Disclaimer: This newsletter is not financial advice this is for educational purposes only so please DO NOT take this newsletter as a buy or sell signal.

Fonix Mobile Fundamentals:

Below is a checklist I normally use in my process when I look at the fundamental health of a company. If the company meets my criteria it will be colour-coded in green and if the company fails to meet my criteria it will be colour-coded in red which means I need to investigate further and ask myself why this is the case.

As you can see below there are 2 red boxes and I am going to explain them both:

Current PE Ratio- Fonix Mobile currently has a PE Ratio of 26x which might be an indicator that this company is currently trading at a premium to the market since the average stock market PE Ratio is 15x. One thing to remember is if a company can grow 26% from now until judgment day and it can sustain that growth then the current valuation will look cheap. This goes for the opposite side of the spectrum where if a company was trading at 15x earnings and they are only growing 3% a year that might seem expensive because the company can’t justify its valuation.

Free Cash Flow Yield-Free Cash Flow Yield gives investors another way to assess the value of a company. Free cash flow yield provides a better measure of a company's performance than the PE ratio because earnings can be manipulated based on accounting rules. The most common way to calculate free cash flow yield is free cash flow divided by the company market cap. Generally, the lower the ratio, the less attractive a company is as an investment because it means investors are putting money into the company but not receiving an excellent return in exchange. A high free cash flow yield result means a company is generating enough cash to satisfy its debt and other obligations including dividend payout. Fonix Mobile’s free cash flow yield is 6% which is lower than my 7% threshold but higher than the risk-free rate which currently sits at 4%. It is important to remember that when the treasury yield is lower than a company’s earnings/cash flow, according to the intelligent investor, you are being compensated for the extra risk you are taking with an individual business.

Business Overview:

Founded in 2006 by Will Neale and Rob Weisz, Fonix Mobile is a mobile payments and mobile messaging platform based in London. Its services are used by the media, entertainment, telecoms, enterprise and commerce sectors. Fonix Mobile also has connections to all of the UK mobile networks. When consumers make a payment, they are charged to their mobile phone bill. This service can be used for ticketing, content, cash deposits and donations. Fonix Mobile was originally named Orca Digital. Orca Digital focused on mobile telephony and provided interactive services to the media and entertainment sectors. In 2014, Orca Digital relaunched as Fonix Mobile under CEO Rob Weisz. At this point, the business became focused on mobile operator payments and mobile messaging services to a range of sectors including media, charity, telecoms, enterprise, gaming and entertainment. Since 2014, Fonix has secured contracts with Channel 5, Sport Relief, Children In Need, Tastecard, UNICEF(Soccer Aid), BT Sport, ITV, Stand Up To Cancer and many more.

Business Segments:

Payment Services

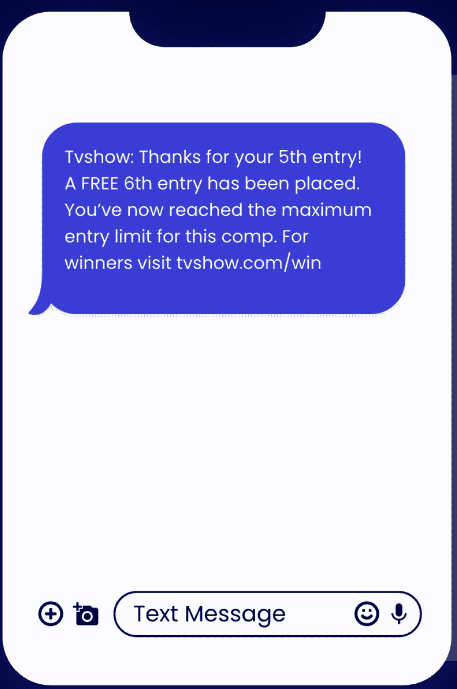

Payment API- Fonix Mobile payment APIs connect digital content merchants, gaming operators, transport operators, media companies and charities to mobile network operators. Fonix Mobile carrier billing API charges users through their phone bills via desktop, mobile or apps. Carrier billing is commonly used for ticketing (e.g. parking tickets), content (e.g. paying for film, live sport, magazines) and cash deposits. Fonix Mobile SMS Billing API charges users through their phone bills via SMS. From purchasing services or making charitable donations, consumers are charged by sending a text message. SMS billing is commonly used for digital purchases such as content, donations, voting, competitions and polls.

Campaign Manager- Fonix Mobile’s easy-to-use communications platform as a Service(CPaaS) allows donations, competitions and consumer interaction to be managed all in one place. Fonix Mobile’s intelligent CRM tools allow marketing messages to be automated or scheduled to optimise revenue and the customer experience.

