Disclaimer: This newsletter is not financial advice; it is for educational purposes only. Please DO NOT take this newsletter as a buy or sell signal.

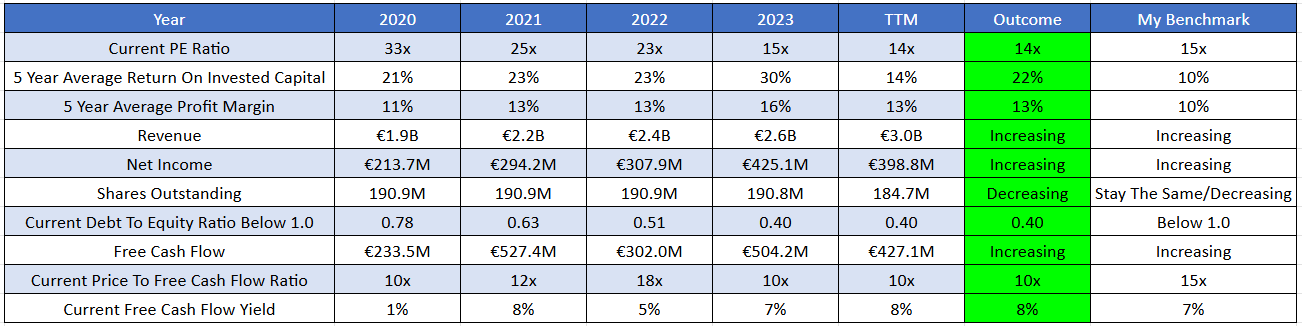

FDJ United Fundamentals:

Below is a checklist I normally use when analysing a company’s fundamental health. If the company meets my criteria, it will be colour-coded in green, and if it fails to meet my criteria, it will be colour-coded in red, which means I need to investigate further and ask myself why this is the case.

As you can see below, FDJ United meets all my criteria.

Business Overview:

Founded in 1933, FDJ United( formerly known as La Française des Jeux) is a leading gaming and betting operator based in France. FDJ United is well-known for its diverse range of lottery products, which includes both traditional draw games and instant-win games. These products are available at various sales points and through online platforms, catering to players who enjoy in-person experiences as well as those who prefer the convenience of digital gaming. In addition to lottery offerings, FDJ United also provides a variety of sports betting options at both physical locations and online platforms, allowing enthusiasts to bet on sporting events. Furthermore, FDJ United supports other sports betting operators by providing essential betting and risk management services. These services are crucial for promoting fair play and ensuring compliance with industry regulations in the gambling sector.

Business Segments:

Sports Betting- FDJ United provides a wide range of sports betting options across major sports like football, basketball, tennis, and rugby, as well as several niche sports to appeal to a diverse audience. With the rise of digital technology, FDJ United has effectively transformed itself by developing a strong online and mobile betting presence, making it easy for users to place bets from anywhere. FDJ United's sports betting platform offers a variety of betting options, such as match results, point spreads, over/under betting, and live betting, allowing fans multiple avenues to engage in real-time sports events. To attract and retain customers, FDJ United employs various promotions and bonuses, including welcome incentives and loyalty programs.

Lotteries- FDJ United is well-known for its lottery services, which include traditional lottery games such as scratch cards and large jackpot draws. This segment is a significant revenue generator for the company, which aims to unite various regional and international lottery systems to enhance the gaming experience for players and increase the overall prize pool. By pooling resources and efforts, FDJ United can offer more substantial rewards and attract a broader audience.

Online Gaming- FDJ United has positioned itself as a key player in the digital gaming landscape by embracing online platforms to reach a broader audience and adjust to changing consumer preferences. With a user-friendly interface and advanced gaming technology, players can enjoy a wide variety of games from the comfort of their homes, including traditional lottery games and numerous interactive options such as virtual scratch cards, video slots, and live dealer games. This diversification engages different types of players and enhances the overall gaming experience.

Retail Operations- FDJ United focuses on enhancing customer satisfaction by partnering with local businesses, such as newsagents, grocery stores, and specialist betting shops. This strategy not only provides more convenient access to gaming but also supports local economies and builds trust with customers. By combining retail operations with community initiatives, FDJ United promotes responsible gaming. This way, players can enjoy their gaming experiences in familiar places, benefiting from the support of local shops.

International Activities(Kindred Group)- Although its primary focus is the French market, FDJ United is also involved in international ventures, such as the recent acquisition of Kindred Group. Established in 1997, Kindred Group is a leading online gambling company headquartered in Malta that is recognised for its wide selection of gaming and betting options, including Unibet, Maria Casino, and 32Red, which are all accessible via its online platforms and mobile applications. Kindred Group emphasises responsible gambling and investing in technologies and initiatives that support safe gaming for users. With a strong commitment to innovation and improving customer satisfaction, Kindred Group leverages cutting-edge technology and data analytics to enhance its offerings and provide users with a better experience.

