Disclaimer: This newsletter is not financial advice this is for educational purposes only so please DON’T take this newsletter as a buy or sell signal.

Dr Martens PLC Fundamentals:

Below is a checklist I normally use in my process when I look at the fundamental health of a company. If the company meets my criteria it will be colour-coded in green and if the company fails to meet my criteria it will be colour-coded in red which means I need to investigate further and ask myself why this is the case.

As you can see below there are 2 red boxes and I am going to explain each one.

5-Year Average PE Ratio-Dr Martens currently has a 5-Year Average PE Ratio of 49x and a 5-Year Average Price To Free Cash Flow Ratio of 19x which might be an indicator that this company is currently trading at a premium to the market since the average stock market PE Ratio is 15x. One thing to remember is if a company can grow 49% from now until judgment day and it can sustain that growth then the current valuation will look cheap. This goes for the opposite side of the spectrum where if a company was trading at 15x 5-year earnings and they are only growing 3% a year that might seem expensive because the company can’t justify its valuation.

Business Overview:

Dr Martens is a German-founded British footwear and clothing brand, headquartered in Wollaston, England. Although famous for its footwear, Dr Martens also makes a range of accessories such as shoe care products, clothing, and bags. The footwear is distinguished by its air-cushioned sole, upper shape, welted construction and yellow stitching.

Dr Martens origins date back to 1945, when Dr Klaus Maertens, a 25-year-old soldier and medical doctor at the time created a unique air-cushioned sole to aid his recovery from a broken foot. Dr Maertens made a prototype shoe and showed it to a friend and engineer, Dr Herbert Funk. The two went into partnership and by 1947 they began formal production of their unique shoe. Within a decade they had a booming business. By 1952, sales had significantly grown so much that they opened a factory in Munich, Germany.

In 1959, British shoe manufacturer R. Griggs Group, owned by Bill Griggs, bought the rights to manufacture the shoes in the United Kingdom. Griggs took the sole and created a new boot, which included an altered sole shape, a bulbous but simple upper, a distinctive yellow welt stitch, a grooved sole edge and a new under sole design. The boots were branded as “Airwair” and came complete with a black and yellow heel loop featuring the brand name and the slogan “with bouncing soles”. Taking its name from the date of its inception, 1 April 1960, the iconic eight-hole 1460 Dr Martens boot was born. The following year, the 1461 shoe arrived. The 1460 and 1461 remain at the core of the original range. To this day the original range still makes up 51% of Dr Martens revenue which highlights the stickiness of their products.

Dr Martens Influence:

The 1950’s: Era Of The Mods-Back in the 1950s, the mod movement was in love with clean-cut fashion solutions like polo shirts, and Italian mohair suits. These are the people who hung out constantly in cafes and Rode Vespas covered in mirrors while listening to bands like The Who. When The Who’s lead guitarist, Pete Townshend, started to strut his stuff in a pair of Dr Martens, the shoes became a must-have for the mod generation.

The 1960s-70s: The Skinheads-By the mid-1960s, we were starting to see the introduction of “skins”, dressed in braces, checkered shirts, and cherry-red Dr Martens. Enthralled by ska music, the movement celebrated an era of multiculturalism and took inspiration from the Jamaican rude boy. Unfortunately, the look quickly became adopted by right-wing racists, but later evolved when a Two-Tone ska revival began. The Two-tone ska revival is a genre of British popular music of the late 1970s and early 1980s that fused traditional Jamaican ska music with elements of punk rock and new wave music. Its name derives from 2 Tone Records, a record label founded in 1979 by Jerry Dammers of The Specials and references a desire to transcend and defuse racial tensions in Thatcher-era Britain. Many Two-Tone groups, such as The Specials, The Selecter and The Beat featured a mix of black, white, and multiracial people. As the years went on, Dr Martens finally shed their association with violent subcultures and began to appeal to a wider audience. This meant that the brand could start to gain popularity among an entirely new generation of wearers. By 1994, over half of Dr Martens wearers were female, with the company producing shoes and boots in a range of styles and patterns.

The 1970s-80s: Goth And Punks-A movement that began with Malcolm McLaren and Vivienne Westwood, punk style was provocative, radical, and exciting. It encouraged entire generations to slash their clothes, put safety pins through their ears, and shave their hair into bizarre styles. From punk, emerged the darker alternative, “Goth”, A group that also embraced Dr Martens history, though often in darker colours.

