Disclaimer: This newsletter is not financial advice this is for educational purposes only so please DON’T take this newsletter as a buy or sell signal.

What Is A Serial Acquirer?

A serial acquirer is a registered company that purchases a portion of or all the rights to another company. The acquiring company takes over the management of another company by obtaining a majority stake in the target which effectively gives them control of the company through stock voting rights. Some great examples of well-known serial acquirers are Constellation Software which has returned 12,556.78% since its IPO in 2006, and Berkshire Hathaway which has returned 50,214.20 since its IPO in 1982. The appeal for investing in serial acquirers is the tendency of such companies to reinvest all or most of their free cash flow at a high rate of return. Serial acquirers also benefit from becoming more diversified businesses over time. A good serial acquirer can compound at high rates of return over time and simultaneously have less idiosyncratic risk, making it easier to never sell and let the position size grow with success.

Future PLC Fundamentals:

Below is a checklist I normally use in my process when I look at the fundamental health of a company. If the company meets my criteria it will be colour-coded in green and if the company fails to meet my criteria it will be colour-coded in red which means I need to investigate further and ask myself why this is the case.

As you can see below there are 2 red boxes and I am going to explain each one:

5-Year Average Return On Invested Capital- Return on invested capital indicates how well management is doing in terms of allocating cash for future growth. When analysing a company I ideally want their return on invested capital(ROIC) to be over 10% but as you can see Future PLC’s return on invested capital currently stands at 8% on a 5-year average and it’s improving as the years go on. Future PLC aims for an ROIC of over 10% in the long run.

Shares Outstanding-When analysing a company I ideally want their shares outstanding to be the same or to decrease over time. As you can see, Future PLC’s shares outstanding have gone up by 33% in the last 5 years due to their acquisitions but at the same time, I have to remember that their revenue in that same time period has far outpaced the number of shares they have issued. In their 2022 annual letter, Future PLC has hinted at the possibility of share buybacks by saying “The Group keeps the capital allocation priorities, as with overall strategy, under review to make sure that it takes account of market conditions. In light of recent macroeconomic conditions, it has been important to consider all potential uses of capital, most notably share buy-backs or debt repayment as interest rates have increased.” This is positive news for current/potential shareholders as share buybacks at this current valuation will help drive future returns.

Business Overview:

Founded in 1985 by Chris Anderson, Future PLC is an international multimedia company established in the United Kingdom. Future PLC, together with its subsidiaries, publishes and distributes content for games, entertainment, technology, sports, savings and wealth, lifestyle, knowledge, news, and B2B primarily in the United States and the United Kingdom. Future PLC operates through Media and Magazine segments. Future PLC offers content through various forms, such as websites, email newsletters, videos, social platforms, magazines, events, digital advertisement, e-commerce, print, digital subscriptions, newstrade and a direct to consumer monetisation frameworks. Future PLC also provides print licensing, endorsement licensing, comparison shopping, video content production, energy auto-switching, digital media publishing services, and various sales and distribution services to third parties. In 2022 Future PLC announced that its media brands have reached 313 million people worldwide which is approximately 1 in 3 adults in the US and the UK.

Future PLC has a long history but from 2012-2015 Future PLC published the official magazines for Microsoft, Nintendo(discontinued in 2014), and Sony(discontinued in 2012). Future PLC had a period of abandoning print media properties in favour of digital media, closing many titles and selling off others. In January 2012, Future PLC sold its U.S. consumer music magazines which included Guitar World and Revolver, to NewBay Media for $3 million. In 2013, Future PLC completed the sale of major components of its UK media-music brands for £10.2 million to Team Rock LTD and In 2017 they bought these back for £800,000 after Team Rock went into administration.

Future PLC’s history took a turn for the good when In 2014 the company announced it would cut 55 jobs from its UK operation as part of a restructuring to adapt more effectively to a primarily digital business model. In 2014 Future PLC decided that it would close all of its U.S.-based print publications and shift U.S. print support functions such as consumer marketing, production and editorial leadership to the UK. Later in 2014, Future PLC sold its sport and craft titles to Immediate Media and its auto titles to Kelsey Media. To undergo this transformation Future PLC announced that they would appoint Zillah Byng-Thorne as CEO after Mark Wood stepped down. Zillah Byng-Thorne started to expand Future PLC’s print and web portfolio through a series of acquisitions where the company bought Blaze Publishing to diversify into the shooting market and they acquired Noble House Media to increase its interest in telecoms media. Future PLC then completed the purchase of rival specialist magazine publisher “Imagine” in 2016 after receiving approval from the Competition and Markets Authority. In 2018, Future PLC made further major acquisitions as It bought What Hi-Fi, FourFourTwo, Practical Caravan and Practical Motorhome brands from Haymarket. Future PLC also acquired NewBay Media, publisher of numerous broadcast, professional video, and systems integration trade titles, as well as several consumer music magazines. This acquisition returned most of the U.S. consumer music magazines to Future PLC, except for Revolver which was sold to Project Group in 2017.

