Disclaimer: This newsletter is not financial advice this is for educational purposes only so please DON’T take this newsletter as a buy or sell signal.

Airtel Africa PLC Fundamentals:

Below is a checklist I normally use in my process when looking at the fundamental health of a company. If the company meets my criteria it will be colour-coded in green and if the company fails to meet my criteria it will be colour-coded in red which means I need to investigate further and ask myself why this is the case.

As you can see below there are 2 red boxes and I am going to explain each one.

5-Year Average Return On Invested Capital- Return on invested capital indicates how well management is doing in terms of allocating cash for future growth. When analysing a company I ideally want their return on invested capital(ROIC) to be over 10% but as you can see Airtel Africa’s return on invested capital currently stands at 8% on a 5-year average which isn’t a dealbreaker because you have to remember this is a telecommunication company, rarely do you see companies in this industry have a high return on invested capital.

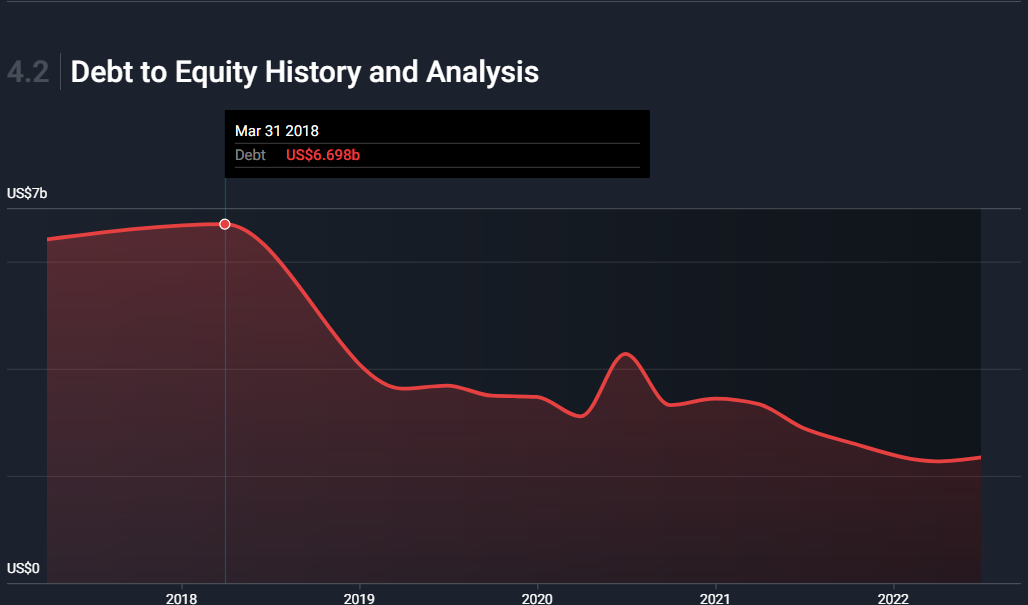

Debt To Equity Ratio Below 1.0-When looking at a company, I ideally want them to have low debt because when a company has low debt, it would be very hard for them to go bankrupt. As you can see Airtel Africa’s debt-to-equity ratio currently sits at 1.13 which is slightly above the 1.0 threshold. I am not worried about this because if you look at Airtel Africa’s history they have significantly reduced their debt load and they are still doing it according to their recent earning report.

Below is a graph illustrating how Airtel Africa has significantly reduced its debt over time from $6.6 billion down to $2.3 billion.

Business Overview:

Founded in 2010, Airtel Africa is a telecommunication and mobile money service that has operations in 14 countries primarily in East, Central and West Africa. Airtel Africa is majority owned by Bharti Airtel. For those who aren’t familiar with Airtel Africa’s parent company Bharti Airtel, they are an Indian telecommunication company based in New Delhi, India. Bharti Airtel currently operates in 18 countries across South Asia, Africa and the Channel Islands. Currently, Bharti Airtel provides 4G and 4G+ services all over India and 5G services in selected cities. Bharti Airtel currently offers services such as fixed-line broadband, and voice services depending upon the country of operation. Bharti Airtel is the second-largest mobile network operator in India and the second-largest mobile network operator in the world behind China Mobile.