The 1980s: Grunge-Combining metal with hardcore, the grunge movement began in Seattle during the mid-1980s. With the arrival of bands like Alice in Chains, Pearl Jam, and Nirvana, it gradually made its way over to the UK, where designers like Marc Jacobs sent models down the runway wearing flannel shirts and classic Dr Martens boots.

The 1990s-2000:BritPop-Britpop was a melting pot of 60’s music, punk and indie-pop. These influences not only came through in the music but also in the attitude and style. Bands like Blur and Oasis championed polo-shirts and fishtail jackets with a nod to the mods, Justine Fisherman of Elastica carried grunge elements to her style, whereas Pulp took their cue from the 60’s and Suede went for the goth look. Although varied in style, their choice of footwear whether it was a pair of burgundy high-tops or black work shoes, Dr Martens remained consistent throughout.

Business Segments:

Originals

Dr Martens 2976-These were the first pair of Dr Martens boots that rolled off the production line in 1960. With its trademark yellow stitch, grooved sole and heel-loop, it was a boot for workers, initially worn by postmen and policemen; comfortable, durable and lightweight in comparison to its competitors at the time. Throughout Dr Martens history, the brand has been adopted and subverted by diverse individuals, musicians, youth cultures and tribes. These are the people who stand out from the crowd and their journey of self-expression has always been accompanied by a pair of Dr Martens. The durability and comfort make this footwear the ideal choice for gigs and street fashion.

Dr Marten 1460 Laced Up Boots- The 1460 leather boot is one of the most iconic silhouettes in Dr Martens arsenal, with black leather construction, and all-black laces. The easy-wearing boot breaks in beautifully, with the leather getting softer and achieving that coveted distressed effect the more you wear it.

Dr Martens 1461- In 1960, the British brand from Northampton County in the Midlands designed the most durable and comfortable pair of footwear for British workers. Only a year later, the low-cut version of the boot rolled off the production line under the name 1461(referring to April 1, 1961). Since its inception, this timeless and rugged silhouette has evolved and adapted through a myriad of cultural movements, becoming an emblem of Dr Martens history with its trusty Airwair sole, heel loop, and trademark yellow stitching.

Fusion Including Sandals

Dr Martens Sinclair-If there’s one thing that most people can agree on with leather boots, it can sometimes be hard to put on. Lacing up boots can be an annoying task that requires extra time when you’re already running out the door, and we have all probably struggled with a pair of pull-on boots before, too. That’s what makes the Sinclair boots such a popular Dr Martens style. They have a removable zipper closure, so you can choose between lacing up or zipping up making these perhaps the most versatile option of them all. They also come in three different colourways and are available in both men’s and women's sizes.

Audrick Quad Neoteric-The new Quad Neoteric collection is built for the brave. The recognisable platform soles have been re-engineered for the next generation and the one after. Stacked on a towering two-part platform sole, the Quad Neoteric collection carves an exaggerated, unmissable side profile with a ton of attitude for everyday wearability.

Jadons-The Jadons was first released in 2013 but, this year has been given a modern makeover. The Jadons have been described as a fierce evolution of their 8-eye boot. The Jadons retain all its original details, grooved edges, yellow stitching and a heel-loop and add a chunky, empowering platform sole.

Casuals

Dr Martens Sandals-Inspired by the streets they're worn on, Dr Martens Sandel is built from a tough-yet-light mix of leather and high-grade nylon. The 8-eye combs tech takes cues from their original 1460 boot and comes with tonal hexagonal eyelets, an Airwair heel loop and an adjustable and removable strap.

Dr Martens Tarik Boots-Standing just a little bit taller with a footprint just a little bit wider, the new Tarik Boot is one of the most rugged to ever leave Dr Martens production line. Set on an extra rugged Tarian outsole, the boots are fitted with military-inspired hardware, a moulded SoftWair in-sock and their signature yellow accents and markings.

Kids

Dr Martens Junior Boots-The smaller version of Dr Martens seasonal floral print boot is here for kids. The 1460 8-eye boot gets a bold reworking with archive-inspired floral with a screen print effect. The floral mash-up boot is constructed from hydro PU-coated leather with a smooth matte finish, the boots are easy-on/easy-off ankle zip, built on the extra flexible version of their ben sole with commando tread, finished off with contrast black laces and collar binding which is then signed with an Airwair heel loop and Dr Martens iconic yellow stitch.