Management:

When evaluating management, I judge the CEO based on several factors, such as experience, capital allocation skills, and Incentives. In this section, I will discuss whether management incentives are aligned with shareholders.

Experience- Stephane Pallez is an influential leader in both the public and corporate sectors. Since November 2014, she has served as the Chairwoman, President, and CEO of FDJ United. With a strong background in finance and regulatory affairs, Stephane Pallez has made a significant impact in the industries where she has worked. Stephane Pallez began her career at the French Treasury, where she spent two decades, from 1984 to 2004, as a civil servant and representative at the World Bank. She then served as the Deputy Chief Financial Officer at France Telecom-Orange from 2004 to 2011. Afterwards, she became the Chairwoman and CEO of the Caisse Centrale de Reassurance (CCR) until 2014. At FDJ United, Stephane Pallez oversees strategic initiatives and is actively involved in international financial negotiations

Below is an image illustrating the current experience of FDJ United board members:

Capital Allocation- Capital allocation is very important when judging management because I want them to create value for shareholders, not destroy it. So far, FDJ United has done a great job with capital allocation. They are providing value back to shareholders by reinvesting in the business to further expand their presence and paying dividends.

FDJ United currently pays a dividend with a yield of 6.82%. This dividend is sustainable because it only covers 89% of the company’s free cash flow.

Incentive- This is important because if the current board is buying shares of their own business, it indicates that management believes the stock is undervalued and is confident in the company’s long-term prospects.

As you can see below, we have zero buy and sell orders.

Bull And Bear Case:

Bull Case

Bull Case- The first bull case is a long runway for growth. FDJ United has the potential for both domestic and international expansion. The increasing interest in regulated betting markets across Europe and beyond could provide FDJ United with further avenues for growth.

Bull Case- The second bull case is a strong balance sheet. FDJ United has a world-class balance sheet that it has used to leverage growth opportunities. Over the years, FDJ United had zero debt, but recently, to achieve its ambition of becoming the number one lottery and gaming operator, it has taken on debt at a favourable interest rate of 3% to supercharge that growth.

Bull Case- The third bull case is the company moat. FDJ United is France's leading gaming and lottery operator, boasting a strong brand reputation and a significant market share. This leadership position enables the company to effectively leverage its brand trust to attract and retain customers. Also, FDJ United is a state-backed firm, which means it will be difficult for new entrants to come into the space and disrupt them.. The support from the government not only provides financial stability but also grants them access to essential resources and regulatory advantages that new competitors may struggle to obtain.

Bear Case

Bear Case- The first bear case is regulation. FDJ United operates in a highly regulated industry. Any shifts in government policy or changes in gambling legislation could adversely impact their operations. Increased restrictions, higher taxes, or changes in licensing requirements could affect profitability.

Bear Case- The second bear case is economic uncertainty. Gambling revenues can be sensitive to economic downturns. During uncertain economic times, consumers may reduce discretionary spending, affecting FDJ United's revenue streams. A significant recession could hurt their profits and overall growth.

Bear Case- The third bear case is being innovative and keeping up with the competition. While FDJ United has made strides in digitalising its offerings, the rapid pace of technological change could pose challenges. If they fail to keep up with innovations or do not effectively leverage technology to enhance user experience, they risk falling behind competitors.

Valuation:

In this section, I will discuss valuation. Using some basic metrics, I will compare FDJ United to its industry rivals and determine whether the company is cheap relative to its peers. Then, I will value FDJ United using a discounted cash flow model to determine a price I am willing to pay based on its expected growth rate and my desired return of 15%.

As shown below, when compared to its peers, FDJ United scores 3/5, while International Game Technology scores 2/5. FDJ United has superior fundamentals compared to International Game Technology, and below, I am going to highlight the key differences between both companies:

Business Model - FDJ United business is focused around lottery and betting in France, with a growing emphasis on online platforms, whilst International Game Technology is more focused on providing technology solutions and gaming products globally.

Market Reach- FDJ United is more concentrated in the French market( although FDJ is expanding its online reach), while International Game Technology has a broader international presence.

Product Offering- FDJ United is focused on digital and online gaming products, relying on their established lottery brand. International Game Technology offers a diverse portfolio, including hardware (slot machines) and software solutions.

As you can see, based on my conservative assumption, FDJ United is looking to grow 8% over the long run, so I went conservative and assumed a 6% growth in the first 1-3 years, then the growth will slow down to 3% 4-6 years out. In my assumption, I also went with an exit multiple of 15x earnings, which is below the historical average at which FDJ United has traded. Based on my assumption, I have come to a buy price of €40.16 compared to the current stock price of €30.34, which means right now, FDJ United is trading below intrinsic value.

Thanks for reading my newsletter on FDJ United. Disclaimer: This newsletter is not financial advice. This is for educational purposes only, so please DO NOT take this as a buy or sell signal.

Follow for more:

Remember to subscribe, share, and comment below if you find this newsletter insightful. Your support helps me continue my work.

Great write up, I learned a lot from it.

I’m happy I own this one 💪🏻