Business Segments:

Media-Media is the largest division with 65% of Future PLC’s total revenue with +5% organic growth in FY 2022. The Media division encompasses all revenue which is not magazines and includes sub-segments like digital advertising which consist of revenue from advertising on their websites/social platform, email marketing, affiliate revenue for both products and services as well as events. Media revenues are now generated from 125 websites and 65 events that are held in the UK, US and Australia. The media division’s growth is powered by strong, attractive long-term growth fundamentals. Digital advertising is expected to continue to take a share in the advertising market to reach $785 billion by 2025, representing 72% of the total advertising market compared to 65% in 2022. Secondly, online retail continues to gain share, with an accelerated conversion during the pandemic. According to e-marketer, global e-commerce sales are projected to reach 23.6% share vs 20.3% currently, growing at 10% CAGR. Long-term, Future PLC expect solid growth from this revenue stream on an organic basis(10%).

Magazine-Magazines represent 35% of Future PLC’s total revenue. The Magazine division encompasses all revenue associated with digital or printed magazines or bookazines from advertising, to subscriptions, to newstrade. During the year, this division has been bolstered by the acquisition of Dennis. As a result, 48% of magazine revenue is now subscriptions, which provide predictable, repeatable revenue with positive working capital. Future PLC published 106 magazines and 743 bookazines in FY 2022. 74% of magazine revenues are generated from the UK. The magazine industry has experienced a long-term secular decline however, the pandemic has created an unusual set of comparators. Fundamentally, Future PLC thinks this business will continue to decline by high single-digit per annum given the improved profile with higher subscription revenue.

Future PLC Brands:

B2B-Future PLC’s B2B portfolio aims to inform, educate and empower their B2B audience with their expert editorial teams across key B2B sectors.

Country Lifestyle-Future PLC Country Life Portfolio aims to cover field sports, equestrianism, property and more.

Events-Future PLC events portfolio connects, entertains, educates and inspires audiences around the world, with more than 1 million people engaging either virtually or in person across B2B and B2C.

Gaming And Entertainment-Future PLC gaming portfolio has been the voice of authority and source of influence for gamers across digital, events and print for over 30 years. With incredible new video-first franchises like Totally Game and the PC Gaming Show, Future PLC has dialled into the pulse of the gaming community.

Home and Gardens-With inspiring and beautiful content for home lovers, Future PLC home interest brands cover everything from vintage and classic to modern interiors and home-building projects.

Knowledge-With expert editorial teams across history, science and technology, Future PLC’s knowledge portfolio provides engaging and authoritative content for all ages.

Music-Future PLC has one of the world’s most extensive music portfolios, with websites, magazines and events covering all genres, from rock to acoustic, drumming to electronic music.

Photography And Design-Future PLC is one of the leading photography networks, reaching both professionals and enthusiasts through their influential global photography brands.

Sports-By inspiring everyone regardless of skill level, Future PLC has become the most trusted destination for a wide range of sports from football to rugby, cycling to yachting.

TV And Films-Entertainment is an ever-evolving landscape and Future PLC responds in real-time. No matter which side of the camera you’re on, and whether it’s the silver screen or phone screen, Future PLC is the leading voice of the television and film industry and its audiences.

Technology-Future PLC’s technology portfolio aims to reach passionate consumers through their world’s favourite tech brands. From mainstream to specialist media Future Tech has unmatched reach to unique audiences.

Videos- Future Studio’s in-house team of journalists and producers cast & create premium digital and film content for social media, streaming platforms & TV. Future PLC aims to bring brands into their world of authentic storytelling through bespoke branded content, series sponsorships & media distribution.

Wealth And Finance-Future Wealth is the global home for everyday financial advice, making money planning easy for millions across the world. Through smart online advice, honest deals, and connections to businesses that give the right support, Future Wealth is the friend people need in the areas that matter most to them and their families.

Women Lifestyle-Future PLC boast one of the world’s leading women’s lifestyle portfolios by aiming to inspire and entertain women in every aspect of their lives as they try to focus on the things that matter to them.