Even though Airtel Africa has a presence in several African countries they had to exit certain markets for instance in 2017 Airtel Africa began operating in Ghana after acquiring Zain Africa. In the same year, Airtel Africa and Millicom International Cellular agreed to merge their operations in Ghana(Airtel Ghana and Tigo Ghana) to create the country's second-largest mobile operator, with the two companies holding an equal stake in the merged entity. In 2020, Airtel Africa announced that it planned to exit its business in Ghana and that it had entered into "advanced stages of discussions" for the sale of shares in Airtel Tigo to the Government of Ghana. Airtel Tigo was sold in October 2020 to the Ghanaian government for $25 million.

Another instance where they had to exit a particular market was in 2020 when Airtel Africa began operating in Burkina Faso and Sierra Leone after acquiring Zain Africa. Airtel Africa and French telecom company Orange signed an agreement in 2015 for the sale of the former operations in Burkina Faso, Sierra Leone, Chad and Congo-Brazzaville. In January 2016, Airtel Africa announced that it had entered an agreement to sell its operations in Burkina Faso and Sierra Leone to Orange. The value of the deal was not disclosed, but analysts estimated the deal to be between $800–900 million.

Business Segments:

With over 128 million subscribers, Airtel Africa currently offers mobile voice and data services as well as mobile money services both nationally and internationally.

Below is a list of countries Airtel Africa is currently operating in:

Airtel Chad- In Chad, Airtel Africa is the #1 operator with a 43% market share.

Airtel DRC(The Democratic Republic Of Congo)-In The Democratic Republic Of Congo, Airtel Africa has over 1 million customers.

Airtel Gabon- In Gabon, Airtel Africa has over 829,000 customers and its market share currently stands at 61%.

Airtel Kenya-In Kenya, Airtel Africa is the second largest operator with over 9 million customers.

Airtel Madagascar-In Madagascar, Airtel Africa holds second place in the mobile telecom market with a 39% market share and over 1.4 million customers.

Airtel Malawi-In Malawi, Airtel Africa is the market leader with a market share of 72%.

Airtel Niger-In Niger, Airtel Africa is the market leader with a 68% market share.

Airtel Nigeria- In Nigeria, Airtel Africa is the 3rd largest operator with 33 million subscribers behind Globacom(37 million) and MTN Nigeria (61 million). Airtel Nigeria is the most profitable unit of Airtel, due to its cheap data plans.

Airtel ROC(Republic Of Congo)-In The Republic Of Congo, Airtel Africa is the market leader with a 55% market share.

Airtel Rwanda-In Rwanda, Airtel Africa launched its services in 2012.

Airtel Seychelles-In Seychelles, Airtel Africa has over 55% market share of the mobile market share.

Airtel Tanzania-In Tanzania, Airtel Africa is the market leader with a 30% market share.

Airtel Uganda-In Uganda, Airtel Africa is the number 2 operator with a market share of 38%.

Airtel Zambia-In Zambia, Airtel Africa has a 40.5% market share.

Airtel Africa currently offers 6 types of services which include Voice, Data, Mobile Money, Airtel TV, Airtel Business and One Network. Below I am going to talk about each one:

Voice

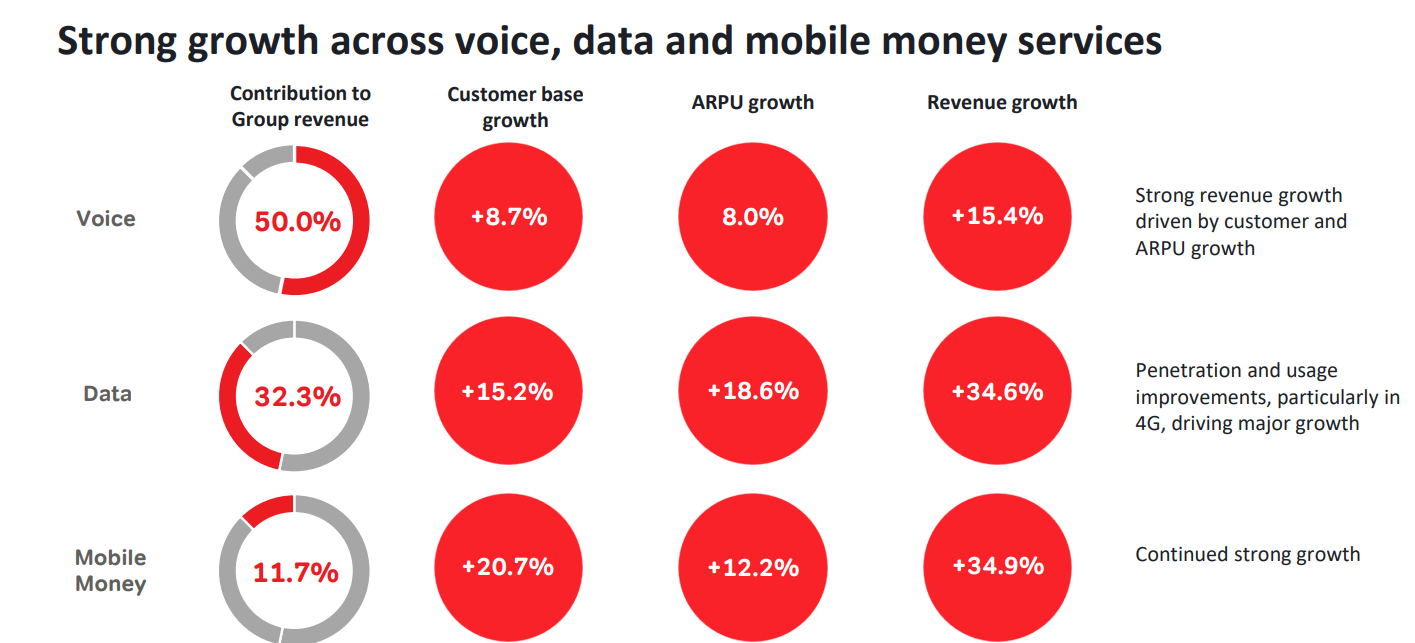

With over 128 million customers, Voice makes up 50% of Airtel Africa’s total revenue. Voice has shown to play an important role in how people communicate with one another where within the last 2/3 years a global pandemic disrupted many lives and businesses which meant the only way consumers and businesses could stay connected is via voice communication. Airtel Africa is currently expanding its voice network in both rural and semi-urban areas and offers pre-and post-paid wireless voice services, international roaming and fixed-line telephone services.

Data

With over 46 million customers, data plans make up 32.3% of Airtel Africa’s total revenue. Airtel Africa currently offers mobile data services which consist of 2G, 3G and 4G data services. Airtel Africa provides the latest technology and faster speed on data networks coupled with affordable products/bundles to meet the mobile data service requirements of customers as well as home broadband solutions. Along with basic data services, Airtel Africa also offers world class digital experience through Airtel Africa digital services, such as Airtel TV which offers live TV, music, sports, movies and so much more.

Mobile Money

With over 26 million customers, mobile money makes up 11.7% of Airtel Africa’s total revenue. Airtel Africa offers mobile money services to all its customers across different markets through its Airtel Money brand, where regulation permits. Mobile money is the chosen method to make payments across the continent. Airtel Africa’s mobile money services include payment systems, microloans, savings and international money transfers. In line with Airtel Africa’s vision of enhancing financial inclusion, Airtel Africa has developed a network of Airtel money agents and has set up thousands of dedicated Airtel money branches and small kiosks, enabling customers to load money onto their phones and withdraw cash. Whilst using Airtel Money customers have the flexibility to pay their bills anytime, anywhere, and use Airtel Money over the counter or online. Airtel Money can also be used to pay for goods, services, utility bills, money transfers to other individuals, or conversion into cash. Through a strategic partnership, Airtel Africa is currently in partnership with several financial firms such as MasterCard, MoneyGram, Western Union etc to further digitalise Africa.

below is an image illustrating Airtel Africa’s 3 main business segments based on the current growth.

Source: Airtel Africa 2022 Investors Presentation

Airtel TV

Airtel Africa provides a world of premium entertainment to their customers across their markets and offers unlimited access to the best Video-On-Demand and Live TV from Africa and around the world. Airtel TV is now live in eleven countries, with more than 4.5 million registered users across Nigeria, Zambia, Uganda, Kenya, Tanzania, The Democratic Republic Of Congo, Niger, Madagascar, Congo Brazzaville, Gabon and Chad. Airtel Africa customers can watch and stream thousands of popular movies, TV series, documentaries, sports events, and children’s programmes from around the world.

Below is an image illustrating what type of channels Airtel TV customers have access to.

Source: Airtel Africa Services

Airtel Business

Airtel Africa is committed to being a valuable digital partner to local businesses. At Airtel Africa they will help you with:

A comprehensive suite of business ICT and digital solutions for any stage of enterprise growth.

Expert solutions to help your business grow.

Mobilise your workforce with unrivalled 4G mobile coverage and reliability.

Accelerate your digital transformation with cloud and data centres.

