Disclaimer: This newsletter is not financial advice it is for educational purposes only. Please DO NOT take this newsletter as a buy or sell signal.

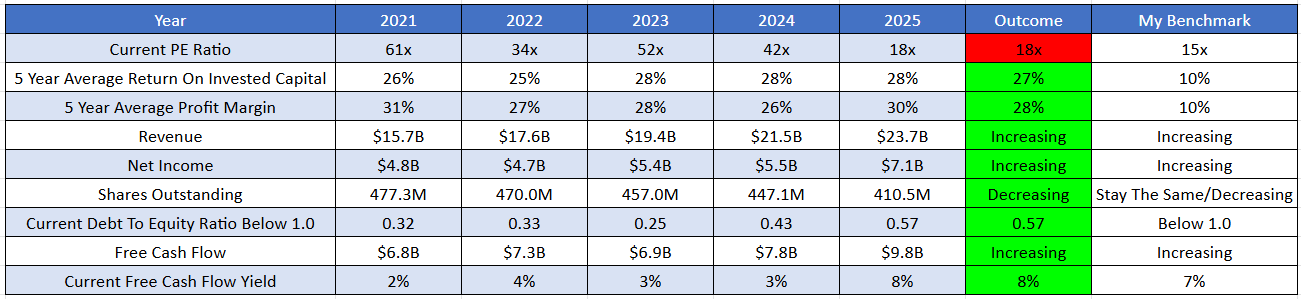

Adobe Fundamentals:

Below is a checklist I normally use when analysing a company’s fundamental health. If the company meets my criteria it will be colour-coded in green and if it fails to meet my criteria it will be colour-coded in red which means I need to investigate further and ask myself why this is the case.

As you can see below there is 1 red box and I am going to explain it:

Current PE Ratio- Adobe currently has a PE ratio of 18x which might indicate that this company is trading at a premium to the market since the average stock market PE ratio is 15x. One thing to remember is if a company can grow 18% from now until judgment day and can sustain that growth then the current valuation will look cheap. This goes for the opposite side of the spectrum where if a company was trading at 15x earnings and only grew by 3% a year that might seem expensive because the company can’t justify its valuation.

Business Overview:

Founded in 1982 by John Warnock and Charles Geschke, Adobe is an American computer software company based in California. Adobe provides a diverse range of software programs including tools for web design, photo editing, vector creation, video and audio editing, mobile app development, print layout, and animation. The company first gained significant success with PostScript a page description language that allows computers to communicate effectively with printers. This innovation led to a strategic partnership with Apple and eventually to the 1993 launch of the Portable Document Format (PDF) which transformed the way the world shares digital documents.

Over the years Adobe has strengthened its market position through key acquisitions including the 1988 acquisition of the rights to Photoshop and the 2005 acquisition of Macromedia which added popular tools such as Flash and Dreamweaver to its offerings. In 2013 the company made a significant transition from selling perpetual software licenses to a subscription-based model known as Adobe Creative Cloud. This provides users with regular updates and cloud-based collaboration capabilities.

Business Segments:

Digital Media - The segment is divided into two major cloud and is the primary driver of Adobe’s financial success. Adobe Digital Media focuses on helping individuals and professionals to create, publish, and promote high-quality digital content.

The first is Creative Cloud. This is the industry standard for design, photography, video editing, and 3D rendering featuring applications such as Photoshop, Illustrator, and Premiere Pro.

The second part of this segment is the Document Cloud which revolves around the PDF ecosystem that includes Adobe Acrobat and Acrobat Sign. This segment has become a massive growth engine because Adobe is turning basic digital paper into an intelligent workspace. By integrating an AI Assistant directly into Acrobat users no longer have to read through hundreds of pages to find specific information. Instead users can simply ask the software questions and the AI provides instant answers with citations. Beyond just answering questions this ecosystem now handles the routine tasks of a modern office. The AI can automatically draft emails, create study guides, or generate social media posts based on the content of a PDF. This makes the software much more valuable than a simple viewing tool. Additionally Acrobat Sign has become essential for businesses because it enables secure and legally valid digital signatures that are integrated directly into these smart workflows. By making PDFs interactive and chat-able Adobe has ensured that the Document Cloud remains a necessary subscription for anyone who works with digital files.