Monetisation:

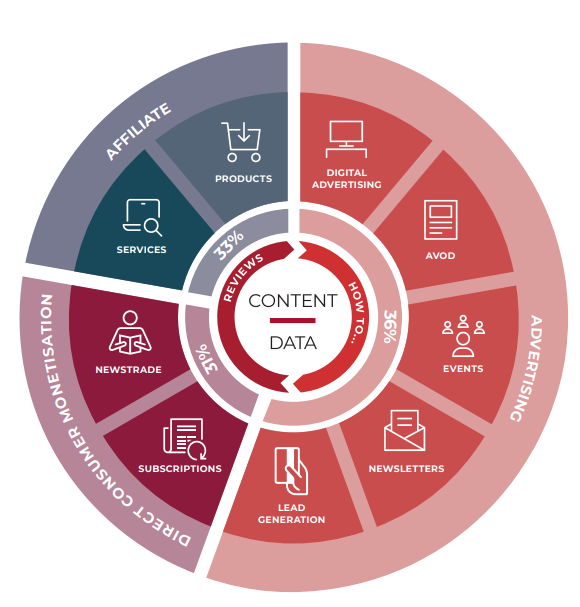

Future PLC diversifies its platform into three segments by using a flywheel to create significant revenue streams from advertising, direct-to-consumer monetisation and e-commerce affiliate. The reason why Future PLC chooses to opt for a more diversified revenue stream is because they want to be in a position to withstand the cyclicality of digital ads. An example of how this might work is that money-saving advice would be in demand in a recessionary environment whereas with ads you might see a slight slowdown. Below I will be explaining the famous Future PLC monetisation flywheel:

Advertising- This part of the business equates to 36% of Future PLC’s revenue. This is the revenue they earn from ads displayed alongside their content on their websites, social platforms, videos, email newsletters, magazines(physical or digital), and events (physical or digital).

Direct Consumer Monetisation- This part of the business equates to 31% of Future PLC’s revenue. This is revenue that comes from the direct purchase of content or services by consumers e.g. the sale of magazines either directly from Newsstand, subscriptions or the purchase of online membership.

E-commerce affiliate-This part of the business equates to 33% of Future PLC revenue. Future PLC earns a commission when an online user clicks through to a retailer or service provider’s website to make a purchase. Future PLC offers this across its content and comparison websites.

Monetisation Technologies:

Vanilla-This is Future PLC’s single modular web platform, it has a single content management system.

Hawk-This is Future PLC’s e-commerce service that enables the monetisation of their content through product affiliates.

Hybrid-This is Future PLC’s advertising system.

Go Demand- This is Future PLC’s e-commerce service that enables the monetisation of its content through service affiliates.

Aperture-This is Future PLC’s customer audience data platform.

Eagle-This is Future PLC’s voucher technology that sits on their owned and operated websites.

SmartBrief-This is Future PLC’s email curation and delivery platform for email products. This offers hyper-audience and advertising capabilities.

Kiosq-This is Future PLC’s reusable paywall service for monetising gated editorial content.

The Merger And Acquisition Framework:

Sustainable Organic Growth-There are numerous ways Future PLC can drive organic growth throughout the business. Having multiple ways to drive organic growth means the company can lean into areas of strength and mitigate areas under pressure, enabling the company to deliver revenue growth consistently without having to worry about cyclicality. One example of Future PLC driving organic growth is by driving vertical leadership. Driving vertical leadership is a key lever to accelerating the monetisation of a content vertical, by growing the audience to unlock a market-leading position. Future PLC can also use data and expert content creators to write the content that their audiences want to read and what is most useful for them. Future PLC also ensures that the content is current, and refreshing regularly as this helps the company to rank highly on search engine optimisation (SEO) while meeting their audience needs. Future PLC also believes in a podium approach, where they want to be their own competition by maximising their audience reach where they are focused on the same categories across several different brands. Another way Future PLC can drive organic growth is through attractive verticals where Future PLC can target an audience with intent (likely to make a purchase of a product or a service), that asks a lot of questions that their expert content can answer or who are highly engaged and loyal.

The platform Effect-The Platform Effect is more than operating leverage and growing the bottom line, it is about the multiplier effect of the organic and inorganic capabilities that deliver unique value creation, both in top and bottom lines. Future PLC platform effect model is a source of competitive advantage where they use evergreen content that enables them to write the content once and monetise it many times. An example of this is the “how to clean my bike” article on Cycling Weekly where the content will largely be unchanged yet still be relevant for many years and continue to earn revenue from user views. Expert content is the key to Future PLC’s success and it is their primary focus. Future PLC continues to reinvest a lot of money into content by hiring expert editorial heads as well as developing talent within the company. Future PLC has been able to prolong the life of magazines via pricing and distribution by increasing the mix of subscriptions. Magazines are a valuable, profitable and cash-generative segment which brings expert content and can be expanded into premium editions and bookazines as well as subscriptions. Bookazines are luxury editions of magazine format content without a periodicity. The benefit of bookazines is that it encompasses a wealth of evergreen content and is sold at a premium with no shelf life, resulting in a better return on sale for retailers and less cost to merchandise.

