Disclaimer: This newsletter is not financial advice. This is for educational purposes only, so please DO NOT take this newsletter as a buy or sell signal.

Alpha Group International Fundamentals:

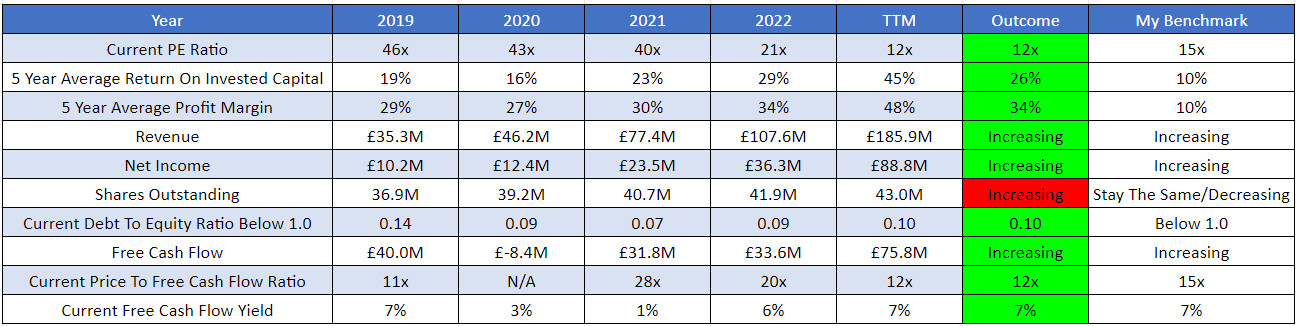

Below is a checklist I usually use when analysing a company's fundamental health. If the company meets my criteria, it will be colour-coded in green, and if it fails to meet my criteria, it will be colour-coded in red, which means I need to investigate further and ask myself why this is the case.

As you can see below, there is one red box, and I am going to explain it:

Shares Outstanding- When analysing a company, I ideally want its shares outstanding to remain the same or decrease over time. As you can see, Alpha Group International shares outstanding have increased by 16.53% in the last five years, but I am not too worried because the company does have a £20 million buyback programme that they are utilising, and the company revenue has far exceeded the number of shares they have issued.

Business Overview:

Founded in 2009 by Morgan Tillbrook, Alpha Group International(formerly Alpha FX) provides foreign exchange risk management and alternative banking solutions in the United Kingdom and Internationally. The company offers forward currency contracts, option contracts, foreign exchange spot transactions, payment collections, and currency account services to corporations and institutions.

Business Segments:

Alternative Banking Solutions- Alpha Group International's global accounts solution has been purpose-built for alternative investment managers, corporate service providers, and fund administrators who support them. These clients require local accounts in key investment jurisdictions for their investment vehicles, typically for asset sales, purchases, or distributions. Fund types normally include private equity, private debt, venture capital, real estate, infrastructure and fund of funds. As Alpha Group International’s reputation and capabilities have grown, they are seeing an increasing level of interest from service providers who wish to partner with them. These organisations are responsible for managing a number of back-office activities on behalf of funds and their underlying investment entities, including opening and managing accounts, sending payments, and executing FX. Such service providers can range significantly in size, with their existing partners estimated to manage between 2,000 and 30,000 investment entities each. These investment entities will typically require their local account, therefore representing a significant undertaking for these service providers.

The company’s Alternative Banking Solution business generates revenues through annually recurring subscription fees against each open account. Several of these accounts will often then go on to process payments and FX transactions at critical stages throughout their lifecycle, providing additional revenue opportunities. Importantly, providing clients with an account also allows the company to build enduring relationships with the investment managers. This means that even when the existing assets or funds come to the end of their lifecycles (typically 5-7 years), the company will have the opportunity to work with the investment manager on their other investments and funds.

Fund Finance- Alpha Group International’s fund finance offering is focused on providing investment managers with a more efficient and cost-effective way of obtaining borrowing facilities for their funds. Such facilities typically consist of short-term revolving credit facilities (Capital Call, NAV Facilities, GP Facilities) designed to optimise liquidity and returns throughout critical stages in the fund’s lifecycle. Preqin reports that there are around 50,000 fund managers globally, and conservatively, Alpha Group International believes that 20,000 of these have between 1 and 2 borrowing requirements per year. These clients are primarily split across North America, Europe, and Asia, with the remaining distributed worldwide.

Alpha Group International generates revenues from its fund finance offering in two main ways. For phase 1, they charge a platform screening fee; for phase 2, they charge advisory fees, which vary depending on the depth of support the client would like them to provide.

