Disclaimer: This newsletter is not financial advice; it is for educational purposes only. Please DO NOT take this newsletter as a buy or sell signal.

Greggs PLC Fundamentals:

Below is a checklist I normally use when analysing a company’s fundamental health. If the company meets my criteria, it will be colour-coded in green, and if it fails to meet my criteria, it will be colour-coded in red, which means I need to investigate further and ask myself why this is the case.

As you can see below, there are four red boxes, and I am going to explain each one:

Current PE Ratio- Greggs currently has a PE ratio of 21x, which might indicate that this company is trading at a premium to the market since the average stock market PE ratio is 15x. One thing to remember is if a company can grow 21% from now until judgment day and can sustain that growth, then the current valuation will look cheap. This goes for the opposite side of the spectrum, where if a company was trading at 15x earnings and only grew by 3% a year, that might seem expensive because the company can’t justify its valuation.

5-Year Average Profit Margin- When analysing a company, I look for a 5-year average profit margin of over 10%. However, given that this company operates in an industry with typically low margins, I will not penalise them for this.

Shares Outstanding- When analysing a company, I prefer that the number of shares outstanding remain stable or decrease over time(given that the shares are cheap). In the case of Greggs, their shares outstanding have increased by 0.50% over the last five years. This level of dilution is minimal, and I am not particularly concerned about it.

Free Cash Flow Yield- Free Cash Flow Yield gives investors another way to assess the value of a company. Free cash flow yield provides a better measure of a company’s performance than the PE ratio because earnings can be manipulated based on accounting rules. The most common way to calculate free cash flow yield is free cash flow divided by the company market cap. Generally, the lower the ratio, the less attractive a company is as an investment because investors are putting money into the company but not receiving an excellent return. A high free cash flow yield implies a company generates enough cash to quickly satisfy its debt and other obligations, including dividend payout. Greggs’s free cash flow yield is 5%, which is lower than my 7% threshold and higher than the risk-free rate, which currently sits at 4.3%. It is important to remember that when the treasury yield is lower than a company’s earnings/cash flow, according to the intelligent investor, you are being compensated for the extra risk you are taking with an individual business, which shows there is some margin of safety with this investment.

Business Overview:

Founded in 1939 by John Gregg, Greggs is a UK-based bakery chain that specialises in a variety of freshly prepared baked goods, sandwiches, and sweet treats. The company has grown significantly and now operates over 2,000 shops across the UK. Greggs is well known for its affordable prices and convenient takeaway options, making it a popular choice for breakfast and lunch among consumers. The brand has a reputation for quality, using freshly sourced ingredients to create its menu items, which include iconic products like sausage rolls, vegan pastries, and a selection of coffee drinks. In recent years, Greggs has also focused on expanding its offerings to meet changing dietary preferences, introducing more plant-based and healthier meal options.

Business Segments:

Bakery Products

Greggs has established itself as the leading bakery chain in the UK, offering a diverse range of baked goods, including pastries, sandwiches, salads, and sweet treats. Its standout products, like sausage rolls and steak bakes, serve as brand flagships. A key advantage for Greggs is the freshness of its offerings, where products are prepared in-store daily, ensuring customers receive quality food at every visit. The company emphasises high-quality, responsibly sourced ingredients that enhance flavour and meet the growing consumer demand for transparency and ethical sourcing. In response to changing dietary preferences, Greggs has expanded its menu with healthier options, including lower-calorie items, vegetarian choices, and gluten-free products. To keep its offerings appealing, the company regularly introduces new items and seasonal promotions, including collaborations featuring vegan options.

Retail Operations

The retail segment of Greggs is a vital part of the company’s business model, focusing on offering a wide variety of freshly baked goods and convenience foods to consumers. Here are some key aspects of the retail segment:

Prime Locations- Greggs has numerous shops in prime high-street locations, making them easily accessible to customers. Many of these stores are situated in train stations, airports, and shopping centres, catering to those on the go.

Drive-Thru Locations- Greggs has expanded its services to include drive-thru formats. This initiative aims to enhance customer convenience by allowing customers to order and collect food without leaving their vehicles. The drive-thru concept aligns with the growing demand for quick service and accessibility, catering to busy individuals and families looking for a fast, quality meal option. The implementation of drive-thru locations is part of Gregg's broader strategy to adapt to changing consumer behaviour and provide a faster, more efficient shopping experience. Drive-thru services can also potentially attract a wider customer base, making it easier for people on the go to enjoy Gregg's offerings.

In-Store Experience- Many locations provide seating options, allowing customers to enjoy their food on-site and improving the overall experience.

New Store Openings- Greggs continues to expand its retail presence across the UK by opening new stores in areas with high demand.

Reformatting Existing Stores- The company is focusing on renovating its current shops to enhance customer experience and respond to evolving consumer preferences.