Value Creation M&A-Whilst organic growth is the company’s priority, Future PLC looks to accelerate the strategy through M&A(merger and acquisition). At its core, this pillar aims to increase its market leadership or enter new markets. There are three types of acquisitions that Future PLC uses and they are tactical, strategic or transformative and they each fall into three categories such as content, capabilities or both. A content acquisition is an acquisition where the company look to either bolster existing content vertically or enter a new one. For example, in March 2022, Future PLC acquired WhatCulture, a digital-only brand focused on the gaming and entertainment market. This acquisition notably reinforces Games and Entertainment verticals whilst benefiting from the Future PLC operating model. A capability acquisition is an acquisition that adds a technology or a route of monetisation. For example, in March 2022 Future PLC acquired Waive, a data insight platform, which provides intelligence on emerging content trends. This acquisition strengthens Aperture, their data platform that provides insight for content production. A tactical or bolt-on acquisition is a small acquisition, funded out of cash and is usually a content-based acquisition to deliver on their podium strategy, such as the WhatCulture acquisition. A strategic acquisition is an acquisition that either adds capability or enters a new vertical for example, In October 2021, Future PLC acquired Dennis which enhanced its wheel by adding subscription capabilities as a route of monetisation and increased the company’s B2B portfolio. A transformational acquisition is an acquisition that helps the company in its long-term strategy but also adds content or capabilities in adjacencies. For example, in February 2021 Future PLC acquired GoCo Group PLC which added e-commerce affiliate technology for services but also entered a new vertical with Wealth & Savings. Future PLC is very disciplined regarding acquisitions, both on valuation where Future PLC typically pays 11x earnings on their purchases. The full integration of acquisitions is an important part of their M&A playbook which has proven its efficiency over multiple transactions. Below is a graphic displaying the acquisition framework of Future PLC:

Management

When looking at management I like to judge the CEO in several different ways such as experience, capital allocation skills and Incentives. In this section, I will cover if management incentive is aligned with shareholders.

Experience-Zillah Byng-Thorne is the former CEO of Future PLC. Currently, she serves as the director of Norwegian Cruise Line, an independent non-executive deputy chair of Trustpilot Group PLC, and an independent non-executive director of Flutter Entertainment PLC. Zillah Byng-Thorne brings extensive technology sector experience from online gaming, digital media and e-commerce. Zillah Byng-Thorne has a degree in Management from Glasgow University. She has a strong track record in developing and delivering successful strategies. Her focus is on driving operational excellence and is a proven people manager, identifying and developing talent.

Jon Steinberg is the incoming CEO of Future PLC. In early 2016, he founded Cheddar Inc a new media company covering tech news and culture, and served as its CEO. Jon Steinberg is also the former President and Chief Operating Officer(COO) of tech and pop-culture website BuzzFeed. In May 2010, Jon Steinberg joined BuzzFeed while it was still a 15-person company. He played a role in helping develop Buzzfeed's business model, which is rooted in content marketing. Before Buzzfeed, Jon Steinberg was strategic partner development manager on Google’s small-medium business partnerships team, executive in residence at Polaris Venture Partners, and founded iBuilding, a commercial real estate software company.

Below is an image illustrating the current experience of the Future PLC board members.

Capital Allocation-When it comes to judging management I think capital allocation is very important because I want management to create shareholder value and not destroy it. So far Future PLC’s capital allocation has been spot on because they are giving value back to shareholders via dividends and creating shareholder value through strategic acquisitions.

Future PLC is currently paying a dividend with a yield of 0.31%. As shown below this dividend is sustainable because this current dividend only takes up 2% of their overall free cash flow.

