want its shares outstanding to remain the same or decrease over time. As you can see, JD Sports shares outstanding have increased by 6.37% in the last five years. This is something to keep an eye on because issuing shares does destroy shareholder value.

Current Debt-To-Equity Ratio Below 1.0- JD Sports has a debt-to-equity ratio of 1.06, which is above my 1.0 threshold. When looking at a company with a debt load like this, it is important to understand what drives it. Currently, JD Sports has £2.1b in long-term debt, of which £36.6m is interest-bearing loans and £2.1b is in lease liabilities.

Free Cash Flow- JD Sports' free cash flow has decreased in the last five years. However, this is due to the company's strategic decision to invest more in capital expenditure to enhance its online presence and in-store experience. With a capex guidance between £ 550m-£575 M, these investments are expected to drive future growth and profitability.

Business Overview:

Founded in 1981 by John Wardle and David Makin, JD Sports is a British sports-fashion retail company based in Bury, Greater Manchester, England. JD Sports sells branded sports fashion and outdoor clothing, footwear, accessories, and equipment for kids, women, and men in the United Kingdom, The Republic of Ireland, Europe, North America, and internationally.

Business Segments:

Sports Fashion

Size?- Established in 2000, Size? specialises in supplying footwear, apparel and accessories. Size? was Initially set up to trial edgier product collections before introducing them to the mass market. Outside of the UK and The Republic of Ireland, Size? has stores in Belgium, Canada, Denmark, France, Germany, Italy, The Netherlands and Spain.

Footpatrol- Footpatrol is famous for supplying the sneaker fraternity with the most desirable footwear, apparel and accessories. The original Footpatrol store is located in the heart of Soho on Berwick Street.

Finish Line- Finish Line is one of the largest retailers of premium, multi-branded athletic footwear, apparel and accessories in The United States. Finish Line trades from over 460 retail stores in more than 40 US states and is also the exclusive partner of athletic shoes for Macy’s, one of the US premier department store operators.

Shoe Palace- Shoe Palace is a retailer of branded sports footwear and apparel located on the West Coast. Shoe Palace has over 160 stores, the vast majority of which trade under the Shoe Palace banner. More than half of the stores are located in California. However, there is also an established retail presence in Texas, Nevada, Arizona, Florida, Colorado, New Mexico and Hawaii, with the store network supported by a developing e-commerce platform. Shoe Palace prides itself on its consumer connection with Hispanic and Latino communities and its strong social media presence.

DTLR- DTLR is a hyperlocal athletic footwear and apparel streetwear retailer with a rich connection with the communities where its stores are located. Originally named Downtown Locker Room, the company later re-branded as DTLR and, in 2017, merged with Sneaker Villa (previously based in Philadelphia). DTLR is based in Baltimore, Maryland and operates from over 240 stores across 19 states, principally in the North and East of The United States.

Livestock/Deadstock- Livestock is renowned in Canada for being the premier destination in the country for limited-release and classic sneakers. Accompanied by a premium apparel offering.

Sprinter- Sprinter is one of the leading sports retailers in Spain, selling footwear, apparel, accessories and equipment for a wide range of sports as well as lifestyle casual wear and childrenswear. Their offer includes both international sports brands and successful private labels.

Sport Zone- Sport Zone is a well-established and leading multi-branded sports retailer in Portugal, offering a wide range of apparel, footwear, accessories, and equipment across multiple sports.

Sizeer- Sizeer is a branded sportswear and apparel retailer, operating over 400 retail stores and several local currency trading websites under the Sizeer and 50 Style banners across Central and Eastern Europe.

JD Gyms-JD Gyms offers stylish, affordable, award-winning fitness facilities across over 70 gyms and plays host to a bespoke mix of industry-leading equipment and an exciting range of fitness classes.