Checkout- Whether you offer one-time purchases or subscriptions, Fonix Mobile checkout is easy to use and securely accepts mobile operator payments via carrier billing. Merchants can start monetising their users with minimal effort using Fonix Mobile checkout.

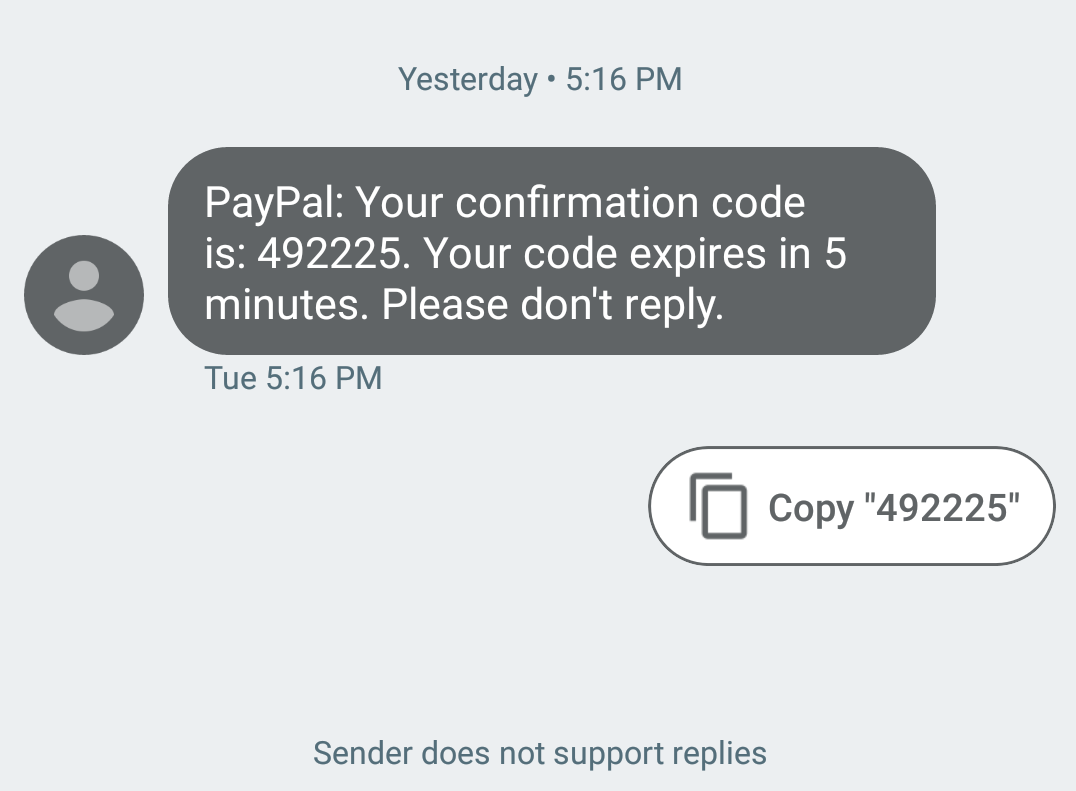

Messaging API- Fonix Mobile Messaging API enables effective communication with customers. Fonix Mobile Messaging API allows user identification, two-factor authentication (2FA), payment confirmations, transactional notifications and marketing messages. The Messaging API can be used with the company’s direct carrier billing and SMS billing platforms or as a standalone solution.

Key Customers

ITV-Fonix Mobile worked with ITV to add a carrier billing payment mechanic to the ITV portal. This allows consumers to log in and enter competitions by using their mobile number as their username. Consumers then need to confirm that they want to charge the competition entry to their mobile phone bill. Consumers then receive a receipt message via text to inform them that their competition entry has been successful. Moreover, this solution makes multiple entries also much easier, allowing consumers to select the number of entries they want, and click to confirm. This avoids having to send individual premium SMS entries and re-enter the keyword, make another phone call or send another postal entry.