Digital Experience - This segment shifts the focus from the creation of content to the management and optimisation of the customer journey. This is an enterprise-level platform designed for Chief Marketing Officers and data scientists who need to orchestrate personalised experiences across various digital touchpoints including websites, mobile apps, and social media. The core of this segment is the Adobe Experience Cloud which offers a suite of tools for real-time data analytics, content management, and e-commerce. Recently Adobe implemented a Real-Time Customer Data Platform (CDP) that aggregates data from multiple sources to create unified customer profiles. This enables brands to deliver hyper-personalised marketing at scale.

Publishing and Advertising - This segment focuses on specialised or legacy software needs. It includes advanced technical publishing tools such as Adobe FrameMaker which is used to create complex manuals for the aerospace and medical industries. While the segment previously included a standalone Advertising Cloud for buying and managing digital ads across television and social media Adobe has shifted much of that focus to its Experience Cloud leaving this division to handle more specialised publishing and advertising services. Additionally this area covers eLearning solutions and high-end web conferencing tools such as Adobe Connect. While it may not have the broad reach of creative tools it provides critical infrastructure for professional domains that require precision and regulated documentation.

Adobe Firefly - Adobe Firefly is the company’s newest and most transformative innovation that serves as the generative AI engine for the entire company. Although it is integrated with other tools it can be viewed as a pillar in its own right that now powers a unified AI-first platform. Firefly enables users to generate images, videos, and vector graphics from simple text prompts which significantly accelerates the production process. Rather than serving solely as a tool for manual editing Firefly enables users to co-create with an intelligent partner that enables the mass production of content that would previously have required hours or days of manual effort.

Management:

When evaluating management I judge the CEO based on several factors such as experience, capital-allocation skills, and Incentives. In this section I will discuss whether management incentives are aligned with shareholders.

Experience - Shantanu Narayen is the Chairman and Chief Executive Officer of Adobe a role he has held since 2007. Since joining Adobe in 1998 as Vice President and General Manager of the engineering technology group Shantanu Narayen has held several leadership positions including Executive Vice President of Worldwide Product Marketing and Development and Chief Operating Officer. His career prior to Adobe includes co-founding the photo-sharing startup Pictra Inc and serving in senior management roles at Apple and Silicon Graphics. Beyond his leadership at Adobe Shantanu Narayen is the Lead Independent Director at Pfizer Inc and serves as a Senior Advisor to KKR & Co. Inc. His influence extends into the public and academic sectors as a past member of the U.S. President’s Management Advisory Board and a member of the Advisory Board of the Haas School of Business at UC Berkeley. Shantanu Narayen holds a B.S. in Electronics Engineering from Osmania University, an M.S. in Computer Science from Bowling Green State University, and an M.B.A. from the Haas School of Business.

Below is an image illustrating the current experience of Adobe board members:

Capital Allocation- Capital allocation is very important when judging management because I want them to create value for shareholders not destroy it. So far management has done a great job with capital allocation because they are providing value back to shareholders by reinvesting in the business to further expand their technological presence and doing aggressive buybacks.

Adobe DOES NOT pay a dividend. All their cash flow is being reinvested in the business for future growth and to fund buybacks.

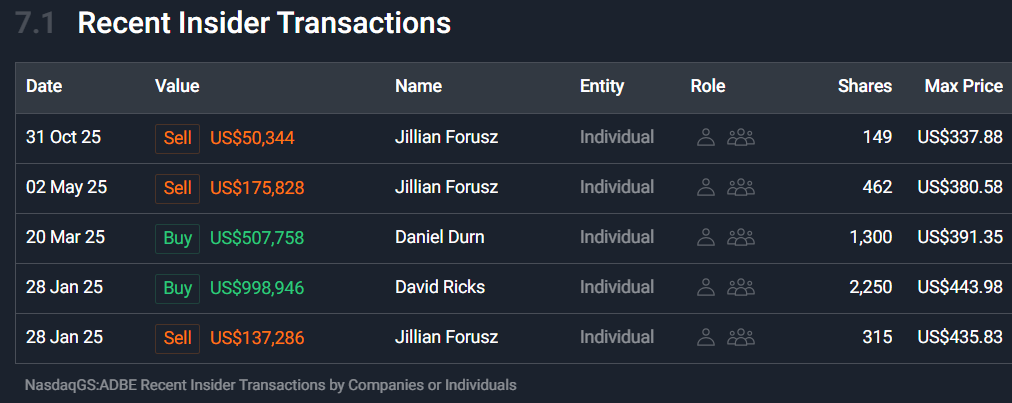

Incentive- This is important because if the current board is buying shares of their own business it indicates that management believes the stock is undervalued and is confident in the company’s long-term prospects.

