Disclaimer: This newsletter is not financial advice this is for educational purposes only so please DO NOT take this newsletter as a buy or sell signal.

Alibaba Fundamentals:

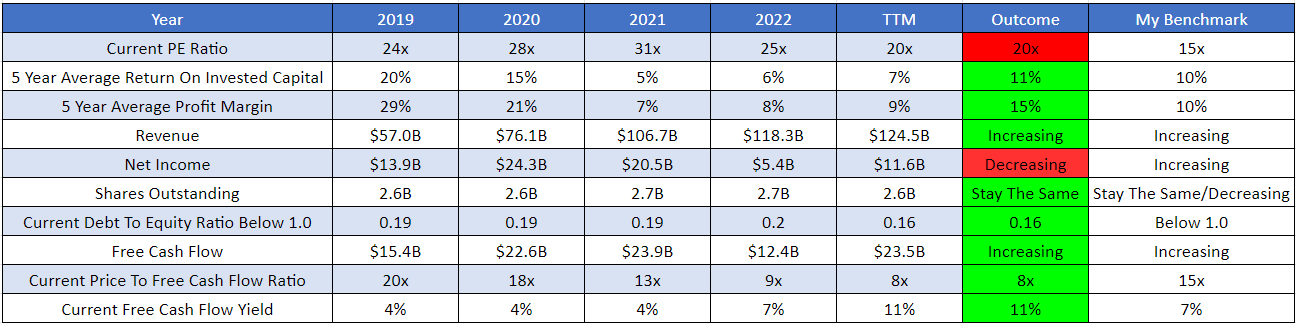

Below is a checklist I normally use in my process when I look at the fundamental health of a company. If the company meets my criteria it will be colour-coded in green and if the company fails to meet my criteria it will be colour-coded in red which means I need to investigate further and ask myself why this is the case.

As you can see below there are 2 red boxes and I am going to explain them:

Current PE Ratio- Alibaba currently has a PE Ratio of 20x which might be an indicator that this company is currently trading at a premium to the market since the average stock market PE Ratio is 15x. One thing to remember is if a company can grow 20% from now until judgment day and it can sustain that growth then the current valuation will look cheap. When it comes to Alibaba you can’t solely judge the company based on its PE Ratio because it is heavily skewed by write-off from its investment portfolio, so Alibaba trading at 20x isn’t a red flag for me. What I would look at when it comes to Alibaba is its Price To Free Cashflow Ratio which is currently 8x.

Net Income- Alibaba’s net income has decreased in the last 5 years and that could be down to several factors like strong regulatory pressure from the Chinese government, write-off on their investment portfolio and an increase in competition from the likes of JD and Pinduoduo. Even though their net income is down Alibaba is making strong strides to increase their profits by being more efficient with their operation.

Business Overview:

Founded in 1999 by Jack Ma and 17 friends and students, Alibaba is a Chinese technology company that specialises in e-commerce, retail, internet and technology. Alibaba provides consumer-to-consumer (C2C), business-to-consumer (B2C), and business-to-business (B2B) sales services via Chinese and global marketplaces, as well as local consumer, digital media and entertainment, logistics and cloud computing services. The name “Alibaba” is unique because the company got its name from the character “Ali Baba” which is a Middle Eastern folk tale. When Jack Ma was in a coffee shop in San Francisco he thought the name Alibaba was good because it was a name that everyone could relate to no matter where you are from. To put this to the test Jack Ma went onto the street and found 30 people and asked them, 'Do you know Alibaba'? People from India, Germany, Tokyo and China all knew about the meaning of Alibaba. Alibaba is a name that is so easy to spell and a name that everyone knows about which is perfect if you are trying to build a brand.

On 5 September 2014, whilst working with the US Securities and Exchange Commission (SEC) Alibaba set a $60-$66 per-share price range for its scheduled initial public offering(IPO). The final price would be determined by an international roadshow which will allow Alibaba to attract interest in the company shares. On the 18th of September 2014, Alibaba's IPO was priced at $68 whilst raising $21.8 billion for the company and investors and making it the biggest US IPO in history. On 19 September 2014, Alibaba's shares began trading on the NYSE at an opening price of $92.70. In May 2019 Alibaba was considering raising a further $20 billion through a second listing in Hong Kong. In November 2019, Alibaba raised $12.9 billion in its secondary listing in Hong Kong, which became the world's largest offering that year.

