Disclaimer: This newsletter is not financial advice; it is for educational purposes only. Please DO NOT take this newsletter as a buy or sell signal.

4imprint Group Fundamentals:

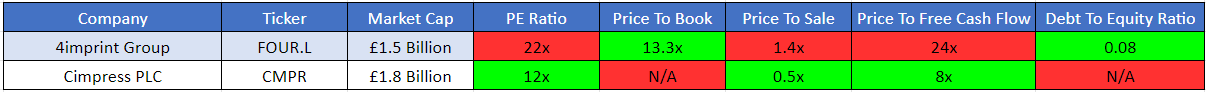

Below is a checklist I normally use when analysing a company’s fundamental health. If the company meets my criteria, it will be colour-coded in green, and if it fails to meet my criteria, it will be colour-coded in red, which means I need to investigate further and ask myself why this is the case.

As you can see below, there are three red boxes, and I am going to explain each one:

Current PE Ratio- 4imprint Group currently has a PE ratio of 22x and a Price To Free Cash Flow Ratio of 24x, which might indicate that this company is trading at a premium to the market since the average stock market PE ratio is 15x. One thing to remember is if a company can grow over 22% from now until judgment day and they can sustain that growth; then the current valuation will look cheap. This goes for the opposite side of the spectrum, where if a company was trading at 15x earnings and only grew by 3% a year, that might seem expensive because the company can’t justify its valuation.

5-Year Average Profit Margin- When analysing a company, I look for a 5-year average profit margin of over 10%. Currently, 4imprint Group's profit margin sits at 5% on average; however, in the last four years, their profit margin has increased significantly due to better cost management and product mix that is higher in the margin.

Business Overview:

Founded in 1985 by Dick Nelson, 4imprint Group has established itself as a leading direct marketer of promotional products across North America, as well as the United Kingdom and Ireland. With an extensive product range, the company specialises in marketing a variety of items, including apparel, bags, drinkware, stationery, writing instruments, outdoor and leisure goods, trade show and signage materials, automotive accessories, home improvement tools, technology products, wellness and safety items, awards, and office supplies. These products are offered under well-known brands such as Crossland, Refresh, and Taskright, which are recognised for their quality and innovation in the promotional products industry. 4imprint Group was formerly known as The Bemrose Corporation Public Limited Company. It was a name held until August 2000, when it rebranded to reflect its growing focus and commitment to the promotional products market. Today, 4imprint Group continues to enhance its reputation by providing its clients with exceptional services and high-quality products, helping businesses effectively promote their brands in a competitive marketplace.

Business Segments:

Apparel- This category includes a variety of clothing items such as T-shirts, hoodies, polo shirts, and caps. Each item can be personalised with a company logo, making them perfect for promotional campaigns, events, or team uniforms. Designed for both comfort and style, the apparel appeals to a wide range of customers.

Bags- 4imprint Group provides a diverse selection of bags, including tote bags, rucksacks, and eco-friendly options. These bags are perfect for daily use and events, offering an excellent way for businesses to promote their brand while delivering utility to customers.

Drinkware- This category includes drink bottles, travel mugs, and cups. Many of these products are crafted from premium materials and can be customised with a logo or message. They are perfect for individuals on the move and are frequently used in offices, gyms, or events.

Stationery- This category includes notebooks, planners, and writing tools. Stationery products are ideal for office environments and serve as great promotional gifts. They ensure brands remain visible in daily activities, whether in meetings or at home.

Writing- 4imprint Group provides a variety of writing tools, including pens, pencils, and highlighters. These products are ideal for both personal and professional settings, and their customisation options present a fantastic branding opportunity for events and meetings.

Outdoors & Leisure- This category features products designed for outdoor activities, such as picnic sets, bug spray, and outdoor games. These items are perfect for events, festivals, and corporate retreats, allowing companies to boost their brand while providing enjoyment and practicality.

Trade Show & Signage- 4imprint Group provides a range of products for trade shows, such as banners, display stands, and tablecloths. These essentials play a crucial role in creating a lasting impact at events, enabling businesses to draw in customers and effectively highlight their brands.

Auto, Home & Tools- This includes practical items such as toolkits, car accessories, and home improvement supplies. These products are useful for everyday situations and can be branded, making them perfect gifts that enhance brand awareness over time.

Wellness & Safety- This category features first aid kits, sanitisers, and wellness products, reflecting a strong commitment to health and safety. These items are perfect for businesses that wish to convey a caring image or provide practical solutions.

Awards & Office- This includes awards, plaques, trophies, and desk accessories. Personalised awards can acknowledge accomplishments within a company, while office products improve workplace environments.

Private Label- 4imprint Group has developed a unique range of private-label brands that are available through its platform. These in-house brands are designed to fulfil essential customer needs and address gaps in various product categories. Over time, many of these private-label products have emerged as top sellers within their respective categories, showcasing their popularity and effectiveness. Emphasis is placed not only on the functionality and quality of each item but also on its design aesthetics. Additionally, 4imprint Group carefully selects its suppliers and manufacturing partners to ensure that these products meet high standards of excellence.

Crossland- This private-label brand specialises in outdoor gear such as fleece jackets, blankets, beanie hats, vacuum mugs, backpacks, and coolers.