Digital And E-commerce

Greggs has been increasingly focusing on expanding its e-commerce and digital segments in recent years. This initiative is part of their strategy to enhance customer experience and adapt to changing consumer behaviours. Here’s an overview of their approach:

Online Ordering- Gregg’s has developed a user-friendly online ordering system that allows customers to place orders for home delivery or click-and-collect. This has become particularly important in the wake of the pandemic.

Mobile App- The Greggs app provides users a seamless way to order and pay for products, check nutritional information, and receive personalised offers. It has gained popularity for its ease of use and promotional offers.

Delivery Partnerships- Greggs has expanded its reach by collaborating with delivery services like JustEat, which allows customers to enjoy their favourite products delivered right to their doorstep.

Loyalty Programmes- Greggs has invested in loyalty programs that reward frequent customers, encourage repeat business, and foster stronger customer relationships.

Digital Marketing- Greggs uses social media and digital marketing to engage with customers, promote new products, and share brand stories. Their creative campaigns resonate well with their target audience, driving brand loyalty.

Website Enhancements- Greggs has improved its website functionality and design, making navigation and access to product information easier. This supports both e-commerce and traditional retail operations.

Management:

When evaluating management, I judge the CEO based on several factors, such as experience, capital allocation skills, and Incentives. In this section, I will discuss whether management incentives align with shareholders' interests.

Experience- Roisin Helen Currie has been the Executive Director of Greggs PLC since February 2022 and has also taken on the role of Chief Executive Officer since May 2022. In addition, she became an Independent Non-Executive Director of Howden Joinery Group in July 2024. Roisin Helen Currie has previously served as Retail & People Director at Greggs PLC and has held the position of Group People Director since January 2010. She plays a crucial role in the development of the Greggs shop estate and is instrumental in its expanding delivery service in collaboration with JustEat. Before joining Greggs in 2010, Roisin Helen Currie worked at Asda, where she occupied various people director roles, overseeing the organisation’s retail and distribution operations. Furthermore, she is a trustee of the Greggs Foundation and serves as the Chair of the Employers Forum for Reducing Reoffending.

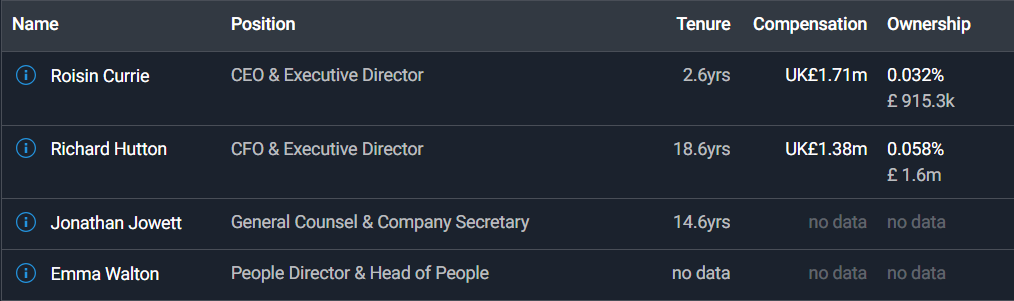

Below is an image illustrating the current experience of Greggs board members:

Capital Allocation- Capital allocation is very important when judging management because I want them to create value for shareholders, not destroy it. So far, Greggs has done a great job with capital allocation. They are providing value back to shareholders by reinvesting in the business to improve customer experience and paying dividends.

Greggs currently pays a dividend with a yield of 2.33%. This dividend is sustainable because it only covers 44% of the company’s free cash flow.

Incentive- This is important because if the current board is buying shares of their own business, it indicates that management believes the stock is undervalued and is confident in the company’s long-term prospects.

As you can see below, we have five buy orders and three sell orders. Roisin Helen Currie(Non-Executive Officer) and Richard Hutton(Chief Finance Officer) are the only insiders buying Greggs shares. As for selling, Roisin Helen Currie(Non-Executive Officer) and Richard Hutton(Chief Finance Officer) are the only insiders selling Greggs shares, but I am not going to put too much weight into this because there are so many reasons why someone might sell their stock.

Bull And Bear Case:

Bull Case

Bull Case- The first bull case is a long runway for growth. Greggs has demonstrated an effective expansion strategy that includes opening new stores in high-traffic areas and diversifying its product offerings. The chain has been increasing its presence in key locations, including city centres, transport hubs, and retail parks. Furthermore, the introduction of drive-thru locations has expanded its customer reach to those looking for convenience. This continued growth trajectory offers significant upside potential for overall revenue.

Bull Case- The second bull case is strong brand recognition and customer loyalty. Greggs is a well-established brand in the UK, known for its quality baked goods, including pastries, sandwiches, and coffee. Its brand identity resonates with a broad customer base, contributing to strong customer loyalty. The positive association customers have with Greggs often translates into repeat business, which is crucial for long-term revenue stability.