In December 2020, the shares of Alibaba Group suffered a historic stock price crash to the lowest close in 6 months, following the antitrust investigation into the company by Chinese regulators. In December 2020, China's State Administration For Market Regulation (SAMR) stated that it opened an investigation into Alibaba over monopolistic practices. The country's central bank, as well as three other regulators, confirmed in a separate statement that the affiliated Ant Group would also be summoned for discussions over "competition and consumer rights", where regulators instructed the company to return its focus to digital payments. People's Daily, the official newspaper of The Central Committee Of The Chinese Communist Party, endorsed the investigation shortly after the announcement, claiming the investigation to be “an important step in strengthening antimonopoly oversight in the internet sphere". As a result, of the antitrust probe, Alibaba lost nearly all of its stock-market gains in 2020, from $859 billion to $586 billion.

Business Segments:

In March 2023, Alibaba announced it would reorganise into six business groups and other investments and follow a holding company model similar to Google. The different business groups will have their own CEO and board of directors and have the freedom to seek their own fundraising and market listings. The six business groups are Cloud Intelligence Group, Taobao & Tmall Group, Local Services Group, Cainiao Smart Logistics Network Group, Alibaba International Digital Commerce Group and Digital Media and Entertainment Group.

Cloud Intelligence Group- Alibaba launched Alibaba Cloud in 2009 with the aim of building a cloud computing service platform which includes e-commerce data mining, e-commerce data processing, and data customisation. Alibaba Cloud is the largest high-end cloud computing company in China with R&D centres and operators in Hangzhou, Beijing, Hong Kong, Singapore, Silicon Valley and Dubai. In 2009, Alibaba acquired HiChina, the largest domain registration service and web hosting service company in China, and built it into Alibaba Cloud. In 2011, Alibaba Cloud released AliOS (formerly Yun OS and Aliyun OS), a Linux distribution designed for mobile devices. At the Computing Conference in Hangzhou, Alibaba launched AliGenie, a China-based open-platform intelligent personal assistant. It is currently used in the Tmall Genie smart speaker.

Even though cloud computing is the future of Alibaba the company is also focusing on artificial intelligence. In 2019, Alibaba unveiled a 64-bit RISC-V processor called the XuanTie-910 (Black Iron 910). It is a 12nm 16-core with a clock rate of 2.5 GHz and was designed by Alibaba's subsidiary T-Head (also known as Pingtouge). Alibaba claims the Xuantie-910 is faster than the ARM Cortex-A73 and is capable of 7.1 Coremark/MHz. Alibaba also announced an AI accelerator called the Hanguang 800. The Hanguang 800 contains 17 billion transistors built with a 12nm processor and was designed by T-Head and DAMO Academy (Alibaba's research team). Alibaba claims it is capable of 78,563 images per second (IPS) inference and 500 IPS/W in ResNet-50. The Hanguang 800 will be available to be rented on Alibaba Cloud. In April 2023, Alibaba revealed its plans to release Tongyi Qianwen a ChatGPT-like chatbot. Its name means "seeking an answer by asking a thousand questions". This AI product can support both English and Chinese languages and will be incorporated into the company's various business operations. It will initially be integrated into the messaging app DingTalk and the voice-activated smart speaker Tmall Genie. According to Alibaba drafting emails creating business proposals, and converting meeting dialogues into written notes are among Tongyi Qianwen's capabilities. Media reported that the company has received more than 200,000 requests from businesses to join its beta testing program from industries as varied as fintech, electronics, transport, fashion and dairy farming. Alibaba is also integrating Tongyi Qianwen into a digital assistant called Tingwu. Tongyi Tingwu, the AI-powered assistant, can analyse multimedia content and generate a text summary from video and audio files.

Taobao/Tmall Commerce Group- In 2003, Alibaba launched Taobao Marketplace. Taobao grew to become China's largest C2C online shopping platform and later became the second most visited website in China, according to Alexa Internet. Taobao's growth was attributed to offering free registration and commission-free transactions using a free third-party payment platform. Advertising made up 75% of the company's total revenue allowing it to break even in 2009. In 2010, Taobao's profit was estimated to be $235.7 million, which was only about 0.4% of their total sales figure of $62.9 billion that year, way below the industry average of 2%, according to iResearch estimates. According to Zhang Yu, the director of Taobao, between 2011 and 2013, the number of stores on Taobao with annual sales under ¥100,000 increased by 60%; the number of stores with sales between ¥10,000 and ¥1,000,000 increased by 30%, and the number of stores with sales over ¥1,000,000 increased by 33%.