Hibbett Sports- Acquired by JD Sports in 2024, Hibbett Sports is an American sporting goods retailer headquartered in Birmingham, Alabama. As of February 2024, the company has 1,169 retail stores, which include 960 Hibbett Sports stores, 193 City Gear stores, and 16 Sports Additions athletic shoe stores in 36 states. Hibbett Sports operates sporting goods stores in small to mid-sized markets in the Southeast, Southwest and lower Midwest regions of the United States. The states with the most stores are Georgia (97), Texas (97), and Alabama (90). Its stores offer a range of athletic equipment, footwear and apparel. The company's primary store format is the Hibbett Sports store, an approximately 5,000-square-foot store located primarily in strip centres.

Outdoors

Go Outdoors- Go Outdoors(GO) focuses on innovation and authenticity whilst always maintaining sight of the consumer’s expectation for value. Go Outdoors helps people step into the outdoors, whether it's for walking, camping, cycling, or fishing. A number of GO Outdoors stores also benefit from specialist sections for fishing and equestrian, leveraging off the specialist knowledge and reputation at Fishing Republic and Naylors, respectively.

Blacks- Blacks is a long-established retailer of specialist outdoor apparel, footwear and equipment. Blacks primarily stock more technical products from premium brands such as Berghaus and The North Face, helping Outdoor participants, from weekend family users to more avid explorers, reach their goals.

Millets- Millets supply a more casual outdoor customer who seeks value for money, providing a wide range of recreational activities with an emphasis on exclusive brands, such as Peter Storm and Eurohike.

Tiso- Tiso is Scotland’s leading adventure sports retailer specialising in outdoor, mountain, skiing and cycling. Initially founded in 1962, their reputation for quality has been established over 57 years. The Tiso group is based in Scotland but includes the iconic George Fisher store in the English Lake District.

Ultimate Outdoors- Ultimate Outdoors is a single destination for many customers. The versatile range caters to outdoors people, whether they want to stroll in the park or scramble up the Cairngorms. Ultimate Outdoors stock the biggest names in the industry, including Rab, The North Face and Merrell.

Fishing Republic- Fishing Republic aims to supply the best choice and value in UK angling. Trading from three stores and a number of concessions within Go Outdoors stores, Fishing Republic prides itself on providing expert advice and guidance. A vast range of products are available both in-store and via the online tackle shop, covering all angling disciplines, from carp and coarse to sea, fly and predator fishing.

Naylors- Naylors has built a solid reputation for providing quality equestrian apparel, footwear, tack and horse supplies. Naylors stock the biggest brands in the industry, including Ariat, Horseware, WeatherBeeta, Barbour and Dubarry.

Management:

When evaluating management, I judge the CEO based on several factors, such as experience, capital allocation skills, and Incentives. In this section, I will discuss whether management incentives are aligned with shareholders.

Experience- Régis Schultz has been the CEO & Director of JD Sports since September 2022. Since 2013, Régis Schultz has served as Chief Executive Officer of Darty Group and Chairman of Darty France. Régis Schultz joined Darty from BUT, where he served as Chairman of the Board and Chief Executive. Prior to BUT, he held a number of senior positions at Kingfisher, including Chief Financial Officer, Sales Director and Chief Operating Officer of B&Q and Head of Strategy & Development of Kingfisher. Régis Schultz graduated from Dauphine University, France, with an MSc in Management in 1992 and a DESS in Finance in 1993.

Below is an image illustrating the current experience of JD Sports board members:

Capital Allocation- When judging management, capital allocation skills are critical because I want management to create shareholder value, not destroy it. So far, JD Sports' capital allocation has been spot on because they are giving value back to shareholders via reinvestment into the business to further expand their footprint, pay a dividend, and make strategic acquisitions.

