Disclaimer: This newsletter is not financial advice. This is for educational purposes only, so please DO NOT take this newsletter as a buy or sell signal.

FW Thorpe Fundamentals:

Below is a checklist I normally use when analysing a company's fundamental health. If the company meets my criteria, it will be colour-coded in green, and if it fails to meet my criteria, it will be colour-coded in red, which means I need to investigate further and ask myself why this is the case.

As you can see below, there are three red boxes, and I am going to explain each one:

Current PE Ratio- FW Thorpe currently has a PE ratio of 20x, which might indicate that this company is trading at a premium to the market since the average stock market PE ratio is 15x. Remember that if a company can grow 20% from now until judgment day and sustain that growth, then the current valuation will look cheap. This goes for the opposite side of the spectrum, where if a company was trading at 15x earnings and only grew by 3% a year, that might seem expensive because the company can’t justify its valuation.

Shares Outstanding- When analysing a company, I ideally want its shares outstanding to remain the same or decrease over time. As you can see, FW Thorpe’s outstanding shares have increased by 1.03% in the last five years. This is minuscule, and I am not too concerned about it.

Free Cash Flow Yield- Free Cash Flow Yield gives investors another way to assess the value of a company. Free cash flow yield provides a better measure of a company's performance than the PE ratio because earnings can be manipulated based on accounting rules. The most common way to calculate free cash flow yield is free cash flow divided by the company market cap. Generally, the lower the ratio, the less attractive a company is as an investment because it means investors are putting money into the company but not receiving an excellent return. A high free cash flow yield implies a company generates enough cash to quickly satisfy its debt and other obligations, including dividend payout. FW Thorpe's free cash flow yield is 6%, which is lower than my 7% threshold but slightly higher than the risk-free rate, which currently sits at 4.4%. It is important to remember that when the treasury yield is lower than a company’s earnings/cash flow, according to the intelligent investor, you are being compensated for the extra risk you are taking with an individual business.

Business Overview:

Founded in 1936 by Frederick William Thorpe and his son Ernest Thorpe, FW Thorpe designs, manufactures, and supplies professional lighting equipment in The United Kingdom, The Netherlands, Germany, The Rest Of Europe, and Internationally. The company offers professional lighting and control systems, including recessed, surface, and suspended luminaires, emergency lighting systems, hazardous area lighting, high and low bay luminaires, lighting controls, and exterior lighting products for commercial, industrial, education, healthcare, manufacturing, retail, display, and hospitality markets. It also provides general illumination, emergency exit signs, and lighting systems for commercial, education, infrastructure, industrial, hospitality, and healthcare sectors.

Business Segments:

Thorlux Lighting- The Thorlux range of luminaires are designed, manufactured and distributed by Thorlux Lighting, a division of FW Thorpe. Thorlux luminaires have been manufactured continuously since 1936, the year Frederick William Thorpe founded the company. Thorlux Lighting is well-known worldwide and provides various professional lighting and control systems for multiple applications.

Philip Payne- Regarding lighting specifications, Philip Payne is amongst the best. Philip Payne was one of the first to be considered by the architectural community for lighting specifications for the UK’s top construction and refurbishment projects.

Solite Europe- Solite Europe is a leading manufacturer and supplier of cleanroom lighting equipment and luminaires within the UK and Europe. It provides luminaires for laboratories, pharmaceutical and semiconductor manufacturing areas, hospitals, kitchens, and food preparation applications.

Portland Lighting- Portland Lighting designs, manufactures, and supplies innovative lighting products for the advertising, brewery, retail, and sign lighting industries. The company operates from a modern 1394m² facility in Walsall, West Midlands, purposely designed to enable the fast turnaround of customer orders. Established in 1994, the company has continually evolved its product range to ensure that Portland remains one of the leading companies in its sector.

Portland Traffic-Portland Traffic has evolved from Portland Lighting and is focused solely on the traffic lighting market. Created by a team with a combined experience of 100 years in road traffic safety, the company is focused on designing and manufacturing value-engineered products whilst utilising the latest technology and manufacturing techniques.

TRT Lighting- TRT (Thorlux Road and Tunnel) Lighting is an independent specialist division that evolved from Thorlux Lighting. Building on years of lighting experience, TRT Lighting is dedicated to designing, manufacturing, and supplying LED road and tunnel luminaires. The company aims to produce quality, efficient, stylish, high-performance LED products manufactured in the UK.

Lightronics- Based in The Netherlands, Lightronics specialises in developing, manufacturing, and supplying external and impact-resistant lighting, including street lighting, outdoor wall and ceiling luminaires, and control systems. Most of its revenue is derived from The Netherlands, but there is also an export presence in other European locations.

Famostar- Based in The Netherlands, Famostar specialises in developing, manufacturing, and supplying emergency lighting products. Revenue is derived from The Netherlands. Famostar was established in 1947, and each product is designed and manufactured at its production facility. Famostar has a reputation for designing and manufacturing reliable luminaires that offer solutions for sectors including commercial, industrial, education, and retail applications.

Zemper- Based in Spain, Zemper is a leading independent producer of emergency lighting. It uses highly automated manufacturing processes and supplies market-leading products, including wired and wireless self-testing systems, through high levels of research and development and extensive in-house and third-party testing.