Accessories

Dr Martens Vegan Satchels-Dr Martens traditional 11-inch satchel boasts an oversized closure flap, classic buckle fasteners(for ease of use), and an adjustable and removable shoulder strap for versatility. The Vegan Satchels are constructed with a puritan stitch to give them the famous Dr Martens utility and durability. This version of the iconic satchel is made with synthetic material and no animal by-products.

Direct To Consumer:

Dr Martens major focus has been growing the brand through direct-to-consumer channels which enable control of brand engagement with consumers.

Driving the direct-to-consumer acceleration is their E-commerce channel which offers consumers access to an extended product range which offers a strong point of sale and enhances profit margins. Dr Martens E-commerce platform is complemented by its retail channel made up of 135 directly operated retail stores primarily located in key global cities. These stores act as profitable brand beacons which allow the company to create an exciting shopping experience and directly control the storytelling, merchandising and presentation of products.

Dr Martens is focused on delivering sustainable and profitable growth to drive long-term value for the brand and its shareholders. The business aims to deliver its growth plan by continuing to execute its tried and tested “DOCS” strategy which is explained below:

Direct To Consumer First:

What It Means-Dr Martens believes in growth through direct-to-consumer. The company can do this by opening up new stores and expanding its E-commerce capabilities. Direct To Consumer also generates a significantly better margin on their bottom line. This pillar also includes developing a profitable resale, repair and end-of-life business model.

Performance in Fiscal Year 2022

Dr Martens E-commerce revenue grew by 11%, and by 92% compared to the fiscal year 2020.

Dr Martens opened up 24 new own stores with 13 in EMEA(Europe, Middle East And Africa), 7 in the USA and 4 in APAC(Asia Pacific).

Direct To Consumer mix increased by 6pts to 49%.

In April 2022, following months of preparation work, Dr Martens launched their first trial in repair and resale, initially in the UK with a third-party partner.

Plans For Fiscal Year 2023-Dr Martens has increased their new store growth guidance from 20-25 to 25-35 with the increase driven by plans to accelerate store expansion in the USA. Dr Martens will work to launch further repair and resale trials, as they assess the optimum approach to ultimately operate this channel at scale.

Organisational And Operational Excellence:

What It Means-Dr Martens is investing and improving their organisation, operations and IT to enable growth and unlock value. This includes driving their culture with a focus on engagement, people development, building a best-in-class, scalable supply chain, and continuing to transform technology into a key business enabler.

Performance In Fiscal Year 2022

Dr Martens supply chain teams navigated unprecedented supply chain disruption due to the pandemic. With a three-month factory lockdown in South Vietnam and a near-doubling of shipping times, particularly in the USA.

Dr Martens have invested in HR organisation led by their new chief human resource officer to ensure the company could optimise their talent development across the business.

Dr Martens successfully launched Hong Kong onto their global ERP solution.

Plans For Fiscal Year 2023-Dr Martens will continue to build and expand their supply chain infrastructure with a focus on risk management through diversification of their source base and distribution network. The company will also implement a global ERP system in Japan and invest more in improving its omnichannel capabilities.

Consumer Connection:

What It Means-This is Dr Martens most important pillar. This includes their communication with consumers and their product strategy. Dr Martens aim to inspire rebellious self-expression through their brand engine. The company’s product innovation is grounded in icons and year-round relevance. Dr Martens aim to lead in sustainability through durability and innovation. Finally, the company will harness insights and a digital-first mindset to drive cut-through marketing initiatives.

Performance In Fiscal Year 2022

Dr Martens continue to drive product innovation with the launch of Quad Neoteric, Tarian and further growth in their sandals business(revenue up 23% year on year).

Significant progress in sustainability.

Continued to support grassroots talent through their ‘Tough As You’ initiative.

Ran compelling marketing campaigns showcasing their icons and product innovation such as WinterWair.

Plans For Fiscal Year 2023- Alongside their collaborations, Dr Martens will continue to invest in compelling marketing campaigns to drive brand and range awareness.

Support Brand Expansion With B2B:

What It Means-Dr Martens aims to partner with fewer and better B2B partners to reach more consumers with greater brand presence. Dr Martens will further improve their brand presence and increase their controlled spaces to enhance the consumer experience. Finally, this pillar includes its conversion market strategy, which enables the company to implement its DOCS strategy in more geographies.