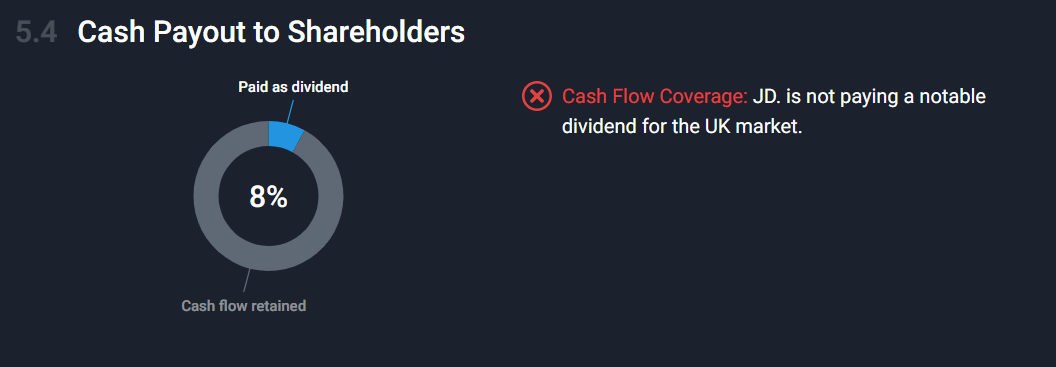

JD Sports is currently paying a dividend with a yield of 0.75%. This dividend is sustainable because it only covers 8% of the company's free cash flow.

Incentive- This is important because if the current board is actively purchasing stock of their own business, this is a positive indicator that shows that management believes the stock is undervalued and believes in the company's long-term prospects.

As you can see below, we have four buy orders and zero sell orders. Darren Shapland Butters(Non-Executive Director), Andrew Long(Non-Executive Director), Andrew Higginson(Non-Executive Chairman) and Régis Schultz(CEO & Director) are the only insiders buying JD Sports shares.

Bull And Bear Case:

Bull Case

Bull Case- The first bull case is JD Sports’ long runway for growth. JD Sports has successfully expanded its physical and digital channels in recent years and is now focused on creating a single omnichannel experience. JD Sports has five areas of focus, and they are re-platforming its websites, strengthening its cyber security, developing its omnichannel experience, developing its loyalty programme, and improving the efficiency and effectiveness of its supply chain. JD Sports is planning to go live in FY25 with their replat-formed website, starting with Italy as their proposed first go-live market. For all companies, cybercrime is a growing global threat, and JD Sports continues to invest in cyber security. JD Sports has recruited a Chief Information Security Officer to lead their cyber programme. JD Sports' click-and-collect trial in France is providing learnings for the future, and they plan to have it live in over 100 stores by the end of the period. JD Sports is now building out a roadmap for future click-and-collect markets in Europe. JD Sports STATUS loyalty programme in the US now has 5.1m active members, and following a successful trial, they have rolled out JD STATUS across the UK during the period. By the end of the period, JD Sports had 800k app downloads in the UK, of which 75-80% were active users. The average transaction value of JD STATUS members in the UK is over 40% higher than non-members. JD STATUS and Nike Connected members will soon benefit from improved targeting of offers and other benefits as the two programmes strengthen their connectivity. JD Sports plans to launch STATUS into European markets during the new financial year.

Bull Case- The second bull case is JD Sports’ market share growth. Sports fashion is driving the overall growth of the market, and within this category, JD Sports is the clear global market leader in a fragmented premium sports fashion retailing market. JD Sports is best positioned to capture a growing market share over the coming years from both same-store and new-store growth. JD Sports market share growth has gone from 2.87% in 2022 to 3.41% in 2023.

Bull Case- The third bull case is JD Sports’ relationship with key suppliers. JD Sports is known for its strong relationships with brands such as Nike and Adidas, which translates into a much better performance than rival Frasers Group’s Sports Direct. In fact, it does it so well that Mike Ashely, who owns Frasers Group, claimed that JD Sports has created an unfair monopoly.