In April 2008, Taobao introduced a spin-off, Taobao Mall(T-Mall), an online retail platform to complement the Taobao C2C portal, offering global brands to an increasingly affluent Chinese consumer base. It became the eighth most visited website in China as of 2013. In 2012, Tmall.com later changed its Chinese name to Tianmao reflecting Tmall's Chinese pronunciation. In March 2010, Taobao launched the group shopping website Juhuasuan which offers "flash sales", which are products that are available at a discount for only a fixed amount of time. In October 2010, Taobao beta-launched eTao, a comparison shopping website that offers search results from mostly Chinese online shopping platforms including product searches, sales and coupon searches. According to the Alibaba Group website, eTao offers products from Amazon China, Dangdang, Gome, Yihaodian, Nike China, Vancl, Taobao and Tmall. As part of a restructuring of Taobao by Alibaba, these spin-offs became separate companies in 2011, with Tmall and eTao becoming separate businesses in June and Juhuasuan becoming a separate business later in October. In 2016, Alibaba's Taobao and Tmall, two of the world's largest and most popular online retail marketplaces, achieved a total transaction volume of 3 trillion yuan.

Launched in 2016, Freshippo is a retail chain for groceries and fresh goods. It exemplifies the creation of a new shopping experience through the convergence of online and offline activities by using retail stores to warehouse and fulfil online orders, in addition to offering a rich and fun experience to customers who shop in-store. Freshippo’s proprietary fulfilment system enables 30-minute delivery to customers living within a three-kilometre radius of a Freshippo store. As of 2022, Freshippo has 273 self-operated Freshippo stores, primarily located in tier-one and tier-two cities in China.

Local Services Group- Founded in 2008 by Mark Zhang and Jack Kang, Ele.Me is the second-largest online food delivery service platform in China with a 53.4% market share. Ele.Me is an online-to-offline (O2O) catering and food delivery platform in China. Ele.Me has covered more than 2,000 cities in China, with more than 1.3 million joining shops, 15 thousand staff and more than nine million daily orders. Also, over three million riders have registered for Fengniao Delivery (the sub-service of Ele.Me). In 2018, Alibaba entered talks to acquire Ele.Me for $9.5 billion.

Cainiao Smart Logistics- In 2013, Alibaba and six large Chinese logistics companies (including SF Express) established a company called Cainiao for the delivery of packages in China. This network gradually grew to 14 local logistics companies in 2014. Alibaba has also announced that it will invest 100 billion yuan over five years to build a global logistics network, underpinning an aggressive overseas expansion, and demonstrating Alibaba's commitment to building the most efficient logistics network in China and around the world. Alibaba said it is investing a further 5.3 billion yuan in Cainiao Logistics to boost its stake to 51% from 47%. The investment would value Cainiao, a joint venture of top Chinese logistics firms, at around $20 billion.

Global Digital Commerce Group- In 2010, Alibaba launched AliExpress.com, an online retail service made up of mostly small Chinese businesses offering products to international online buyers. AliExpress also allows small businesses in China to sell to customers all over the world, resulting in a wide variety of products. It might be more accurate to compare AliExpress to eBay, though, as sellers are independent(it simply serves as a host for other businesses to sell to consumers). Similar to eBay, sellers on AliExpress can be either companies or individuals. It connects Chinese businesses directly with buyers.

In April 2016, Alibaba announced that it intended to acquire a controlling interest in Lazada by paying $500 million for new shares and buying $500M worth of shares from existing investors. Lazada Group is a Singaporean e-commerce company founded by Rocket Internet in 2011. Lazada operates sites in Indonesia, Malaysia, The Philippines, Singapore, Thailand, and Vietnam. Its sites launched in March 2012, with a business model of selling inventory to customers from its warehouses. In 2013 it added a marketplace model that allowed third-party retailers to sell their products through Lazada's site. Lazada features a wide product offering in categories ranging from consumer electronics to household goods, toys, fashion and sports equipment. In March 2018, Alibaba announced its plan to invest an additional $2 billion in the company, totalling a $4 billion investment. Alibaba also plans to appoint Alibaba co-founder Lucy Peng as Lazada's new CEO.

