Disclaimer: This newsletter is not financial advice this is for educational purposes only so please DO NOT take this newsletter as a buy or sell signal.

Andrew Sykes Group Fundamentals:

Below is a checklist I normally use in my process when I look at the fundamental health of a company. If the company meets my criteria it will be colour-coded in green and if the company fails to meet my criteria it will be colour-coded in red which means I need to investigate further and ask myself why this is the case.

As you can see below Andrew Sykes Group Meets all my criteria.

Business Overview:

Founded in 1857, Andrews Sykes Group is a specialist hire company in the United Kingdom. The company was established as a pump specialist working on numerous schemes along the River Thames. In the late 1920s, founder Henry Sykes bought land on the Greenwich marshes to supplement premises in Bankside which became the business headquarters. Andrews Industrial Equipment was the first entity of the Sykes brand in 1964. Andrews was predominantly involved with heating equipment and steam cleaners initially but by 1970, had branched out into air conditioning units. During this period, the company quickly broadened its geographical presence by opening depots in London, Glasgow and Nottingham in addition to its original base in Wolverhampton. Andrews Sykes Hire is now active across the world, with depots in the Netherlands, France, Switzerland, Belgium, Italy, Dubai, Abu Dhabi and other Middle Eastern regions. The company currently offers heating and air conditioning equipment, boilers, chillers and other HVAC services. The equipment is regularly used across a full range of applications, ranging from construction sites and power stations to offshore oil facilities and manufacturing plants.

Business Segments:

Hire And Sales UK

Andrews Sykes Hire Limited- This is Andrew Sykes Group’s main UK trading subsidiary. Andrew Sykes Hire has 22 locations covering the UK and employs around 300 members of staff. Andrew Sykes Hire continues to develop both their product range and service offering, with further investments in hire fleet, depots, and infrastructure.

Hire And Sales Europe

Andrews Sykes BV- With over 50 years of experience in the Dutch market, Andrew Sykes BV currently has four depots strategically located throughout the Netherlands providing full coverage of the country. The company’s Dutch business also provides backup support to its operations in Belgium and Luxembourg.

Andrews Sykes BVBA- This is Andrew Sykes’s Belgian subsidiary that provides the full range of Andrews Sykes climate rental products throughout the country. Trading in both French and Flemish languages, the business has dual language branding, literature and website for the Belgian market.Andrews Sykes Sarl- Andrew Sykes’s Luxembourg subsidiary, Andrew Sykes Sarl was established in 2014. Andrew Sykes Sarl works in conjunction with their Belgian operation, with administration and technical support.

Nolo Climat SRL- Andrew Sykes’s Italian subsidiary, Nolo Climat SRL was established in 2011. The company’s main depot is strategically located close to the centre of Milan where it is well placed to cover the Lombardy region and the North of Italy with further depots located in Bologna and Verona.

Andrews Sykes Climat Location SAS- Andrew Sykes’s French subsidiary, Andrew Sykes Climat Location SAS was established in 2012. Andrew Sykes Climat Location SAS currently has three remaining depots in Paris, Marseille and Nantes. Despite Andrew Sykes Climat Location SAS producing an operating loss in 2022, management continues to focus on revenue growth opportunities to regrow the business further and improve the operating profit performance.

Climat Location SA- Andrew Sykes’s Swiss subsidiary, Climat Location SA was established in 2013. This operation was established to service the French cantons and works closely with the company’s French subsidiary.

UK Installation business

Andrews Air Conditioning And Refrigeration Limited- Andrews Air Conditioning and Refrigeration (AAC&R) is the company UK-based fixed air conditioning, service, maintenance and installation business. This subsidiary provides a specialist service to customers who need to have their air conditioning system installed.

Hire And Sales Middle East

Khansaheb Sykes LLC- Khansaheb Sykes is the company’s long-established pump hire and dewatering business, which is based in the UAE with locations in Sharjah, Dubai and Abu Dhabi. These centres also provide a base that covers other parts of The Middle East for both pump sales and hire. Khansaheb Sykes has agents based throughout The Middle East including Oman, Kuwait, Bahrain and Qatar, which allows the company to provide their products and services in these local markets.

Management:

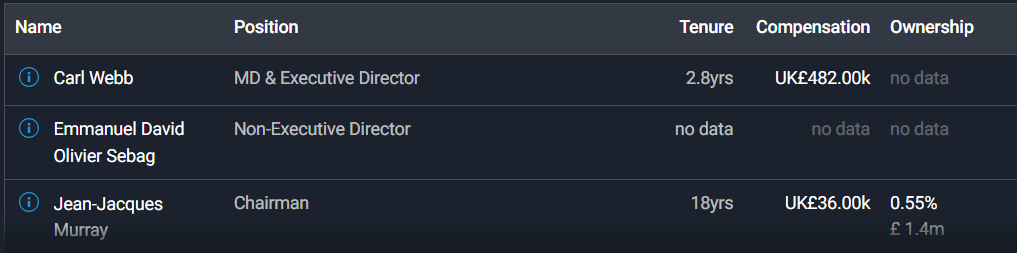

When looking at management I like to judge the CEO in several different ways such as experience, capital allocation skills and Incentives. In this section, I will cover whether management incentives are aligned with shareholders.