As shown below we have two buy orders and three sell orders. Daniel Durn (Chief Financial Officer) and David Ricks (Independent Director) are the only insiders buying Adobe shares. As for selling Jillian Forusz(Senior Vice President) is the only insider selling Adobe shares but I am not going to put too much weight into this because there are many reasons why someone might sell their stock.

Bull And Bear Case:

Bull Case

Bull Case - The first bull case is Innovation. Adobe is aggressively moving into agentic AI in which tools do more than just generate images they perform multi-step tasks. Features like the Acrobat AI Assistant and new conversational interfaces in Photoshop and Express are driving higher Average Revenue Per User (ARPU). By shifting from a seat-based model to a usage-based model powered by Generative Credits, Adobe is finding a way to grow revenue even if total user growth stabilises.

Bull Case - The second bull case is Adobe's Aggressive Share Buyback Program. Adobe has utilised its strong cash flow to aggressively repurchase shares. In late 2025 the company confirmed its commitment to returning capital to shareholders by reducing its total share count by more than 10% over the last three years. This reduces the dilutive effect of employee stock options and increases Earnings Per Share (EPS) for remaining investors.

Bull Case - The third bull case is Commercial Safety and Legal Indemnity. Adobe Firefly remains the only major generative AI model trained on licensed and public-domain content rather than scraped internet data. For enterprise clients this provides a copyright-safe guarantee. Adobe even offers legal indemnification for its corporate users making it the non-negotiable choice for legal and procurement departments in the Fortune 500.

Bull Case - The fourth bull case is High Switching Costs and Ecosystem. Adobe’s Creative Cloud isn’t just a set of apps it’s a deeply integrated pipeline. A professional editor using Premiere Pro doesn’t just use the software they use the cloud assets, the collaboration tools, and the shared libraries. This ecosystem makes it highly difficult for users to switch to a standalone AI tool such as Sora or Midjourney for professional production.

Bull Case - The fifth bull case is Adobe Financial Health. Adobe remains a cash cow with over $10 billion in annual operating cash flow and a record $9.85 billion in free cash flow supported by a near-zero net debt-to-EBITDA ratio. This financial strength enables them to outspend smaller AI startups on R&D and to acquire emerging competitors that pose a legitimate threat to their dominance.

Bear Case

Bear Case - The first bear case is the Disruption of the Seat-Based Model. Adobe’s historical success is built on selling high-priced seats to professionals. AI is significantly increasing worker productivity meaning that a task that once required five designers can now be completed by one or two.

Bear Case - The second bear case is the Democratisation of Design. AI has lowered the barrier to entry for high-quality creative work. Tools from Canva and AI-native startups enable non-professionals to achieve good enough results without needing to learn complex software such as Photoshop or Illustrator. This threatens Adobe’s top-of-funnel user acquisition as casual creators no longer feel the need to graduate to Adobe’s professional suite.

Bear Case- The third bear case is Margin Compression from AI Compute Costs. Operating large-scale generative AI models such as Firefly and the upcoming video models is significantly more expensive than operating traditional software. To remain competitive with OpenAI or Midjourney Adobe must invest billions in GPU infrastructure and R&D. Analysts expect this to weigh on operating margins which are projected to dip to around 45% in 2026.

Bear Case - The fourth bear case is Competitive Pricing Pressure. To fend off rivals such as Figma (which remains a significant threat after the blocked merger) and Canva, Adobe has had to keep prices for its Express and Freemium tiers low. This race to the bottom in pricing for mid-level tools prevents Adobe from fully monetising its massive user base of 70+ million Express users.

Bear Case - The fifth bear case is Regulatory Risk. Adobe is currently facing intense scrutiny from the FTC regarding its subscription cancellation practices and disclosures of dark patterns. Beyond legal fees a forced overhaul of its high-margin subscription model or a ban on certain pricing practices could lead to a sudden spike in churn (users leaving the platform).