Refresh- Launched in 2017, this brand initially focused on a core selection of budget-friendly water bottles before expanding to offer tumblers, travel mugs, and a variety of other drinkware products.

Taskright- Founded in 2020, Taskright specialises in everyday stationery items, including notebooks, sticky notes, and pencils.

Management:

When evaluating management, I judge the CEO based on several factors, such as experience, capital allocation skills, and Incentives. In this section, I will discuss whether management incentives are aligned with shareholders.

Experience- Kevin Lyons-Tarr has led 4imprint Group as Chief Executive since March 2015. Previously, he was Chief Executive of the Direct Market Division and President of The Direct Marketing Business from 2004. He also became President of 4imprint Group and an Executive Director of the company in June 2012.

Below is an image illustrating the current experience of 4imprint Group board members:

Capital Allocation- Capital allocation is very important when judging management because I want them to create value for shareholders, not destroy it. So far, 4imprint Group has done a great job with capital allocation. They are providing value back to shareholders by reinvesting in the business to improve customer experience and product offerings and paying dividends.

4impint Group currently pays a dividend with a yield of 3.17%. This dividend is sustainable because it only covers 54% of the company’s free cash flow.

Incentive- This is important because if the current board is buying shares of their own business, it indicates that management believes the stock is undervalued and is confident in the company’s long-term prospects.

As you can see below, we have one buy order and zero sell order. Paul Moody(Independent Non-Executive Chairman) is the only insider buying 4imprint Group shares.

Bull And Bear Case:

Bull Case

Bull Case- The first bull case is a long runway for growth. The promotional products sector is fragmented, fueled by the rising demand for businesses to improve their branding and visibility. The projected combined market size of the US and Canadian promotional products industry in 2023 is approximately $26 billion in annual revenue, an increase from about $25 billion in 2022. This figure represents a notable increase from the roughly $25 billion seen in 2022, demonstrating a healthy upward trajectory in this sector.

Bull Case- The second bull case is Customer Loyalty and Recurring Revenue. 4imprint Group has built a loyal customer base, with many clients returning for repeat orders. This loyalty can lead to more predictable revenue streams and a stronger business. Their focus on customer satisfaction can also foster long-term relationships.

Bear Case

Bear Case- The first bear case is competition. The promotional products industry is highly competitive, with numerous players vying for market share. If competitors innovate or offer similar products at lower prices, 4imprint Group might struggle to maintain its customer base.

Bear Case- The second bear case is Price Sensitivity. The promotional products market can be price sensitive, and if input costs rise, 4imprint Group may be forced to increase prices, potentially leading to lower demand or loss of market share.

Valuation:

In this section, I will discuss valuation. Using some basic metrics, I will compare 4imprint Group to its industry rivals and determine whether the company is cheap relative to its peers. Then, I will value 4imprint Group using a discounted cash flow model to determine a price I am willing to pay based on its expected growth rate and my desired return of 15%.

As shown below, when compared to its peer, 4imprint Group scores 3/5, while Cimpress PLC also scores 3/5. Even though both companies are statistically matched, it ultimately comes down to sheer quality, where 4imprint Group is a better-run company based on several factors, such as:

Profitability- 4imprint Group has sustained a strong operating margin due to its effective cost management and efficient operations. In contrast, Cimpress PLC has faced pressure on its operating margins, partly due to difficulties in scaling and competition within the online printing industry.

Debt Level- 4imprint Group generally maintains low debt levels, allowing it to adapt to economic changes and pursue growth opportunities. Its favourable debt-to-equity ratio shows a reduced reliance on external funding. In contrast, Cimpress PLC has a higher debt burden, which might worry investors. The increased debt-to-equity ratio suggests significant dependence on borrowed funds, potentially creating risks, especially in economic downturns that could impact cash flow.

Revenue Growth- 4imprint Group has consistently grown its revenue, especially in the North American market. The demand for promotional products frequently aligns positively with economic growth, whereas Cimpress PLC has faced fluctuating revenue due to its diverse operations. Some segments thrive while others encounter challenges.

In summary, 4imprint Group appears to have better overall business quality, lower debt, strong revenue growth, and profitability than Cimpress PLC. While Cimpress PLC has a larger market presence, its higher debt levels and inconsistent profitability create additional challenges. Each company has unique strengths and market positions, but from a financial health and operational standpoint, 4imprint Group stands out as the stronger contender.

As you can see, based on my conservative assumption, 4imprint Group is looking to grow mid to high single digits over the long run, so I went conservative and assumed a 5% growth in the first 1-3 years, then the growth will slow down to 2% 4-6 years out. In my assumption, I also went with an exit multiple of 12x earnings, which is below the historical average at which 4imprint Group has traded. Based on my assumption, I have come to a buy price of £42.78 compared to the current stock price of £56.60, which means right now, 4imprint Group is trading above intrinsic value.

Thanks for reading my newsletter on 4imprint Group. Disclaimer: This newsletter is not financial advice. This is for educational purposes only, so please DO NOT take this as a buy or sell signal.

Follow for more:

Remember to subscribe, share, and comment below if you find this newsletter insightful. Your support helps me continue my work.

Shares came back quite a bit since you wrote about FOUR....

Nice one! Thanks once again 👏🏻