Cobase- Joining Alpha Group International in December 2023, Cobase is an innovative, cloud-based provider of bank connectivity technology that enables corporates to manage their banking relationships, accounts, and transaction activity via one single interface. The company unlocks significant operational and financial efficiencies, especially for international businesses with multiple banking relationships worldwide. With Cobase, companies can manage multiple platforms and integrations across various banks, significantly reducing the efficiency and visibility with which they can manage their payments, cash management and treasury functions. The more banks and accounts a company has, the more challenging this becomes. Companies can utilise Cobase’s solution directly through its platform or off-the-shelf ERP connections with widely used solutions providers such as Oracle, NetSuite, Microsoft Dynamics, and SAP S4/HANA. The ease and simplicity with which this connectivity can be offered is the differentiator in a marketplace where it is typically only achieved through enterprise-grade Treasury Management Systems (“TMSs”). Research on Alpha Group International’s existing client base shows that less than 10% use a traditional TMS.

Management:

When evaluating management, I judge the CEO based on several factors, such as experience, capital allocation skills, and Incentives. In this section, I will discuss whether management incentives are aligned with shareholders.

Experience- Morgan Tillbrook is the current Chief Executive Officer and Executive Director of Alpha Group International. Morgan Tillbrook founded Alpha Group International in 2009 after identifying the opportunity to provide high-quality foreign exchange advisory services. Before co-founding Alpha Group International, Morgan Tillbrook founded an online poker league and social network company, Poker Project Ltd, which later formed part of Sky Poker. He is a member of the Chartered Institute for Securities and Investment.

Below is an image illustrating the current experience of Alpha Group International board members:

Capital Allocation- When judging management, capital allocation skills are critical because I want management to create shareholder value, not destroy it. So far, Alpha Group International’s capital allocation has been spot on because they are giving value back to shareholders via reinvestment into the business to expand their product offering, pay a dividend, share buybacks and making strategic acquisitions.

Alpha Group International is currently paying a dividend with a yield of 0.65%. This dividend is sustainable because it only covers 9% of the company's free cash flow.

Incentive- This is important because if the current board is actively purchasing stock of their own business, this is a positive indicator that shows that management believes the stock is undervalued and believes in the company's long-term prospects.

As you can see below, we have one buy order and one sell order. Timothy Butters(Chief Risk Officer) is the only insider buying Alpha Group International shares. As for selling, Timothy Butters(Chief Risk Officer) is the only insider selling, but I won’t put weight into this because there are so many reasons why someone might sell their stock.

Bull And Bear Case:

Bull Case

Bull Case- The first bull case is Alpha Group International’s main market listing. Alpha Group International moved to the main market in May 2024. The company view this new listing as an opportunity to add to its solid reputation within its markets and to allow it to target clients across new geographies. From a board perspective, the company also believe the higher levels of governance and disclosure required by the listing will strengthen its relationships with new and existing stakeholders.

Bull Case- The second bull case is Alpha Group International’s proven track record. Alpha Group International has achieved profitable and organic revenue growth every year since its inception in 2009. Since taking its business public in 2017, every new significant investment they have made has proven itself, with all five of its subsidiaries being profitable and delivering substantial revenue contributions.

Bull Case- The third bull case is a well-diversified business. Alpha Group International provide solutions across various sectors and geographies, with clients in over 50 countries and 30 industries. As a result, they have grown enormously and profitably every year since inception, even in the most challenging macro-environments.

Bear Case

Bear Case- The first bear case is regulatory risk. Alpha Group International operates in an industry that is highly regulated. Failure to adhere to its regulatory and legal requirements could expose Alpha Group International to significant regulatory penalties, reputational damage, and partners terminating their contracts. Additionally, any new regulation or changes to existing laws may require the company to increase its spending on regulatory compliance or change business practices.

Bear Case- The second bear case is technological innovation. Technology underpins most businesses, and Alpha Group International is no different. The company rely on the uptime and availability of in-house and third-party systems. A failure in this technology could disrupt both their own and clients’ businesses.

Valuation:

In this section, I will discuss the company's valuation. Using some basic metrics, I will compare Alpha Group International against its industry rivals and see if the company is cheap relative to its peers. Then, I will value Alpha Group International using a discounted cash flow model to arrive at a price I am willing to pay based on the expected growth rate and my desired return of 15%.

As shown below, when compared to its peer, Alpha Group International scores 1/5, whilst Argentex scores 4/5. Even though Argentex is valued cheaper, Alpha Group International is a better-run company with a predictable stream of cash and is well diversified.

As you can see, based on my conservative assumption, Alpha Group International is looking to grow high-single digit, so I went conservative and assumed a 6% growth in the first 1-3 years, then the growth will slow down to 3% 4-6 years out. In my assumption, I also went with an exit multiple of 15x earnings, which is below the historical average at which Alpha Group International has traded. Based on my assumption, I have come to a buy price of £25.27p compared to the current stock price of £24.80p, which means right now, Alpha Group International is trading below its intrinsic value.

Thanks for reading my newsletter on Alpha Group International. Disclaimer: This newsletter is not financial advice. This is for educational purposes only, so please DO NOT take this as a buy or sell signal.

Follow for more:

Don’t forget to subscribe, share, and comment below if you find this newsletter insightful, as it helps support my work.

👏🏻👏🏻