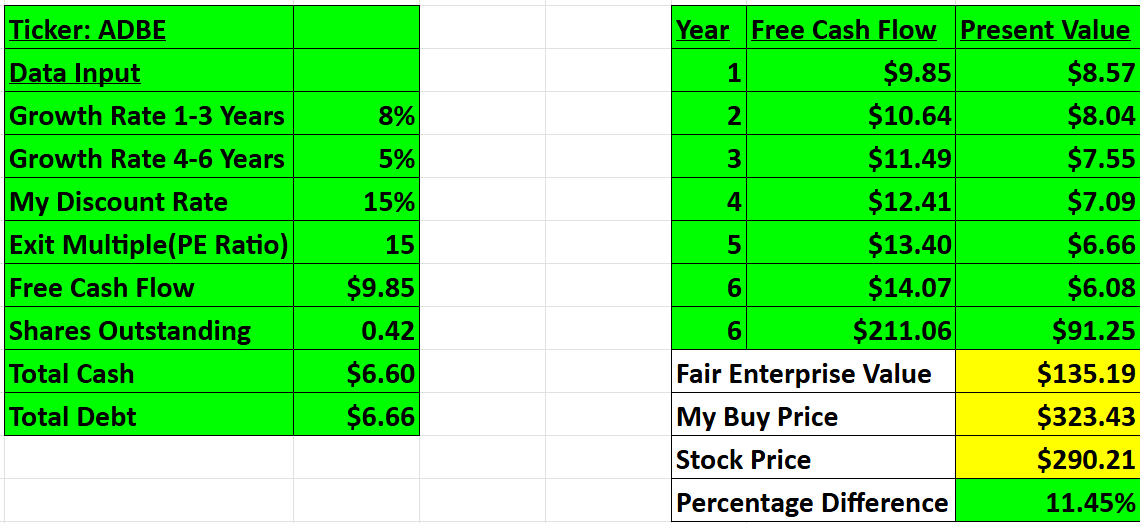

Valuation:

In this section I will discuss valuation. Using basic metrics I will compare Adobe with its industry rivals and determine whether the company is undervalued relative to its peers. Then I will value Adobe using a discounted cash flow model to determine a price I am willing to pay based on its expected growth rate and my desired return of 15%.

As shown below when compared with its peer Adobe scores 3/5 whereas Figma scores 2/5. Adobe has superior fundamentals compared to Figma and below I am going to highlight the key differences between the two companies:

Business Model - Adobe operates as a multi-product ecosystem centred on its Creative Cloud subscription. The company’s strategy is based on deep horizontal integration that enables a single subscription to provide industry-standard tools for photography, video production, vector graphics, and 3D design.

Figma utilises a web-first/seat-based model that prioritises accessibility and collaboration. By offering a free tier and charging per editor Figma encourages adoption across entire organisations. This will bring non-designers such as product managers and engineers into the design environment thereby increasing billable seats.

Market Reach - Adobe has significant global presence as a long-established leader in professional creative services across nearly every visual discipline including Hollywood film editors and freelance photographers. Its influence is strengthened by strong relationships with enterprise IT departments and a diverse educational presence that helps train the next generation of professionals to use its tools.

Figma has secured a leading position in the technology and software industry. It has become the go-to standard for modern product teams and startups by serving as the browser-based hub for digital product development. In this environment live collaboration is more important than specialised high-fidelity editing.

Product Offering - Adobe offers a powerful suite of specialised tools such as Photoshop and Illustrator (assisted by Firefly). These tools are designed to generate and refine high-quality assets including realistic textures, complex vector graphics, and commercial-grade imagery. Adobe has largely stepped back from the UI/UX design space which is dominated by Figma and instead positions itself as an asset factory that provides content for those layouts.

Figma provides a unified platform where design, prototyping, and developer handoff occur in a single live environment. Its 2026 product suite includes advanced features like Dev Mode and AI-powered Check Designs linters that ensure consistency between design and code. While Adobe focuses on creating visually stunning images Figma emphasises the design and maintenance of functional digital products. It prioritises responsive layouts, design tokens, and real-time multiplayer workflows that bridge the gap between mockups and shipping applications.

As you can see based on my conservative assumption Adobe is looking to grow 8%-10% over the long run so I went conservative and assumed a 8% growth in the first 1-3 years then the growth will slow down to 5% 4-6 years out. In my assumption I also went with an exit multiple of 15x earnings which is below the historical average at which Adobe has traded. Based on my assumption I have come to a buy price of $323.43 compared to the current stock price of $290.21 which means right now Adobe is trading below its intrinsic value.

Thanks for reading my newsletter on Adobe.

Disclaimer: This newsletter is not financial advice. This is for educational purposes only so please DO NOT take this as a buy or sell signal.

Follow for more:

Remember to subscribe, share, and comment below if you find this newsletter insightful. Your support helps me continue my work.

prolly works but never hitting buy on this one