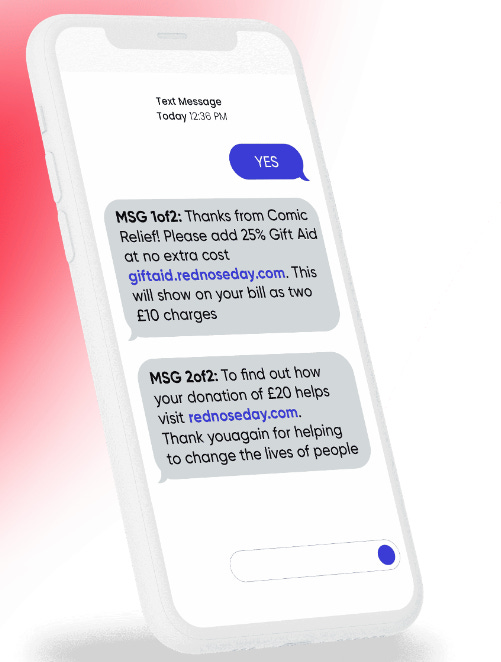

BBC Red Nose Day- The aim was to raise as much as possible via text-to-donate for Red Nose Day. The campaign allowed people to donate to the appeal by sending a text message to a short five-digit code and this was promoted for the duration of the live show and during the series of Red Nose Day programmes. For the 2022 campaign, a new tariff was introduced where donors were allowed to donate £40 via text to Red Nose Day for the very first time alongside the conventional £10 and £20 price points and the £30 price point which was introduced in 2019. The £40 price point made up just over 15% of the overall donations. Another element was introduced where the public could donate by entering a competition where they would text a specific word related to the competition prize. Using Fonix Mobile’s delayed donation system, entrants could pay £10 to enter the competition and then decide whether to donate or opt out within 60 minutes of entering the competition.

Soccer Aid-Soccer Aid for UNICEF wanted to raise as much money as possible. They needed to make it as easy for the public to donate during the live broadcast of the match. To do this they needed a quick and intuitive way for people to donate. The charity was also looking to maximise the amount of Gift Aid donated by the UK government to boost the total amount raised. Mobile billing has been incredibly effective when it comes to voting, entering competitions and donating to charity essentially for any campaign where there is a clear call to action. Fonix Mobile processed mobile donations during Soccer Aid for UNICEF by allowing viewers to donate at four price points: £10, £20, £30 and, a first for Soccer Aid, £40. To donate, consumers text a memorable 5-digit short code with their chosen amount e.g. “text FORTY to 70818”, to donate £40. These donations were charged to the donors’ mobile phone bills which meant that they didn’t need to leave the sofa to get their wallets out to enter credit card details which makes it a quick and convenient way to donate for those watching the match on ITV. Fonix Mobile also managed Gift Aid for Soccer Aid for UNICEF where they built a dedicated microsite for donors to make Gift Aid declarations. An automated text prompt was sent to donors about Gift Aid including a link to this in the message reply after a member of the public had donated.

Management:

When looking at management I like to judge the CEO in several different ways such as experience, capital allocation skills and Incentives. In this section, I will cover whether management incentives are aligned with shareholders.

Experience- Robert Weisz has been the chief executive officer at Fonix Mobile since July 1, 2014. Robert Weisz has held several senior positions in technology companies including commercial director at Mobile Interactive Group. Before this, he was a commercial partnership manager at O2 (UK) where he worked within interactive services, holding responsibility for new business and account management. He has had extensive experience working in both public and private companies within the telecoms and technology sectors.

Below is an image illustrating the current experience of Fonix Mobile board members:

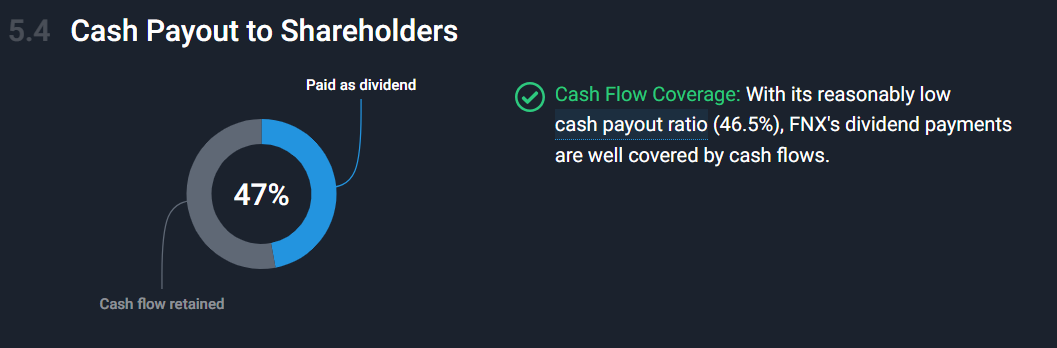

Capital Allocation-When it comes to judging management I think capital allocation skill is very important because I want management to create shareholder value and not destroy it. So far Fonix Mobile’s capital allocation has been spot on because they are giving value back to shareholders via reinvestment back into the business to further expand their technological capabilities and they pay a dividend.