Experience- Carl Webb has served as Managing Director and Executive Director at Andrews Sykes Group since March 2021. Previously Carl Webb served as Interim Managing Director at Andrews Sykes Group from January 2021 until March 2021.

Below is an image illustrating the current experience of Andrew Sykes Group board members:

Capital Allocation-When it comes to judging management I think capital allocation skill is very important because I want management to create shareholder value and not destroy it. So far Andrew Sykes Group’s capital allocation has been spot on because they are giving value back to shareholders via reinvestment back into the business to further expand their presence, share buybacks and paying a dividend.

Andrew Sykes Group is currently paying a dividend with a yield of 4.14%. As shown below this dividend is sustainable because this current dividend only takes up 48% of their overall free cash flow.

Incentive- This is important because if the current board is actively purchasing stock of their own business this is a positive indicator that shows that management believes the stock is undervalued and they believe in the long-term prospect of the company.

As you can see below we have 0 buy orders and 0 sell orders.

Bull And Bear Case:

Bull Case

Bull Case- The first bull case is a long runway for growth. Management continues to focus on revenue growth opportunities to regrow the business after the setbacks from the pandemic. Management is currently investing in human resources across various subsidiaries in France and The Middle East in order to grow the business further and improve the operating profit performance.

Bull Case- The second bull case is customer demand. According to a recent survey, 6 in 10 Brits believe the extreme weather is here to stay. Brits also estimate they’ve spent upwards of £790 in the last five years on repairs to their homes as a result of weather damage and more than 1 in 10 have had to spend more than £2,000 on weather-related restorations. 1 in 5 are also planning changes to their home to combat the increasingly dangerous weather conditions.

Bear Case

Bear Case-The first bear case is competition. Competition, product innovations and industry changes are regarded as the main strategic risks. To mitigate this Andrew Sykes Group is investing in new environmentally friendly technologically advanced products and equipment, and providing service levels that are recognised as being amongst the best in the industry. Market research and customer satisfaction studies are undertaken to ensure that their products and services continue to meet the needs of their customers. Andrew Sykes Group pricing is regarded as competitive in the marketplace.

Bear Case-The second Bear care is climate risk. The potential impact of the weather has been reduced over the past few years by the expansion of the company’s non-weather-related business. The group also has a diverse product range of heaters, pumps, air conditioning and environmental control equipment, which enables Andrew Sykes Group to take maximum advantage of the opportunities presented by any extremes in weather conditions whenever they arise. This, combined with their policy of reducing fixed costs enables the group to achieve a satisfactory level of profits, even in non-extreme weather conditions.

Valuation:

In this section, I am going to talk about valuation. Using some basic metrics I am going to compare Andrew Sykes Group against its industry rivals and see if the company is cheap relative to its peers then I will value Andrew Sykes using a discounted cash flow model to come up with a price I am willing to pay based on expected growth rate and my desired return of 15%.

As shown below when comparing Andrew Sykes Group against its peer it scores 4/5 whilst Watsco scores 2/5.

As you can see based on my conservative assumption, Andrew Sykes Group is looking to grow 8% so I went conservative and assumed a 6% growth in the first 1-3 years then the growth will slow down to 3% 4-6 years out. In my assumption, I also went with an exit multiple of 12x earnings which is below the historical average that Andrew Sykes Group has traded at. Based on my assumption I have come to a buy price of £5.25 compared to the current stock price of £6.25 which means right now Andrew Sykes Group is trading ABOVE intrinsic value.

Thanks for reading my newsletter on Andrew Sykes Group. Disclaimer This newsletter is not financial advice This is for educational purposes only so please DO NOT take this as a buy or sell signal.

Follow for more:

Don’t forget to subscribe, share and leave a comment below if you found this newsletter insightful as it helps support my work.

When you present free cashflow as £0.02 and shares outstanding as 0.04 it’s very unhelpful. Based on my research they did around £25m in free cashflow in 2022 and have 42.2m shares outstanding, so by the looks of things you’re presenting the figures in billions which makes little sense considering there’s not a single figure in the financial statements of this company in the billions range.

Nice write up mate. Do you think they can expand their margins? I am asking because I am interested in how strong their pricing power is.