Mobile Money payment solutions which bring small and medium-sized businesses onto the e-commerce highway.

One Network

One Network is a mobile phone network that allows Airtel Africa customers to use the service in several countries at the same price as their home network. Customers can place outgoing calls at the same rate as their local network, and incoming calls are free. As of 2021, the service is available in Bangladesh, Burkina Faso, Chad, Democratic Republic of Congo, Congo Brazzaville, Gabon, India, Kenya, Madagascar, Niger, Nigeria, Rwanda, Seychelles, Sierra Leone, Sri Lanka, Tanzania, Uganda, and Zambia.

Below is a map illustrating where the one network service is available.

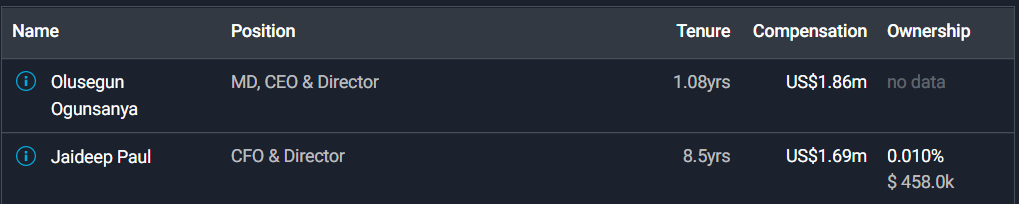

Management

When looking at management I like to judge the CEO in several different ways such as experience, capital allocation skills and Incentives. In this section, I will cover if management incentive is aligned with shareholders.

Experience-Olusegun Ogunsanya also known as Segun has served as the chief executive officer, managing director & director of Airtel Africa since 2021. Olusegun Ogunsanya has occupied several different roles throughout his career for example in 1994 he was the managing director and head of retail banking operations at Ecobank Transnational and head of treasury for Coca-Cola in Nigeria. Olusegun Ogunsanya has experience across multiple geographies, organisations and diverse sectors including fast-moving consumer goods and banking. During his leadership of the bottling operations in Ghana, the business doubled its size in five years and tripled its operating profit, increasing both market share and weighted distribution. Olusegun Ogunsanya served as managing director of retail banking operations and head of retail banking operations at Ecobank Transnational INC from 2008 to 2009, covering 28 countries in Africa. Two years later, in January 2010, he returned to the Coca-Cola business as the chief executive officer of Coca-Cola in Kenya. Olusegun Ogunsanya is a 1987 graduate of electrical & electronics engineering from the University Of Ife in Nigeria. He is a Chartered Accountant from the Institute of Chartered Accountants of Nigeria.

Below is an image illustrating the current experience of the Airtel Africa board members.

Capital Allocation-When it comes to judging management I think capital allocation is very important because we want management to create shareholder value and not destroy it. So far Airtel Africa’s capital allocation has been spot on because they are giving value back to shareholders via dividends and making strategic partnerships with companies like Mastercard, and American Towers to further grow the business.

Airtel is currently paying a dividend with a yield of 3.62%. As shown below this dividend is sustainable because this current dividend only takes up 13% of their overall free cash flow.

Incentive-This is important because if the current board is actively purchasing stock of their own business this is a positive indicator that shows that management believes the stock is undervalued and they believe in the long-term prospect of the company.

As you can see below insiders are buying Airtel Africa shares with John Danilovich an active member of the board making up the bulk of the purchase.

Bull And Bear Case:

In this section, I am going to highlight the bull and bear case for this investment.

Bull Case

Bull Case- The population in Africa is young and expanding rapidly, the middle class is growing, and people need to connect with each other, yet the global infrastructure is limited, and there is huge scope to increase the reach and penetration of effective, affordable telecom services, and to include more people in the digital economy.

Bull Case- Digitalisation will be at the heart of Africa’s future growth as many governments have recognised. Secure, reliable, competitively-priced data is essential to a wide range of service providers, and businesses both large and small. Mobile technology enables digital solutions and supports the growing use of online channels by consumers. Whilst growing fast, smartphone adoption in Africa remains relatively low. The availability of 4G is also expanding but is not yet available everywhere. GSMA projects that 4G coverage will reach 64% of the population in sub-Saharan Africa by 2025, and that customer usage of 4G will more than double from 12% in 2020 to 28% by 2025, still some way short of the global average of 57%. Digitalisation is therefore a clear opportunity for Airtel Africa to fulfil their purpose of transforming lives as well as growing its business.