Fonix Mobile is currently paying a dividend with a yield of 2.97%. As shown below this dividend is sustainable because this current dividend only takes up 47% of their overall free cash flow.

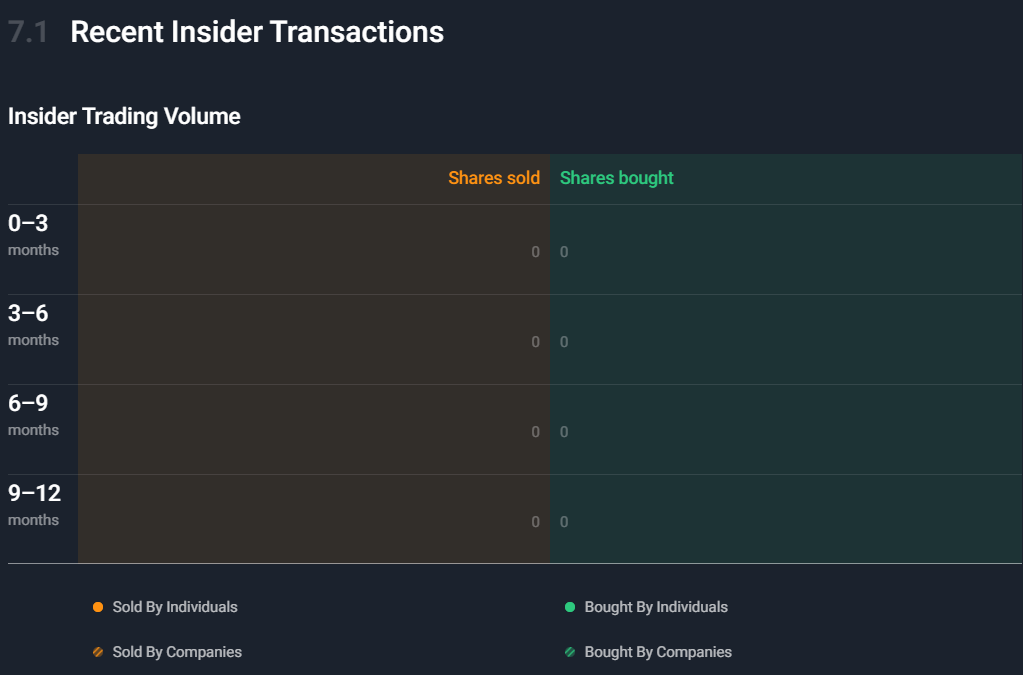

Incentive- This is important because if the current board is actively purchasing stock of their own business this is a positive indicator that shows that management believes the stock is undervalued and they believe in the long-term prospect of the company.

As you can see below we have 0 buy orders and 0 sell orders.

Bull And Bear Case:

Bull Case

Bull Case- The first bull case is a long runway for growth. Fonix Mobile’s approach to international expansion continues to be client-led through its network of tier-1 multinational clients. Following Fonix Mobile’s launch into Ireland through a referral from a UK customer, the company have since added several new customers in Ireland and is now the master aggregator for all third-party aggregators looking to provide services to Virgin Media Ireland mobile consumers. Outside of Ireland, further international growth remains a priority for the business, although it still forms a relatively small part of their short-term forecasts.

Bull Case-The second bull case is Fonix Mobile’s ability to be sector-focused. Currently, the company is focused on 4 key growth sectors as shown below:

Media- Consisting primarily of TV, radio, print and digital publishers this is Fonix Mobile’s largest market. The TV and radio engagement market is estimated to be worth £173.2 million. The growth strategy is to further increase market share in their core markets by focusing on broadcasters and media organisations currently not utilising the power of interactive services and supporting clients moving into international markets. Fonix Mobile also expects existing clients to continue to offer significant growth opportunities.

Charity- This remains a large market that is underdeveloped in terms of carrier billing. In the UK alone £10.7 billion was donated by people in the UK in 2021 of which only £35.9 million was through carrier billing. The focus will be to continue to drive Fonix Mobile’s market-leading ‘text to donate’ and ‘click to donate’ products in the UK as well as new international markets.

Gaming- The UK online gaming industry is estimated to be worth £6.4 billion of which only £61.3 million uses carrier billing, with additional opportunities for international rollout of existing clients.

Ticketing & Transport Services- This is a significant market covering the UK parking industry valued at £1.1 billion in 2022 and the UK bus & tramway industry projected to be worth £7bn in 2024, as well as new forms of e-mobility, such as e-scooter hire and e-bike hire.