Performance In Fiscal Year 2022

Dr Martens aim to elevate their wholesale presence by adding brand-enhancing accounts and continuing to exit underperforming accounts. This was particularly the case in the USA, as they were able to prioritise products within wholesale to their strongest account partners.

Successfully converted Italy and Iberia to owned and operated markets, having previously been distributor-run.

Plans For Fiscal Year 2023- Dr Martens will look to drive growth in their recently converted markets of Italy and Iberia. The way they can do this is through store expansion and investment in the brand.

Dr Martens 2022 Annual Report

Management

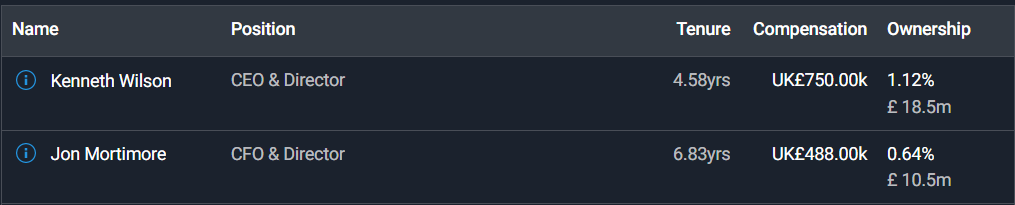

When looking at management I like to judge the CEO in several different ways such as experience, capital allocation skills and Incentives. In this section, I will cover if management incentive is aligned with shareholders.

Experience-Kenneth Wilson, also known as Kenny, is the Chief Executive Officer at Dr Martens since July 2018 and serves as its director since January 2021. Kenneth Wilson has experience in building and growing global consumer brands where he worked at Levi Strauss & Co. Whilst working at Levi Strauss & Co, Kenneth Wilson was a key player in expanding Levi's brand across the European region. Before he was president of Claire Accessories where he doubled profitability in two years and led a team that delivered impressive expansion across Europe, Kenneth Wilson moved to the Burton Group as a merchandiser for the Top Shop brand. He started his career as a Graduate Trainee in 1987 with K Shoe Shops Limited. Kenneth Wilson is a graduate of Aberdeen University where he studied and received a Master Of Arts in English.

Below is an image illustrating the current experience of the Dr Martens board members.

Capital Allocation-When it comes to judging management I think capital allocation is very important because I want management to create shareholder value and not destroy it. So far Dr Martens capital allocation has been spot on because they are giving value back to shareholders via dividends and making strategic reinvestment back into the business that will help drive future growth.

Dr Martens is currently paying a dividend with a yield of 3.49%. As shown below this dividend is sustainable because this current dividend only takes up 56% of their overall free cash flow.

Incentive-This is important because if the current board is actively purchasing stock of their own business this is a positive indicator that shows that management believes the stock is undervalued and they believe in the long-term prospect of the company.

As you can see below Lynne Weedall(Lead Director) is currently the only insider that bought Dr Martens shares.

Bull And Bear Case:

Bull Case-The first bull case is the pricing power of the company and brand loyalty. Dr Martens carried out a survey in seven of its key markets to determine how high it could take its price before consumers were put off from purchasing the brand. Kenny Wilson(CEO) found that consumers around the world said there is more value in the Dr Martens brand than what the company is currently charging.

Dr Martens Price Hike

Bull Case- The second bull case is the total addressable market. The footwear market is a large and growing market. It is comprised of several sub-categories such as sneakers, which is expected to grow by 12% CAGR by 2025, athletic footwear (forecasted to 11% CAGR by 2025), leather footwear (forecasted to grow by 7% CAGR by 2025) and textile and other footwear categories. The majority of Dr Martens products are leather, which is the second largest category of global footwear in absolute terms and is forecast to deliver good growth. Dr Martens have a very low market share, particularly in the USA and continental Europe, which presents a significant opportunity in the years ahead. Dr Martens have also seen a good performance in their casual and sandals ranges, which represent additional growth opportunities for the company, enabling it to grow its share of wallet from consumers who predominantly buy from other categories such as sneakers.

Dr Martens 2022 Annual Report

Bear Case

Bear Case- The first bear case is to do with trends. The fashion industry is very fickle because companies within this sector tend to go in and out of trend very quickly. Dr Martens must keep on innovating and offering new ranges of products as this will help keep the trend going.