Bull Case- The fourth bull case is JD Sports’ diverse portfolio. Fashion retailers were predicted to be some of the first to feel the cost-of-living crisis, as shoppers stayed away from new items to focus on more essentials rather than wants. JD Sports does offer more premium sportswear like Nike and Adidas, but it also has deals with cheaper options such as Fila and Champion. This spread of offering, both in product and price, allows it to appeal to virtually everyone and withstand some of the issues that are plaguing most of its competitors, where their offering may limit them to one demographic. JD Sports’ diverse portfolio has allowed it to achieve relative success even in the toughest of times.

Bear Case

Bear Case- The first bear case is key suppliers & brands. JD Sports is heavily dependent on third-party brands, and these brands themselves and their products are desirable to the consumer if the revenue streams are to grow. JD Sports is also subject to the distribution policies of some third-party brands. Further, supply chain issues or a reduction in the allocation of stock from key suppliers could negatively impact the results of JD Sports. Brands may opt to discount certain lines via their direct-to-consumer (DTC) channels, which could have a knock-on effect on the company’s revenue and margins.

Bear Case- The second bear case is acquisition, integration & expansion Risk. JD Sports’ status as a premier global strategic partner with key international brands is an important factor in the company’s success. Acquired businesses may fail to realise expected synergies, growth targets and performance, which could impact the company’s profitability and cash flows.

Bear Case- The third bear case is market risk. As with other retailers and distributors, the demand for JD Sports products is influenced by several economic factors. These economic factors are impacted by events outside of the company’s control, such as global conflicts and the ongoing cost-of-living crisis. JD Sports also considers the risk that the company fails to keep pace with changes in consumer habits and fashion trends, or the brand is no longer perceived as ‘premium’, which may result in a downturn in sales.

Valuation:

In this section, I will discuss the company's valuation. Using some basic metrics, I will compare JD Sports against its industry rivals and see if the company is cheap relative to its peers. Then, I will value JD Sports using a discounted cash flow model to arrive at a price I am willing to pay based on the expected growth rate and my desired return of 15%.

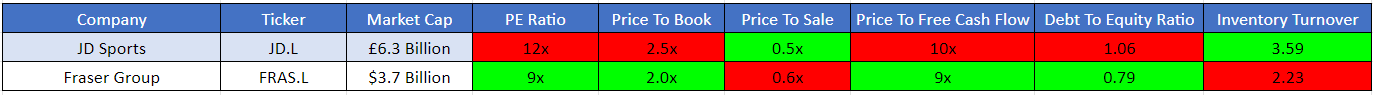

As shown below, when compared to its peers, JD Sports scores 2/6, whilst Fraser Group scores 4/6. Even though Fraser Group is valued cheaper on paper, JD Sports is a better-run company with a more diverse product offering, customer base, and growth potential.

As you can see, based on my conservative assumption, JD Sports is looking to grow 4%, so I went conservative and assumed a 4% growth in the first 1-3 years, then the growth will slow down to 1% 4-6 years out. In my assumption, I also went with an exit multiple of 10x earnings, which is below the historical average at which JD Sports has traded. Based on my assumption, I have come to a buy price of £1.24p compared to the current stock price of £1.21p, which means right now, JD Sports is trading below its intrinsic value.

Thanks for reading my newsletter on JD Sports. Disclaimer: This newsletter is not financial advice. This is for educational purposes only, so please DO NOT take this as a buy or sell signal.

Follow for more:

Don’t forget to subscribe, share, and comment below if you find this newsletter insightful, as it helps support my work.

Great article. JD is executing very well in a macro period where many brand retailers are struggling. Their investments into growth will inevitably pay off when consumer demand picks up again with rates coming down. Once the economy becomes more favourable, there's no reason why they cannot resume their strong growth trajectory especially with their upcoming acquisition or Courir which'll strengthen their Europe presence (a region where theyre growing very strongly). I believe they can grow earnings to 15p/share in 2-3 years which assuming a 15 multiple, which equate to a pps of 225p. Therefore I think your valuation estimate on JD is far too conservative.

I’m glad I have them in my portfolio. Great write up as always my friend!