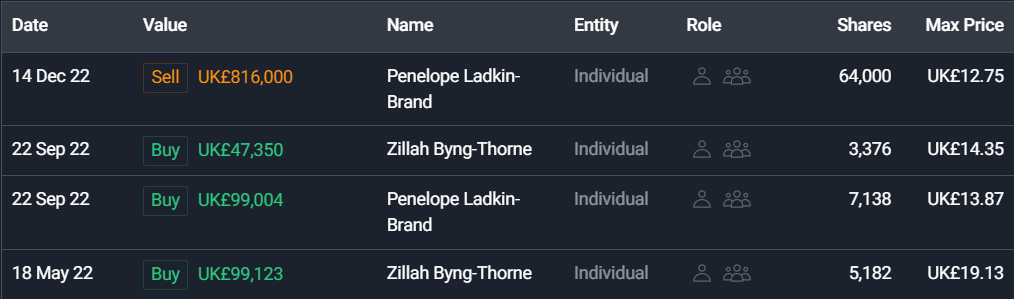

Incentive-This is important because if the current board is actively purchasing stock of their own business this is a positive indicator that shows that management believes the stock is undervalued and they believe in the long-term prospect of the company.

As you can see below we have 1 person selling and 2 people buying. Zillah Byng-Throne(former CEO) and Penelope Ladkin-Brand(CFO) are the only insiders buying Future PLC shares. As for selling Penelope Ladkin-Brand(CFO) is the only insider selling but I am not going to put too much weight into this because there are so many reasons why someone might sell their stock.

Bull And Bear Case:

Bull Case

Bull Case-The first bull case is the runway for growth. Future PLC’s long-term goal is to tap into the US ad market which is 7x greater than the UK market. If they can reach their long-term goal of reaching 1 in 3 US adults there is a lot of potential for this to translate onto their top and bottom line.

Bull Case- The second bull case is the resiliency of this company where right now the ad market is taking a hit which no digital advertising company is immune to but what makes Future PLC so unique is they have a diversified revenue stream so when one stream is out of favour another stream of revenue will be there to offset that. Future PLC currently has different revenue streams coming from ads, affiliates and direct-to-consumer monetisation.

Bear Case

Bear Case-The first bear case that could potentially damage the long-term thesis of this company is Zillah Byng-Throne(CEO) announced last year that she is leaving Future PLC and joining Trustpilot PLC. The moment that news came out the stock plunged 17% because she was the one that turned Future PLC from a loss-making magazine company into a highly profitable and free cash flow generative ad business in a short period of time. Since she joined in May 2014 the stock has returned over 950% in 8 years so you can see why the stock is down so much as investors are on edge because we don’t know what the new CEO Jon Steinberg might bring to the table.

Bear Case-The second bear case is Innovation. Future PLC’s strategic priority is to stay relevant for newer generations and new media models. Future PLC must continue to grow its organic audience and that of its acquired websites through investment in its editorial content. Future PLC’s Failure to anticipate and respond to market disruption and changing consumer habits may affect demand for their products and services and their ability to drive long-term growth.

Valuation:

In this section, I am going to talk about valuation. Using some basic metrics I am going to compare Future PLC against some of its industry rivals and see if the company is cheap relative to its peers then I will value Future PLC using a discounted cash flow model to come up with a price I am willing to pay based on expected growth rate and my desired return of 15%.

As shown below when comparing Future PLC against its peers it scores 2/5 whilst Graham Holding also scores 2/5. Both are high-quality companies but Future PLC steals this one based on the potential for long-term growth and Future PLC is a smaller company.

As you can see based on my conservative assumption, Future PLC is looking to grow 7% I went conservative and assumed a 4% growth in the first 1-3 years then the growth will slow down to 1% in 4-6 years out. In my assumption, I also went with an exit multiple of 10x earnings which is below the historical average that Future PLC has traded at in the past. Based on my assumption I have come to a buy price of £13.11p which means right now Future PLC has significant upside potential if you compare it against the stock price of £11.59p.

Thanks for reading my newsletter on Future PLC. Disclaimer this newsletter is not financial advice this is for educational purposes only so please DON’T take this as a buy or sell signal.

Follow for more:

Don’t forget to subscribe, share and leave a comment below if you found this newsletter insightful as it helps support my work.

the biggest problem with this company is that it cannot generate organic growth but needs to take on ever increasing debt and issue new equity to fund acquisitions to drive growth. hence the continuous equity dilution, and for almost flatlining growth? yikes

your growth expectation for this company is much more optimistic than the market. Looking at consensus free cash flow estimates from capital iq, futr's fcf cagr is expected to be 1.15% from 2023 to 2032. Important to note that growth is expected to decline by -1% consistently from 2027 to 2031. This could actually be positive tho if the company can surprise to the upside, but then again its valuation is not particularly attractive. what i am most concerned about is the moat of the business and wether it may get disrupted, particularly in the digital and e - commerce segments. digital ad is a competitive market which is always evolving fast. all in all this company seems to be a hold for me.