Bear Case

Bear Case- The first bear case is competition. The food retail and bakery market is highly competitive, with numerous established players like Pret A Manger, Costa Coffee, and local independent shops. Increased competition could lead to price wars, which may compress profit margins. Moreover, new entrants with unique offerings or improved customer experiences can disrupt the market, making it essential for Greggs to innovate and differentiate itself continuously.

Bear Case- The second bear case is consumer preference. Consumer preferences are constantly evolving, with a growing trend towards healthier eating, plant-based diets, and environmentally sustainable options. If Greggs fails to adapt its menu to meet these changing demands, it risks losing market share to competitors who offer healthier or more diverse options. Staying relevant to dietary trends is crucial for sustaining customer interest.

Valuation:

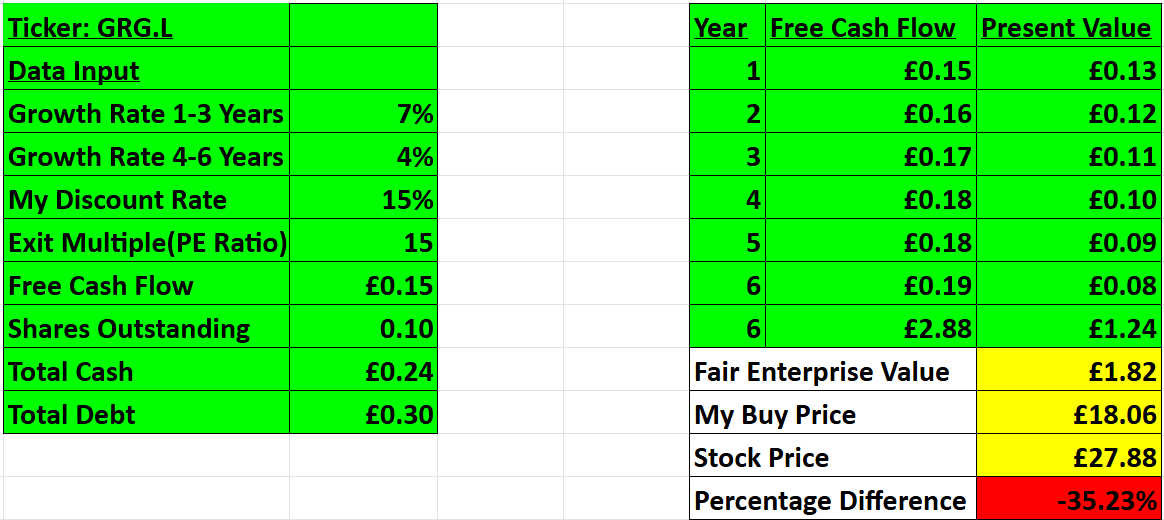

In this section, I will discuss valuation. Using some basic metrics, I will compare Greggs to its industry rivals and determine whether the company is cheap relative to its peers. Then, I will value Greggs using a discounted cash flow model to determine a price I am willing to pay based on its expected growth rate and my desired return of 15%.

Greggs does not have direct like-for-like competition, but it faces challenges from several major players in the market. McDonald’s, a global fast-food giant, competes by offering a wide variety of quick-service meals, including breakfast options that attract similar customers. Supermarkets such as Sainsbury and Tesco also present significant competition as they provide bakery items and ready-to-eat meals, appealing to consumers seeking convenience. Together, these companies create a dynamic competitive landscape that pushes Greggs to continually innovate and maintain its appeal in the fast-casual dining market.

As you can see, based on my conservative assumption, Greggs is looking to grow 9% over the long run, so I went conservative and assumed a 7% growth in the first 1-3 years, then the growth will slow down to 4% 4-6 years out. In my assumption, I also went with an exit multiple of 15x earnings, which is below the historical average at which Greggs has traded. Based on my assumption, I have come to a buy price of £18.06 compared to the current stock price of £27.88, which means right now, Greggs is trading above intrinsic value.

Thanks for reading my newsletter on Greggs. Disclaimer: This newsletter is not financial advice. This is for educational purposes only, so please DO NOT take this as a buy or sell signal.

Follow for more:

Remember to subscribe, share, and comment below if you find this newsletter insightful. Your support helps me continue my work.

Thank you for your analysis, but I have a different opinion.

Customers have loved Greggs for decades and the Sausage Rolls are a big seller. The vegan alternatives are the best rated online and Greggs has already reached an unbelievable size (3000 stores while McD only has around 1700 stores) has double the number of stores in the UK than McDonalds.

Over the past 10 years, sales have increased by an average of 9% and FCF by 17%. The fact that FCF is currently suffering somewhat is due to high CAPEX in the short term, as they continue to invest in logistics infrastructure (2 additional locations). For this reason, investment costs are expected to remain high until 2026. Greggs has an ROIC of over 20% and hardly any debt. With their app, they also generate a great deal of insight into customer wishes and The loyalty app is already increasing the frequency of visits and the average basket size. With a gross margin of over 60%, these key figures and the historical development, Greggs is valued more than favorably.