Trendyol is an e-commerce platform based in Turkey. Founded in 2010 by Demet Mutlu, Trendyol is a private company that specialises in the fashion and retail sector. There are 12 different main headings for products in Trendyol. These are Women's Fashion, Men's Fashion, Shoes and Bags, Accessories and Watches, Children's Products, Supermarkets, Cosmetics, Electronics, Home, Books and Hobby and Life, Sports and Outdoor, and Electronics. In August 2021, Trendyol entered into agreements to raise $1.5 billion from a number of high-profile investors, valuing the company at $16.5 billion. With this new funding, Trendyol becomes Turkey’s first decacorn (the term given for start-up companies which have a valuation of over $10 billion). The round was co-led by General Atlantic, SoftBank Vision Fund 2, Princeville Capital and sovereign wealth funds, ADQ (UAE) and Qatar Investment Authority. In 2018 Alibaba became the largest shareholder of the company with an 86.5% stake.

Digital Media and Entertainment Group- Alibaba created a new live entertainment business unit under its Digital Media and Entertainment Group which focuses on ticketing, content creation and live experiences, bringing its entertainment ticketing platform Damai and its content creation and technology units MaiLive and Maizuo under one roof. It aims to provide a platform for live events (e.g. concerts, plays, esports and sports events), as well as supporting content partners and leveraging Alibaba's data capability for offline shows. It also provides the online digital distribution service 9Apps, which hosts downloadable content and applications. In March 2014, Alibaba agreed to acquire a controlling stake in ChinaVision Media Group for $804 million. The two firms announced they would establish a strategic committee for potential future opportunities in online entertainment and other media areas. The company was renamed Alibaba Pictures Group.

In March 2015, Alibaba Group launched AliMusic as its music division. Xiami Music and Tiantian Music are two music streaming apps owned by AliMusic. AliMusic named Gao Xiaosong as the chairman and Song Ke as the chief executive officer in July 2015. In 2017, Tencent Music expected a $10bn IPO by signing a rights deal with Alibaba, strengthening its position within the important Chinese market. Under the terms of the deal, Alibaba will gain the right to stream music from international labels such as Sony Music, Universal Music Group and YG Entertainment, which already have exclusive deals with Tencent, in return for offering its catalogue from Rock Records and HIM International Music. In April 2014, Alibaba and Yunfeng Capital, a private equity company controlled by Alibaba's founder, Jack Ma, agreed to acquire a combined 18.5% stake in Youku Tudou, which broadcasts a series of popular television programs and other videos over the Internet.

FinTech And Online Payment Platforms

In 2004, Alibaba launched Alipay, a third-party online payment platform. Alipay provides an escrow service, in which buyers can verify whether they are happy with the goods they have bought before releasing money to the seller. Alipay has the biggest market share in China with 300 million users and control of just under half of China's online payment market. The leading factor for Alipay’s success is the company's quick and reliable payment system, where it offers several types of payment systems such as credit card, debit card, Alipay, Quick-pay, and online banking. These payment systems help to cope with simultaneous cash flow transactions with ease and convenience. In November 2020 The Ant Group IPO was scrapped after regulators flagged concerns with the company. One key event that led up to the IPO being scrapped was during a public event attended by Chinese regulators, Jack Ma said the financial and regulatory system stifled innovation and must be reformed to fuel growth. He also compared the Basel Committee of global banking regulators to “an old man’s club.” As a result of Jack Ma’s public criticism of the financial system, The Ant Group IPO was scrapped and Jack Ma vanished from public view.

Management

When looking at management I like to judge the CEO in several different ways such as experience, capital allocation skills and Incentives. In this section, I will cover whether management incentives are aligned with shareholders.

Experience- Currently serving as the chairman of Taobao and Tmall Group, Eddie Wu will take over the CEO role from Daniel Zhang on September 10th. In his new role, he will continue to lead both of those platforms. Taobao is a leading Chinese online shopping platform, while Tmall is a spin-off of Taobao, and focuses on business-to-consumer online retail. Though not widely known outside of Alibaba Group or China, Eddie Wu is one of the 19 original co-founders of Alibaba and was the company’s first programmer in 1999. He was also credited internally with spearheading the company’s transition to the mobile era with the launch of Taobao’s mobile app as well as leading technology during the setup of the company. Eddie Wu first met Jack Ma in 1996, when they both worked at China Yellow Pages. The following year, he followed Jack Ma to Beijing to build Alibaba. Eddie Wu is also credited with introducing Jack Ma to another Alibaba co-founder, Shi Yufeng, a techie then working at the Central Weather Bureau. Eddie Wu has also held various executive tech roles during his nearly 25-year career at Alibaba, including CTO roles both at Taobao and at Alipay, he also served as director of the subsidiary Alibaba Health Information Technology and founded Vision Plus Capital, a VC firm that focuses on investing in advanced technologies and digital healthcare. Eddie Wu holds a computer science degree from the Zhejiang University Of Technology.