Bear Case

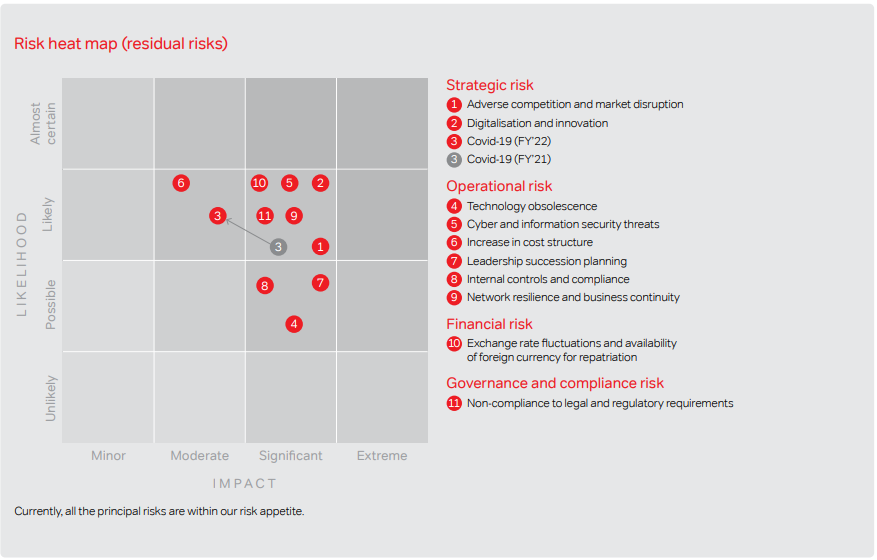

Bear Case- Airtel Africa operates in an increasingly competitive environment across many different markets. Aggressive competition by existing players or the entry of a new player could put downward pressure on prices, adversely affecting their revenue and margins, as well as their profitability and long-term survival. The nature and level of the competition Airtel Africa faces vary for each of its markets, products and services.

Bear Case- Cybersecurity threats through internal or external sabotage or system vulnerabilities could potentially result in customer data breaches and/or service downtimes. Like any other business, Airtel Africa is increasingly exposed to the risk that third parties or malicious insiders may attempt to use cyber-crime techniques, including distributed denial of service attacks, to disrupt the availability, confidentiality and integrity of Airtel Africa IT systems. This could disrupt Airtel Africa’s key operations, making it difficult to recover critical services and damage their assets.

Below is a risk diagram that potential investors should be aware of.

Source: Airtel Africa 2022 Annual Report

Valuation:

In this section, I am going to talk about valuation. Using some basic metrics I am going to compare Airtel Africa against some of its industry rivals and see if the company is cheap relative to its peers then I will value Airtel Africa using a discounted cash flow model to come up with a price I am willing to pay based on expected growth rate and my desired return of 15%.

As shown below when comparing Airtel Africa against its peers it scores 1/6 against its competition whilst Vodafone and Orange score 2/6. You might be wondering why don’t we just buy Vodafone and Orange since they look like the better company if you go by the metrics. Despite being the smallest company when compared to its peers, Airtel Africa has a long runway for growth and they have a near monopoly in each of its target markets as illustrated in an earlier segment of this newsletter.

In this final part, I will be valuing Airtel Africa by using a discounted cash flow model to come up with a price that I need to pay. When valuing a company I tend to be conservative so below is the valuation of Airtel Africa based on a 6-year projection.

As you can see based on a conservative assumption where Airtel Africa is looking to grow around 9% I went conservative and assumed a 6% growth in the first 1-3 years then the growth will slow down to 3% 4-6 years out. In my assumption, I also went with an exit multiple of 8x earnings which is slightly below the 9x earning multiple Airtel Africa has always traded at on average. Based on my assumption I have come to a buy price of £1.58p which means right now Airtel Africa has significant upside potential if you compare it against the stock price of £1.20p.

Thanks for reading my newsletter on Airtel Africa. Disclaimer this newsletter is not financial advice this is for educational purposes only so please DON’T take this as a buy or sell signal.

Follow for more:

Don’t forget to subscribe, share and leave a comment below if you found this newsletter insightful as it helps support my work.

Are you worried about there being a controlling shareholder which owns 57% of the company, thereby reducing minority shareholder protections and the ability for minority shareholders to influence company decision-making?

Have you updated your investment thesis at this price after 2 years or do you think airtel it is still a buy?