Bear Case-The second bear case is to do with the current macro environment. Dr Martens saw the most challenging global supply chain backdrop they have ever experienced, with Covid-19 resulting in factory closures in the south of Vietnam (which accounts for around a third of our global production) for over three months, and a near-doubling of shipping times from APAC to the USA. Even though all their factories are open and operating at an average of 90% capacity if this issue arises again this could cause a knock-on effect on the company’s financial performance.

Bear Case-The third bear case is to do with the recent bottleneck issue. Very recently, the company identified significant operational issues at their new LA DC. This issue led to Dr Martens reducing their fiscal year 2023 EBITDA by £16-25m, and wholesale revenue by £15-25m. The company expect the issue to normalise in 2024.

Dr Martens Q3 Report

Valuation:

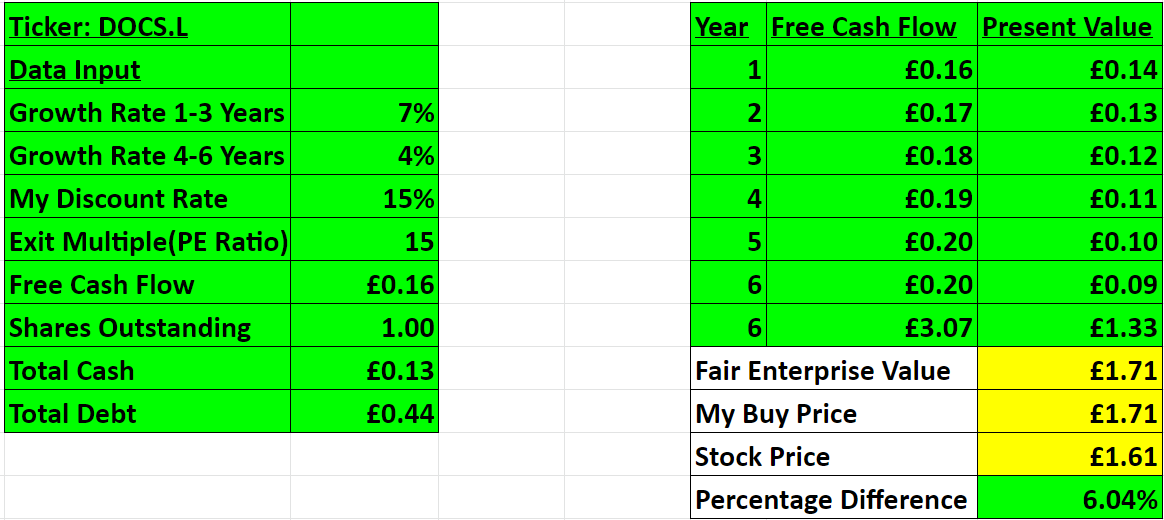

In this section, I am going to talk about valuation. Using some basic metrics I am going to compare Dr Martens against some of its industry rivals and see if the company is cheap relative to its peers then I will value Dr Martens using a discounted cash flow model to come up with a price I am willing to pay based on expected growth rate and our desired return of 15%.

As shown below when comparing Dr Martens against its peers it scores 1/5 against its competition whilst ShoeZone scores 4/5. You might be wondering why don’t I just buy ShoeZone since they look like the better company and that is because Dr Martens is a much better quality company with a much wider moat that a lot of people can relate to.

In this final part, I will be valuing Dr Martens by using a discounted cash flow model to come up with a price that I need to pay. When valuing a company I tend to be conservative so below is the valuation of Dr Martens based on a 6-year projection.

As you can see based on a conservative assumption where Dr Martens is looking to grow around 5-9%(mid to high single digit) I went conservative and assumed a 7% growth in the first 1-3 years then growth will slow down to 4% 4-6 years out. In my assumption, I also went with an exit multiple of 15x earnings. Based on my assumption I have come to a buy price of £1.71p which means right now Dr Martens has significant upside potential if you compare it against the stock price of £1.61p.

Thanks for reading my newsletter on Dr Martens. Disclaimer this newsletter is not financial advice this is for educational purposes only so please DON’T take this as a buy or sell signal.

Follow for more:

Don’t forget to subscribe, share and leave a comment below if you found this newsletter insightful as it helps support my work.

Thanks