Disclaimer: This newsletter is not financial advice this is for educational purposes only so please DON’T take this newsletter as a buy or sell signal.

Cake Box Holdings Fundamentals:

Below is a checklist I normally use in my process when I look at the fundamental health of a company. If the company meets my criteria it will be colour-coded in green and if the company fails to meet my criteria it will be colour-coded in red which means I need to investigate further and ask myself why this is the case.

As you can see below there are 2 red boxes and I am going to explain each one.

5-Year Average PE Ratio-Cake Box currently has a 5-Year Average PE Ratio of 18x and a 5-Year Average Price To Free Cash Flow Ratio of 17x which might be an indicator that this company is currently trading at a premium to the market since the average stock market PE Ratio is 15x. One thing to remember is if a company can grow 18% from now until judgment day and it can sustain that growth then the current valuation will look cheap. This goes for the opposite side of the spectrum where if a company was trading at 15x 5-year earnings and they are only growing 3% a year that might seem expensive because the company can’t justify its valuation.

Business Overview:

Founded in 2008 by Sukh Ram Chamdal and Pardip Dass, Cake Box Holdings through its subsidiaries engages in the retail of fresh cream cakes in the United Kingdom. Cake Box offers cakes by celebration, cakes by design, and seasonal cakes, as well as wedding cakes. The main mission of Cake Box is to provide the UK market with a new concept of fresh cream celebration cakes made without using eggs. By eliminating eggs, without compromising on taste and texture, Egg Free Cake Box was an instant success and a favourite amongst many who have certain religious, dietary or lifestyle choices. Many of the founder’s family members follow a strict lacto-vegetarian diet and that is how they came up with the idea for the company. Whilst Cake Box cakes are egg-free, you really can’t taste the difference, which makes them a perfect choice for any occasion meaning that it is a safe choice for a party where you are not sure if anybody has any egg allergies. As of 2023, Cake Box has over 185 franchise stores in the UK.

Business Segments:

Franchise-Cake Box has grown predominantly through franchise expansion and today does not directly own or operate any of Cake Box’s stores, although its executive directors have all previously run their own franchise stores.

Opening up a Cake Box store isn’t easy as the company is looking to recruit the right people to work with for their company. Cake Box is looking for people with the right attitude who must be prepared to follow an established business model and be flexible as changes arise. Below is the required attribute Cake Box is looking for when they are assessing if a person is right for their business or not:

You must have a genuine commitment to providing the highest quality Egg Free cakes to a diverse range of customers and communities.

You must be dedicated and motivated to provide the highest levels of customer service in a retail environment.

You must be a leader as you will have to manage your employees.

You must be a team player as franchising is all about the wider network and you will become part of a supportive ‘family’ of franchise owners.

You must be well-organised and disciplined.

You must have the ability to follow systems and set procedures.

You don’t need to have previous food or cake knowledge as full training will be provided.

If your application for a franchise is successful then Cake Box will ensure that you start your new business venture with the best possible impact on your customers as the company will provide the necessary training to help you and your staff succeed as shown below:

Before you start you will receive 3 weeks of full training on all aspects of operating your Egg Free Cake Box franchise before you open up your store. This training will be conducted at Cake Box’s head office training academy in Enfield and their centre of excellence in Milton Keynes.

On opening up your operation, you will have in attendance a training manager and regional business development manager for help and advice to ensure the smooth opening up of your business.

You will also receive regular training, guidance, and full support every step of the way to ensure your success.

You will receive the full support of the franchise team in helping you succeed in your franchise venture.

As an Egg Free Cake Box franchisee, you will have the benefit of attending their franchise forums every 2 months to be trained and updated on any new developments and products within the company.

Below is a visual representation of the application process you would have to go through before setting up their Cake Box franchise. It’s not an easy process because Cake Box is looking for quality and not quantity.

Click And Collect-Cake Box offers a service called click and collect. Click and collect offers you the ability to click and order your chosen egg-free cake online and it will be ready for you to collect in your preferred store within the hour (selected cakes only).

Personalisation-More than 90% of customers have messages added to their cakes, many deciding on the spot whilst purchasing the cake in-store. This sets Cake Box apart from traditional bakers who require several day’s notices to add a message.

Ready To Go-Over the years’ Cake Box in-store displays have increased in size with improved lighting that offers customers an improved experience and showcase for a variety of their cakes. They are far easier to manage for the stores when receiving, preparing, and storing orders, especially for click & collect orders within the hour.

Products

Below is the type of products you can expect to get from Cake Box. I have had personal experience with Cake Box where I do like their cakes as I get them all the time whether that is for birthdays or if I want to treat myself to a cake. Even though I don’t have an egg allergy or a specific dietary lifestyle that I follow I much prefer Cake Box cakes to anything else on the market. I feel these types of Cakes are much lighter and easy to eat.

Management

When looking at management I like to judge the CEO in several different ways such as experience, capital allocation skills and Incentives. In this section, I will cover if management incentive is aligned with shareholders.

Experience-Sukh Chamdal is the Co-Founder of Cake Box since 2008. Sukh Chamdal has experience in the food manufacturing and retail industry, having begun his career in the family business selling Indian sweets and savouries. Sukh Chamdal is a consultant for a food equipment company specialising in high-volume food production.

Below is an image illustrating the current experience of the Cake Box board members.

Capital Allocation-When it comes to judging management I think capital allocation is very important because I want management to create shareholder value and not destroy it. So far Cake Box’s capital allocation has been spot on because they are giving value back to shareholders via dividends and other initiatives such as opening up new stores which will drive long-term growth.