Bear Case

Bear Case-The first bear case is technological change. The company operates in an industry which is subject to continuous and fast-paced technological change, with new products and services being introduced to the market frequently. If the company is unable to respond to such changes in a cost-effective manner, the company may become less marketable and less competitive or perceived to be obsolete and the company’s operating results may be adversely affected. The company’s success depends on its ability to anticipate these changes effectively and to develop its offering in line with changing customer demands and market preferences, as well as to adapt to changes in hardware, software, networking, browser and database technologies. The company may be required to invest significant time and resources to develop or establish the necessary expertise and experience to sell and deliver new solutions to its customers effectively and there can be no assurance that any new investment would ultimately prove successful.

Bear Case-The second bear care is competition. The company faces competition for its technology and products from other providers of carrier billing and alternative payment providers. The results of such increased competition may have a material adverse effect on the company’s financial results. Some of the company’s alternative payment provider competitors may have greater financial and human resources and may have more experience in the development and commercialisation of their technology and products. As a result, the company’s competitors may develop safer or more effective products, implement more effective sales and marketing programs or be able to establish superior proprietary positions. It is possible some mobile network operators (MNOs) could develop direct contractual relationships with the company’s customers and therefore obviate the need to contract with the company to provide carrier billing services.

Valuation:

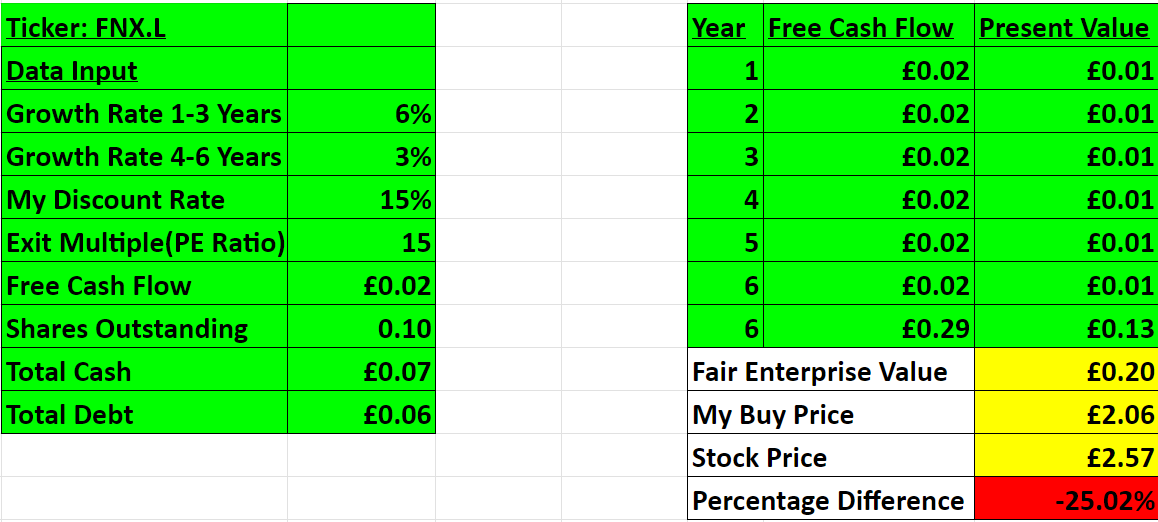

In this section, I am going to talk about valuation. Using some basic metrics I am going to compare Fonix Mobile against its industry rivals and see if the company is cheap relative to its peers then I will value Fonix Mobile using a discounted cash flow model to come up with a price I am willing to pay based on expected growth rate and my desired return of 15%. Since Fonix Mobile hasn’t got a like-for-like competitor that is publicly traded, there won’t be any industry comparison.

As you can see based on my conservative assumption, Fonix Mobile is looking to grow 9% over the long run so I went conservative and assumed a 6% growth in the first 1-3 years then the growth will slow down to 3% 4-6 years out. In my assumption, I also went with an exit multiple of 15x earnings which is below the historical average that Fonix Mobile has traded at. Based on my assumption I have come to a buy price of £2.06 compared to the current stock price of £2.57 which means right now Fonix Mobile is trading above intrinsic value.

Thanks for reading my newsletter on Fonix Mobile. Disclaimer This newsletter is not financial advice This is for educational purposes only so please DO NOT take this as a buy or sell signal.

Follow for more:

Don’t forget to subscribe, share and leave a comment below if you found this newsletter insightful as it helps support my work.

Hi, just a little confused about the valuation section - how do we go from £0.20 fair EV to £2.06 buy price firstly?

Nice write-up though.

Great write up !