Ratio Electric- Ratio Electric designs, develops, and manufactures electrical power connection and distribution systems from its base in The Netherlands. It has built a reputation for reliable and affordable products in electric vehicle (EV) charging, marine power systems, and distribution systems for data centre and office applications.

SchahlLED Lighting- Based in Munich, SchahlLED Lighting provides intelligent LED solutions for the industrial and logistics sectors. The company was established in 2006 as a spin-off from Richard Schahl GmbH & Co KG, a German distributor of speciality lamps.

Management:

When evaluating management, I judge the CEO based on several factors, such as experience, capital allocation skills, and Incentives. In this section, I will discuss whether management incentives are aligned with shareholders.

Experience-Michael Allcock is the current CEO of F.W. Thorpe. He joined FW Thorpe in 1984 as an apprentice, working to become Technical Director for Thorlux Lighting. His key areas of expertise/responsibilities include Lighting & Controls Technology, Product Design/ Management, Industry Knowledge, Marketing, and Strategy. Michael Allcock is passionate about developing innovative, high-technology, market-leading products.

Below is an image illustrating the current experience of F.W. Thorpe board members:

Capital Allocation- When judging management, capital allocation skills are very important because I want management to create shareholder value, not destroy it. So far, FW Thorpe’s capital allocation has been spot on because they are giving value back to shareholders via reinvestment into the business to expand their product offering, pay a dividend, and make strategic acquisitions.

FW Thorpe is currently paying a dividend with a yield of 1.73%. This dividend is sustainable because it only covers 28% of the company's free cash flow.

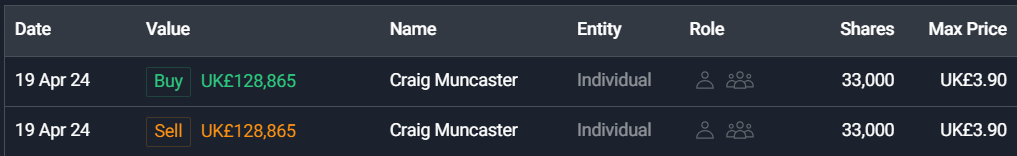

Incentive- This is important because if the current board is actively purchasing stock of their own business, this is a positive indicator that shows that management believes the stock is undervalued and believes in the company's long-term prospects.

As you can see below, we have one buy order and one sell order. Craig Muncaster is the only insider buying FW Thorpe shares. As for selling, Craig Muncaster is the only insider selling, but I won’t put weight into this because there are so many reasons why someone might sell their stock.

Bull And Bear Case:

Bull Case

Bull Case- The first bull case is the increase in demand for technological innovation, where more and more FW Thorpe customers are moving towards wireless innovation. By moving towards wireless innovation, the company can offer its customers additional functionality by adding different sensor technology and presenting data. The potential this brings to FW Thorpe is that with wireless controls, it is less cost-prohibitive.

Bull Case- The second bull case is energy efficiency. Energy prices are high, and the world has to meet emission targets. There is an increase in demand for sustainable, energy-efficient lighting solutions and retrofit lighting solutions driving energy savings using LED and wireless control technology. FW Thorpe is responding to this demand by continuing to offer energy-saving technology and the ability to report on energy usage with the SmartScan platform, financing options with partners to make solutions more affordable to customers, offering turnkey packages to customers to enable change and Investment in electric vehicle charging products with ratio.

Bear Case

Bear Case- The first bear case is a competitive environment. Existing competitors, powerful new entrants and the continued evolution of technologies in the lighting industry can erode the company's revenue and profitability over time. To protect itself, FW Thorpe must differentiate itself from their competitors by offering innovative products and service solutions that are technologically advanced, Investing in research and development activities to produce new and evolving product ranges, Investing in new production equipment to ensure the company can keep costs low and maintain barriers to new market entrants.

Bear Case- The second bear case is price fluctuation. Whether it is commodity fluctuation or the cost of materials, management reviews prices regularly to account for cost fluctuations and minimise the risk of reducing gross margin or losing market share due to a lack of competitiveness.

Valuation:

In this section, I will discuss valuation. Using some basic metrics, I will compare FW Thorpe against its industry rivals and see if the company is cheap relative to its peers. Then, I will value FW Thorpe using a discounted cash flow model to arrive at a price I am willing to pay based on the expected growth rate and my desired return of 15%. Since FW Thorpe hasn’t got a like-for-like publicly traded competitor, there won’t be any industry comparison.

As you can see, based on my conservative assumption, FW Thorpe is looking to grow 8%(the same rate as the industry it operates), so I went conservative and assumed a 5% growth in the first 1-3 years, then the growth will slow down to 2% 4-6 years out. In my assumption, I also went with an exit multiple of 12x earnings, which is below the historical average at which FW Thorpe has traded. Based on my assumption, I have come to a buy price of £2.56p compared to the current stock price of £3.72p, which means right now, FW Thorpe is trading above intrinsic value.

Thanks for reading my newsletter on FW Thorpe. Disclaimer: This newsletter is not financial advice. This is for educational purposes only, so please DO NOT take this as a buy or sell signal.

Follow for more:

Don’t forget to subscribe, share, and comment below if you find this newsletter insightful, as it helps support my work.