Cake Box is currently paying a dividend with a yield of 5.87%. As shown below this dividend is affordable but I question its sustainability. Currently, this dividend takes up 92% of Cake Box’s cash flow but I question this because I think having such a high payout ratio might not be sustainable in the long run. This is defiantly something to pay attention to as I won’t oppose the idea of reducing this to free up cash for other initiatives.

Incentive-This is important because if the current board is actively purchasing stock of their own business this is a positive indicator that shows that management believes the stock is undervalued and they believe in the long-term prospect of the company.

As you can see below Jaswir Singh(Board Of Directors), Sukh Chamdal(CEO) and Nilesh Sachdev(Chairman Of The Board) are the only insiders that bought Cake Box shares.

Bull And Bear Case:

Bull Case

Bull Case-The first bull case is the growth potential for this company. Currently, Cake Box has around 185 stores but most of them are in London so I believe Cake Box can expand to the North West and North East of England as well as Scotland and Wales. Currently, Cake Box has 5 branches in North East, 8 In North West, 2 In Wales and 1 in Scotland. Also, Kiosk is another growth engine as Cake Box is starting to open up small pop-up shops in malls as well as in supermarkets. They are currently on trial with Asda(one of the Uk biggest supermarkets) with their Kiosk programme. below gives you a visual representation of how much free space there is for Cake Box to grow into. I am not worried about saturation just yet.

Bull Case- The second bull cake is people will always celebrate birthdays so you do have that recurring revenue. If one person buys from Cake Box they might recommend it to a friend or family or buy a cake for their children.

Bear Case

Bear Case-The first bear case for Cake Box is their accounting issue which caused distrust between the company and current/potential shareholders. Cake Box’s CFO of 10 years resigned in response to this and in a 2022 YouTube interview, interim CFO David Forth said they were working to improve auditing. Michael Botha will be the next CFO.

Bear Case-The second bear case is to do with the current macro environment. In late 2022 Cake Box issued a profit margin warning where they said the latest inflationary environment was eating into their bottom line. Since then Cake Box has passed some of the cost increases onto franchises with a recent price increase but warned the full-year gross margin will be impacted regardless. Cake Box has also implemented supply price increases.

Valuation:

In this section, I am going to talk about valuation. I will be valuing Cake Box using a discounted cash flow model to come up with a price I am willing to pay based on a conservative growth rate and my desired return of 15%. Since Cake Box hasn’t got a like-for-like competitor that is publicly traded, there won’t be any industry comparison based on valuation.

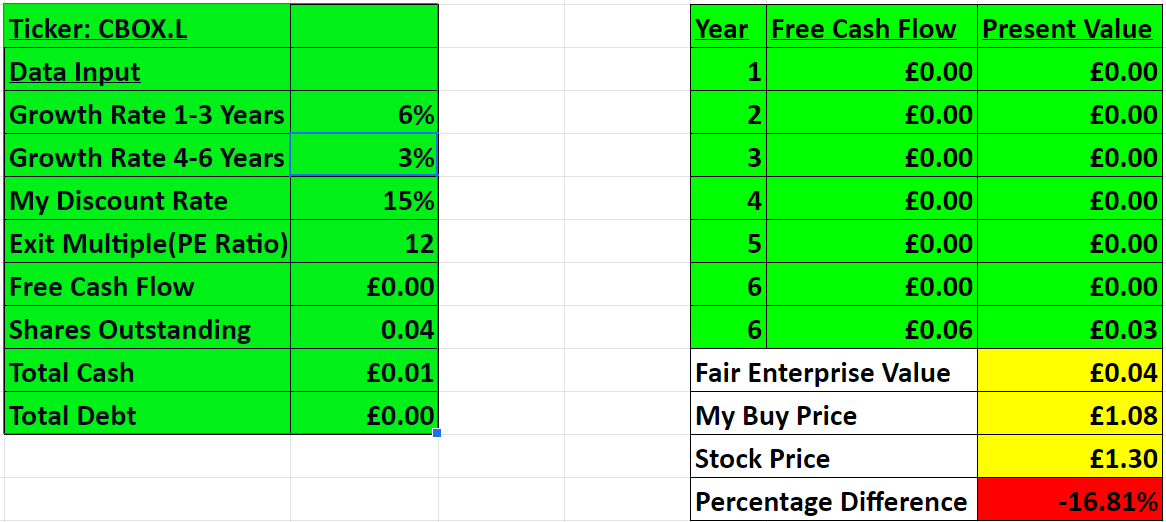

In this final part, I will be valuing Cake Box by using a discounted cash flow model to come up with a price that I am willing to pay for the company. When valuing a company I tend to be conservative so below is the valuation of Cake Box based on a 6-year projection.

As you can see based on a conservative assumption where Cake Box is looking to grow around 8% I went conservative and assumed a 6% growth in the first 1-3 years then the growth will slow down to 3% 4-6 years out. In my assumption, I also went with an exit multiple of 12x earnings which is below the historical average that Cake Box has traded at in the past. Based on my assumption I have come to a buy price of £1.08p which means right now Cake Box is trading significantly above what I am willing to pay, therefore Cake Box will go onto my watchlist.

Thanks for reading my newsletter on Cake Box. Disclaimer this newsletter is not financial advice this is for educational purposes only so please DON’T take this as a buy or sell signal.

Follow for more:

Don’t forget to subscribe, share and leave a comment below if you found this newsletter insightful as it helps support my work.

Great article Wesley. Let's hope the price hits the £1.08 mark soon!

Interesting idea, but how do you invest as a non UK investor? They seem to block you from going to their investor relations page if you are not a UK resident.