Below is an image illustrating the current experience of Alibaba’s board members:

Capital Allocation-When it comes to judging management I think capital allocation skill is very important because I want management to create shareholder value and not destroy it. So far Alibaba’s capital allocation has been spot on because they are giving value back to shareholders via reinvestment back into the business and buyback shares. Alibaba currently has a $25 billion share repurchase programme.

Alibaba DOES NOT pay a dividend. All their cash flow is being used as reinvestment back into the business for future growth and share repurchase.

Incentive- This is important because if the current board is actively purchasing stock of their own business this is a positive indicator that shows that management believes the stock is undervalued and they believe in the long-term prospect of the company.

As you can see below we have 0 buy orders and 0 sell orders.

Bull And Bear Case:

Bull Case

Bull Case- The first bull case is the end of the Tech crackdown. Since the government's regulatory crackdown on the sector began more than two years ago China's major tech companies have shed more than $1 trillion in value which is the equivalent of the entire Dutch economy. The government looks like they have changed their stance towards Chinese Tech after they have realised they might have taken things too far. The government is now calling for China’s tech companies to help support the economy after the Chinese economy took a hit due to their strict lockdown measures. The government has also been more lenient with their fines towards their tech giants after fining Tencent and its subsidiary Tenpay $410 million and Alibaba and Ant Group $1 billion.

Bull Case-The second bull case is Alibaba’s restructuring into 6 units. Alibaba spinning off its units was designed to unlock shareholder value where the market can finally value each segment by its true worth instead of penalising the whole company. Spinning Off their units can also mean they can evade regulators.

Bear Case

Bear Case-The first bear case is delisting. When it comes to Chinese stocks delisting is always a fear because investors aren’t sure if Chinese companies will comply with US regulators. In July 2022, the SEC added Alibaba to a list of companies facing delisting from U.S. stock exchanges if its auditors remain unable to examine Alibaba's books before 2024. The transparency between China and US regulators seems to have improved as Alibaba vows to comply with US regulators to protect shareholder value.

Bear Case-The second Bear care is competition. The Chinese E-commerce industry is getting very competitive with the likes of Pinduoduo, JD and Alibaba competing for market share. Alibaba dominates in terms of market share, although the Group's share of the market has gradually declined from almost 75% of the market to just over 60% during the 2017-2020 period. At the same time, Pinduoduo had a small but growing market share that increased from 3% of the market to 15%. In contrast to its peers, JD maintained a consistent and moderate 24% market share throughout recent years. Even though China’s 3 main players in the E-commerce space seem to be fighting over market share the pie will get bigger over time with the Chinese E-commerce market looking to be worth $3.3 Trillion by 2025.

Valuation:

In this section, I am going to talk about valuation. Using some basic metrics I am going to compare Alibaba against its industry rivals and see if the company is cheap relative to its peers then I will value Alibaba using a discounted cash flow model to come up with a price I am willing to pay based on expected growth rate and my desired return of 15%.

As shown below when comparing Alibaba against its peers it scores 1/5 whilst JD scores 3/5. If you ask me to pick between Alibaba and JD I probably can’t do that since they are very different in terms of business model. Alibaba focuses on medium to high premium products(3P Platform) whilst JD focuses mainly on premium products(mostly 1P platform).

As you can see based on my conservative assumption, Alibaba is looking to grow 8% so I went conservative and assumed a 6% growth in the first 1-3 years then the growth will slow down to 3% 4-6 years out. In my assumption, I also went with an exit multiple of 15x earnings which is below the historical average that Alibaba has traded at. Based on my assumption I have come to a buy price of $126.99 compared to the current stock price of $86.53 which means right now Alibaba is trading below intrinsic value.

Thanks for reading my newsletter on Alibaba. Disclaimer This newsletter is not financial advice This is for educational purposes only so please DO NOT take this as a buy or sell signal.

Follow for more:

Don’t forget to subscribe, share and leave a comment below if you found this newsletter insightful as it helps support my work.

Well-written analysis! It's hard not to be a contrarian at these valuation levels with so much fear spreading around China.

I've featured a link to this post in my latest Friday Roundup, where I share interesting articles and insights from the week.

https://open.substack.com/pub/rhinoinsight/p/the-friday-roundup-cd2?r=2587ts&utm_campaign=post&utm_medium=web

Why you want alibaba? There are many companies that trade under intrensic value wiithout the heavy risks?